Title: Fairfax Virginia Order Granting Summary Judgment regarding Non-Dischargeable Debt: Understanding the Types and Implications Keywords: Fairfax Virginia, order granting summary judgment, non-dischargeable debt, types, implications Introduction: In Fairfax Virginia, an order granting summary judgment regarding non-dischargeable debt holds significant importance in bankruptcy cases. This legal action determines whether certain debts cannot be discharged by an individual filing for bankruptcy. This article aims to provide a detailed description of Fairfax Virginia Order Granting Summary Judgment regarding Non-Dischargeable Debt, including its types and their implications on bankruptcy proceedings. 1. Types of Fairfax Virginia Order Granting Summary Judgment regarding Non-Dischargeable Debt: a) Student Loan Debt: One common type of non-dischargeable debt is student loan debt. Fairfax Virginia Order Granting Summary Judgment may be issued to affirm that student loan debts cannot be discharged through bankruptcy, unless the debtor can establish undue hardship. b) Tax Debt: Another important type of non-dischargeable debt includes tax debts owed to federal, state, or local taxing authorities. An order granting summary judgment may declare tax debts non-dischargeable, leading to continued liability for the debtor. c) Child Support and Alimony: Fairfax Virginia Order Granting Summary Judgment may also encompass non-dischargeable debts related to child support and alimony obligations. These debts are typically prioritized to protect the best interests of the children and the receiving spouse. d) Debts Resulting from Fraud: If a creditor establishes that the debtor incurred debts through fraudulent actions or misrepresentation, an order granting summary judgment may deem such debts non-dischargeable. e) Judgment or Settlement arising from Willful and Malicious Injury: Order Granting Summary Judgment might apply to civil debts resulting from willful and malicious injury committed by the debtor, further establishing their non-dischargeable nature. 2. Implications of Fairfax Virginia Order Granting Summary Judgment regarding Non-Dischargeable Debt: a) Continued Liability: Once an order granting summary judgment establishes that a debt is non-dischargeable, the debtor remains legally responsible for repayment even after bankruptcy. b) Impact on Repayment Plan: Non-dischargeable debts affect the structure of repayment plans within bankruptcy proceedings. These debts must be prioritized and factored into the debtor's repayment plan. c) Legal Consequences: Failure to comply with non-dischargeable debt obligations established by the order granting summary judgment can result in legal consequences such as wage garnishment, asset liens, or other punitive measures. d) Importance of Legal Representation: Given the complexities surrounding non-dischargeable debts, it is crucial for debtors to seek legal representation to navigate through bankruptcy proceedings and potentially challenge the order granting summary judgment if deemed necessary. Conclusion: In summary, a Fairfax Virginia Order Granting Summary Judgment regarding Non-Dischargeable Debt holds significant implications in bankruptcy cases. It determines the debts that cannot be discharged and subjects debtors to continued liability. Understanding the types of non-dischargeable debts covered by such an order is vital for individuals involved in bankruptcy proceedings in Fairfax Virginia. Seeking legal counsel helps navigate the complexities associated with this legal action, protecting the rights and interests of the debtor.

