Fairfax Virginia Financial Account Transfer to Living Trust: A Comprehensive Guide In Fairfax, Virginia, individuals have the option to transfer their financial accounts to a living trust, a legal arrangement that allows for the management and distribution of assets during their lifetime and after death. This detailed description aims to provide an overview of what a Fairfax Virginia financial account transfer to a living trust entails, the importance of this process, and various types of transfers available. What is a living trust? A living trust, also known as a revocable trust or inter vivos trust, is a legal document created by an individual (trust or granter) to hold and manage their assets during their lifetime and designate beneficiaries who will receive the assets upon their death. It allows for the seamless transfer of financial accounts, such as savings accounts, retirement accounts, stocks, bonds, and other investments, to the trust, ensuring efficient management and distribution without probate. Benefits of a living trust in Fairfax, Virginia: 1. Probate avoidance: By transferring financial accounts to a living trust, individuals can bypass the often lengthy and costly probate process, ensuring a more efficient and private transfer of assets to their beneficiaries. 2. Asset management during incapacity: Living trusts provide a mechanism for the seamless management of financial accounts in the event of the trust or's incapacity, ensuring that their interests are protected and their affairs are handled by a designated successor trustee. 3. Privacy: Unlike wills, living trusts are private documents, eliminating the need for public disclosure of assets and the associated probate proceedings. Types of Fairfax Virginia Financial Account Transfer to Living Trust: 1. Bank Account Transfer: Individuals can transfer their savings accounts, checking accounts, and money market accounts to their living trust, allowing for better management and distribution of funds. 2. Retirement Account Transfer: IRAs, 401(k)s, and other retirement accounts can be transferred to a living trust, ensuring designated beneficiaries receive the proceeds according to the trust's instructions. 3. Investment Account Transfer: Stocks, bonds, mutual funds, and other investment accounts can be included in a living trust, providing clarity and simplicity in managing and distributing these assets. Process and Considerations: 1. Consult an Estate Planning Attorney: It is crucial to consult with an experienced estate planning attorney who specializes in living trusts to understand the legal requirements and implications specific to Fairfax, Virginia. 2. Drafting the Living Trust: Working with an attorney, the trust or will outline their wishes, including identifying beneficiaries, appointing a successor trustee, and determining how the financial accounts will be managed and distributed. 3. Retitling of Financial Accounts: To transfer financial accounts into the trust, the trust or must work closely with their financial institutions to retitle the accounts in the name of the trust. 4. Ongoing Management: Once the financial accounts are transferred, the trust or, or the appointed successor trustee, will be responsible for managing and monitoring the accounts to ensure they align with the trust's objectives and beneficiaries' needs. In conclusion, a Fairfax Virginia financial account transfer to a living trust offers numerous benefits, including probate avoidance, efficient asset management, and privacy. By consulting with an estate planning attorney, individuals can create an appropriate living trust, transferring different types of financial accounts, including bank accounts, retirement accounts, and investment accounts, ensuring seamless management and distribution according to their wishes.

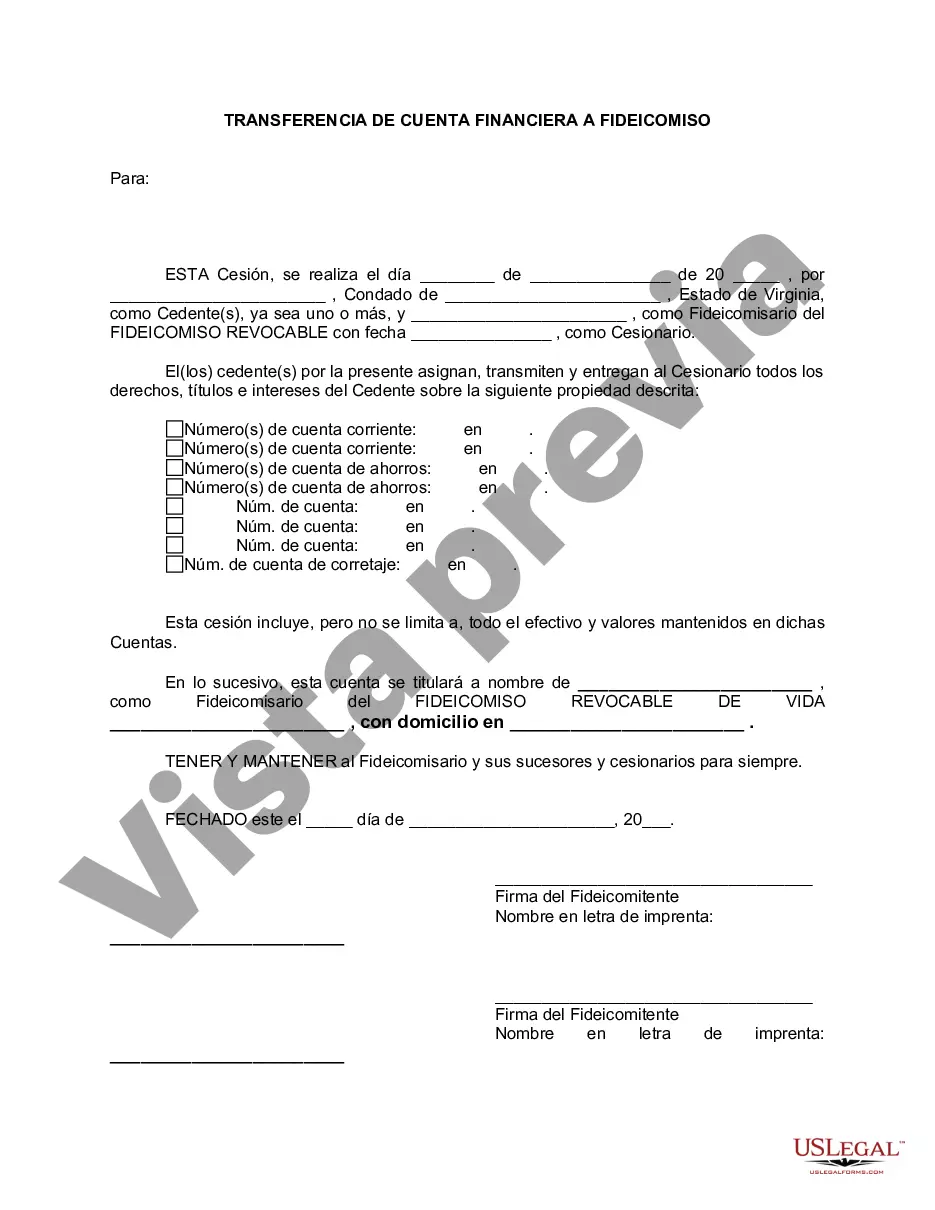

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Transferencia de cuenta financiera a fideicomiso en vida - Virginia Financial Account Transfer to Living Trust

Description

How to fill out Fairfax Virginia Transferencia De Cuenta Financiera A Fideicomiso En Vida?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone with no legal education to draft such papers from scratch, mostly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you want the Fairfax Virginia Financial Account Transfer to Living Trust or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Fairfax Virginia Financial Account Transfer to Living Trust quickly using our trustworthy service. If you are already an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before obtaining the Fairfax Virginia Financial Account Transfer to Living Trust:

- Be sure the template you have found is specific to your area considering that the regulations of one state or area do not work for another state or area.

- Preview the form and read a quick description (if available) of scenarios the paper can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the suitable form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your credentials or register for one from scratch.

- Select the payment method and proceed to download the Fairfax Virginia Financial Account Transfer to Living Trust once the payment is completed.

You’re good to go! Now you can go ahead and print the form or fill it out online. If you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.