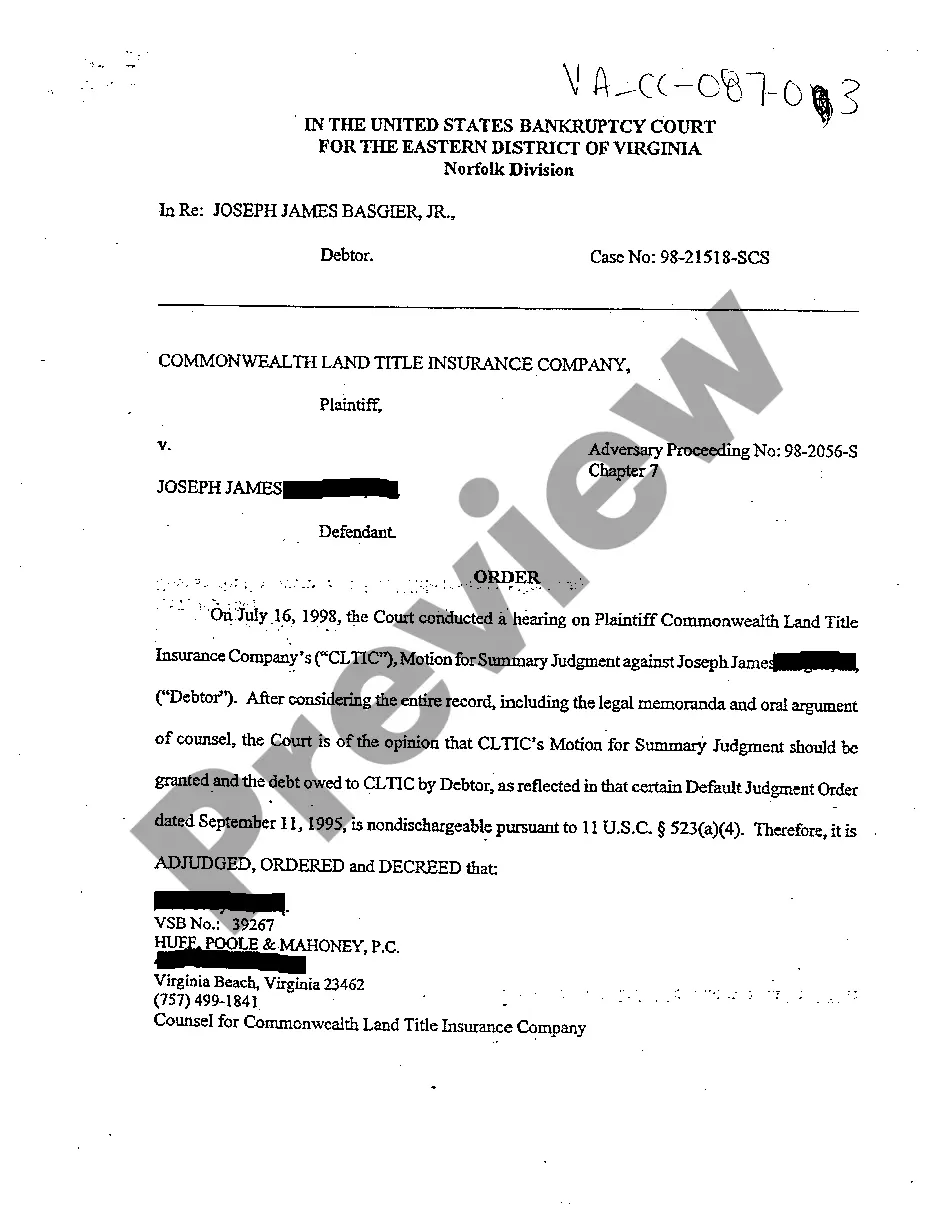

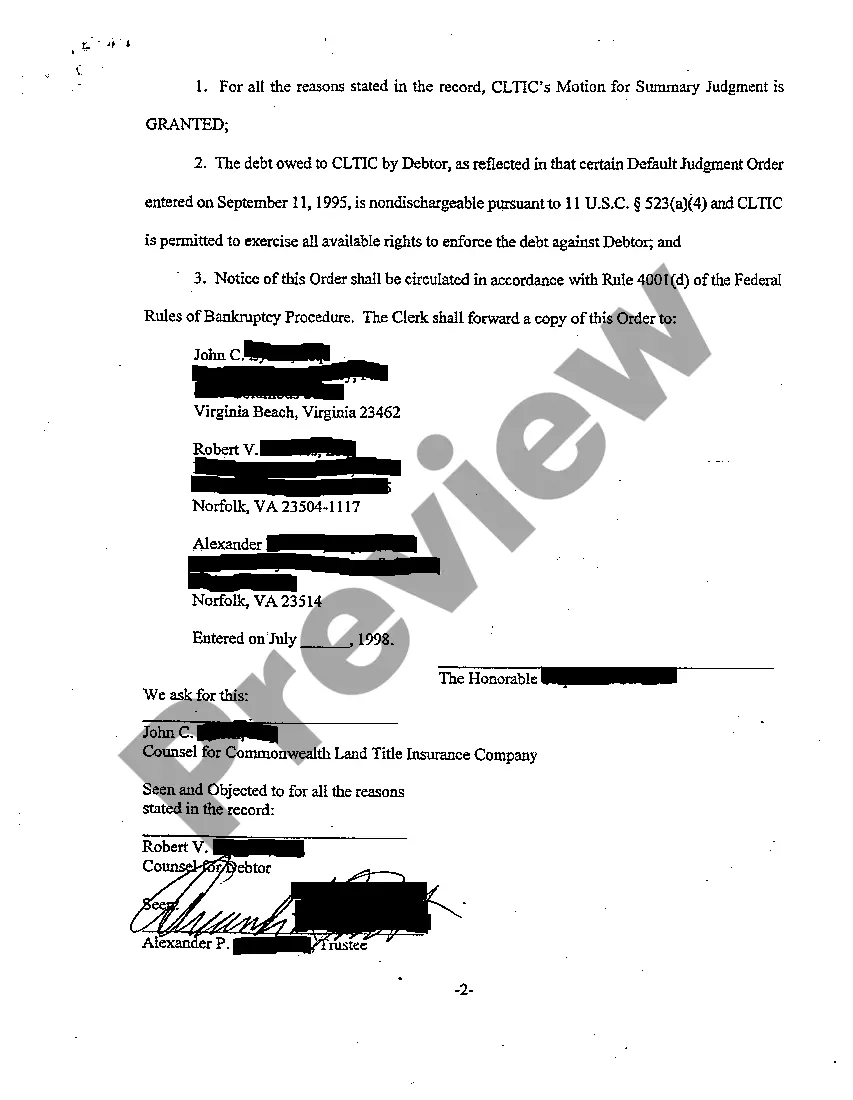

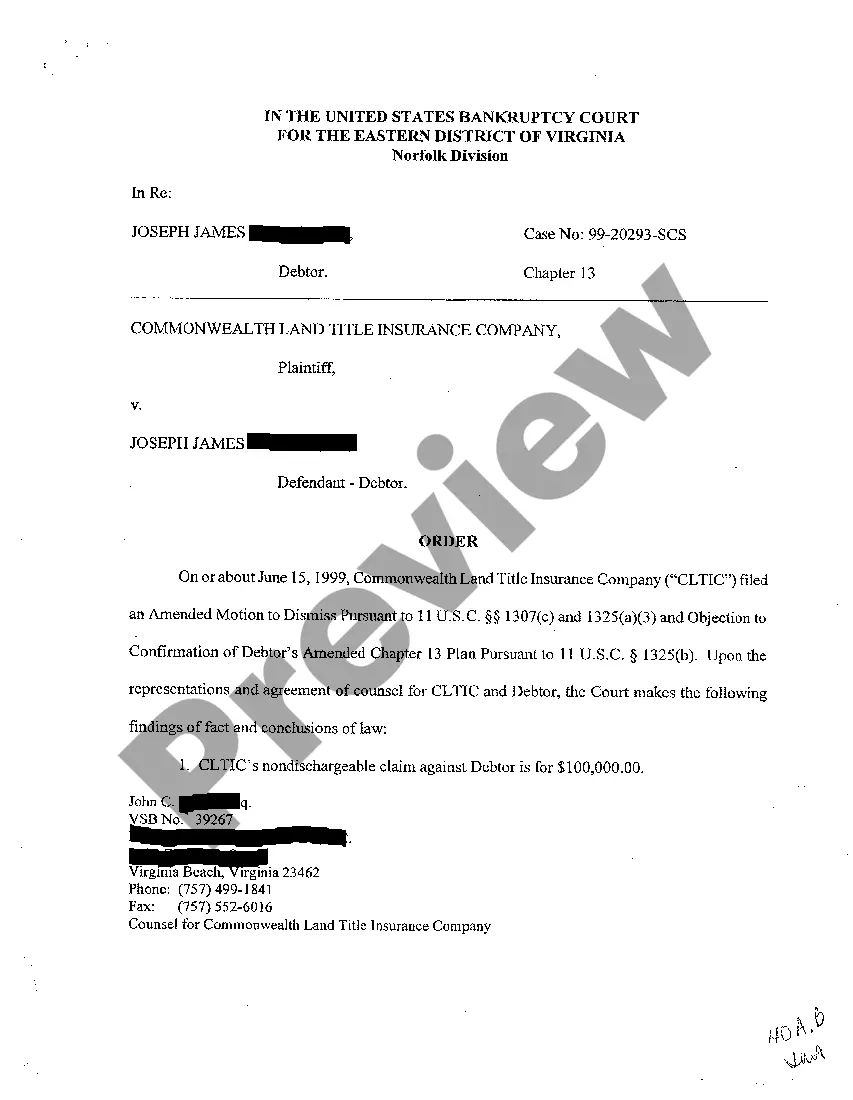

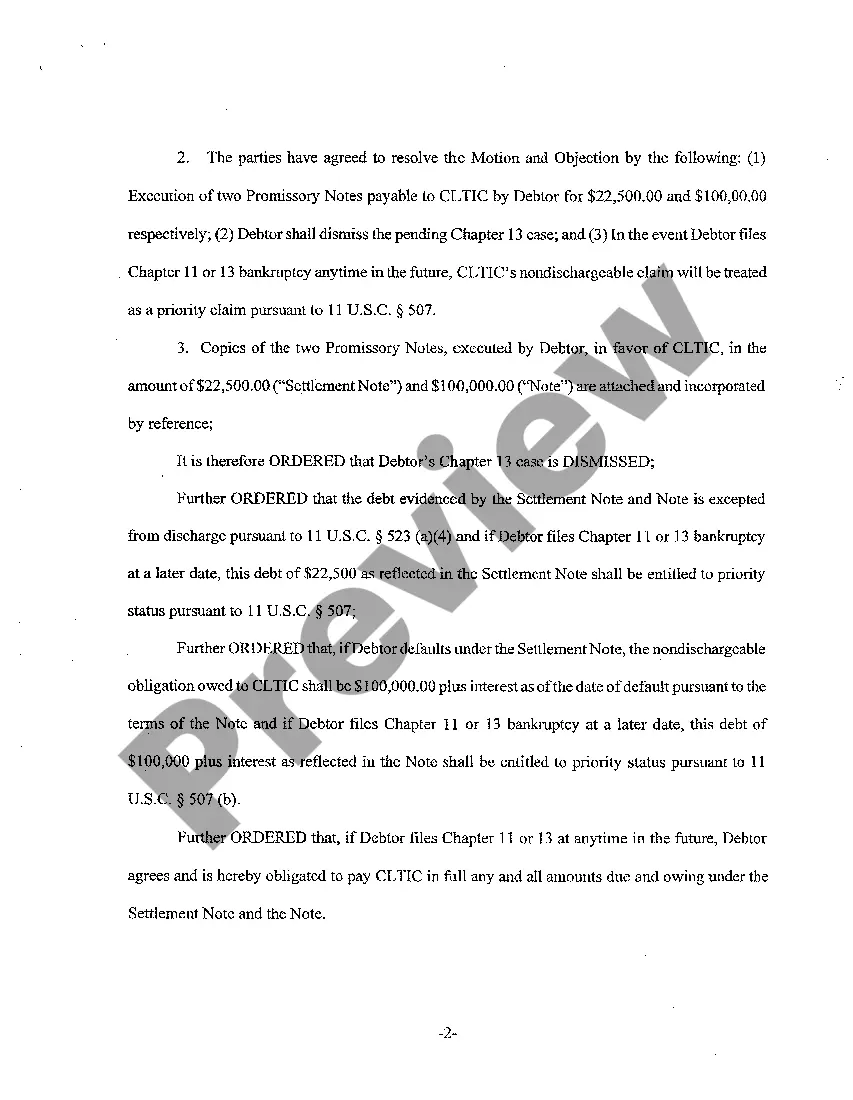

Fairfax Virginia Order Granting Summary Judgment regarding Non Dischargeable Debt

Description

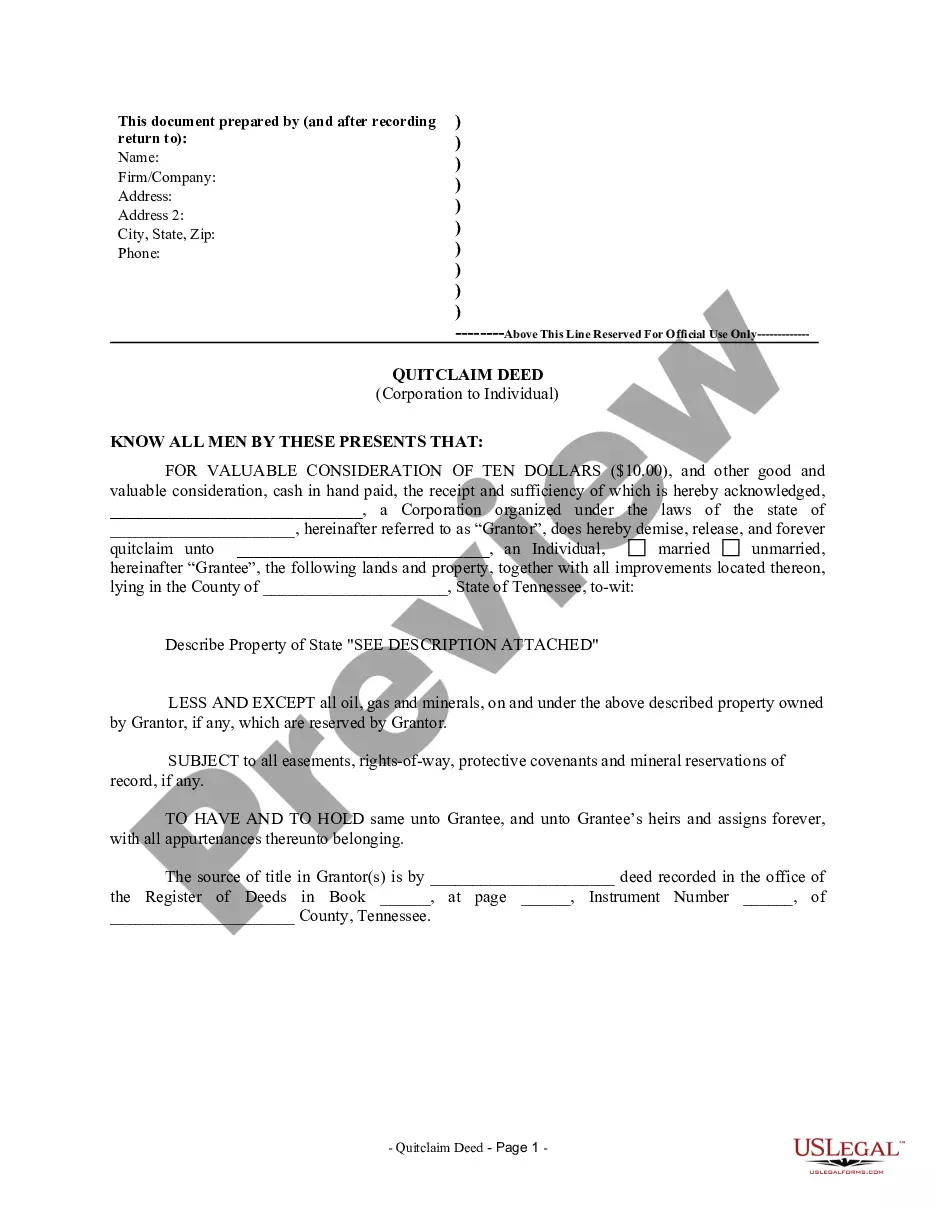

How to fill out Fairfax Virginia Order Granting Summary Judgment Regarding Non Dischargeable Debt?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for a person with no law education to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms can save the day. Our service offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you need the Fairfax Virginia Order Granting Summary Judgment regarding Non Dischargeable Debt or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Fairfax Virginia Order Granting Summary Judgment regarding Non Dischargeable Debt quickly using our trustworthy service. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

However, if you are new to our library, ensure that you follow these steps before obtaining the Fairfax Virginia Order Granting Summary Judgment regarding Non Dischargeable Debt:

- Be sure the template you have chosen is suitable for your area considering that the regulations of one state or county do not work for another state or county.

- Review the document and go through a brief description (if provided) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Fairfax Virginia Order Granting Summary Judgment regarding Non Dischargeable Debt once the payment is through.

You’re good to go! Now you can go on and print out the document or complete it online. In case you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.