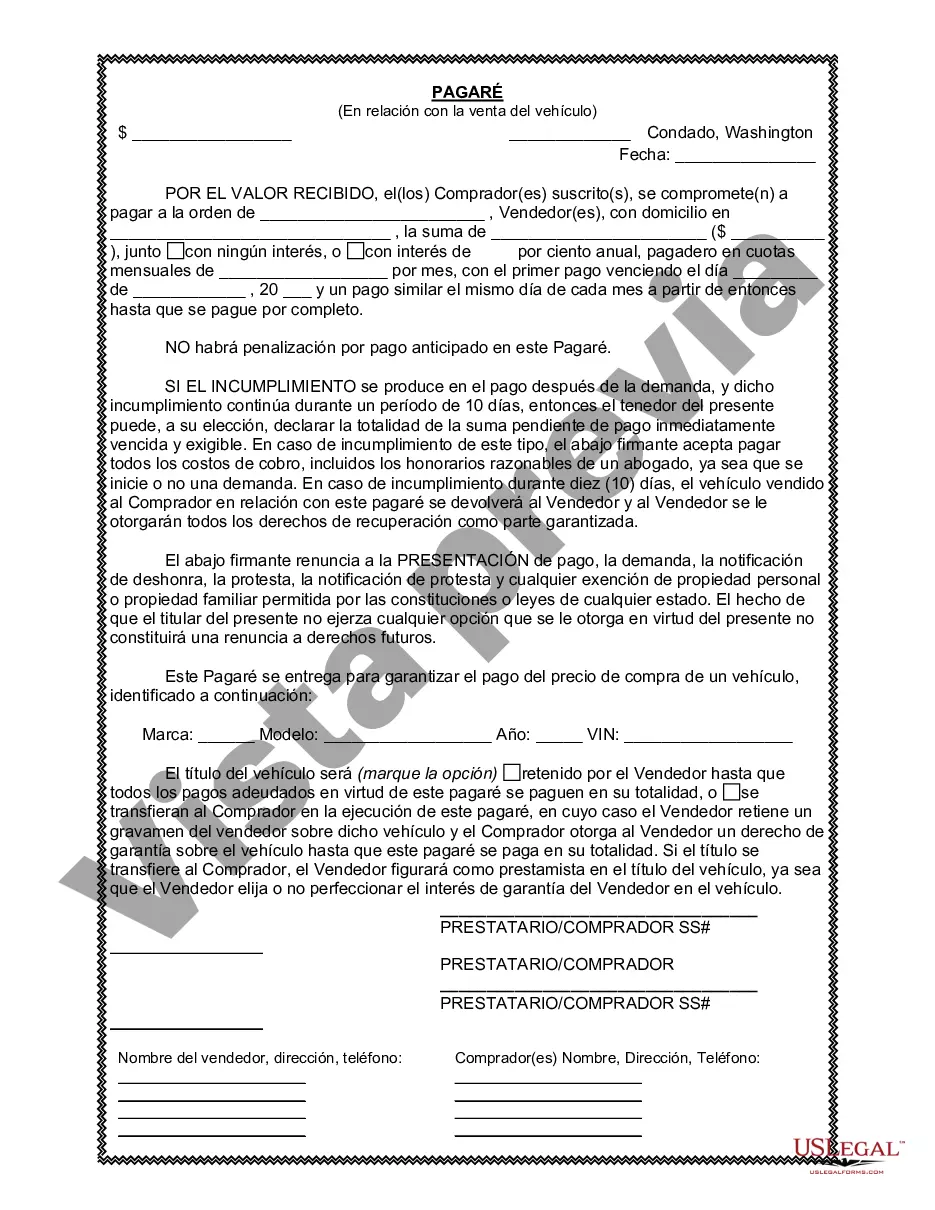

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A King Washington Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a vehicle or automobile sale, where the buyer agrees to make payments to the seller over a specified period of time. This promissory note serves as evidence of the buyer's promise to pay the agreed amount for the vehicle. The King Washington Promissory Note for the Sale of Vehicle or Automobile includes key information such as the names and addresses of both the buyer and the seller, the vehicle's description (make, model, year, identification number), the purchase price, the down payment, and the interest rate (if applicable). It also lists the repayment schedule and any consequences for late or missed payments. Different types of King Washington Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. King Washington Promissory Note with Balloon Payment: This type of promissory note allows the buyer to make smaller periodic payments for the term of the loan, with a larger final payment (balloon payment) due at the end of the agreed-upon period. 2. King Washington Promissory Note with Collateral: In this case, the promissory note may include provisions that allow the seller to reclaim the vehicle if the buyer defaults on the loan, serving as collateral for the loan. 3. King Washington Promissory Note with Co-Signer: This type of promissory note involves a third party (co-signer) who agrees to be responsible for the loan if the buyer fails to make payments as agreed. 4. King Washington Promissory Note for Lease with Option to Purchase: This variation of the promissory note allows the buyer to lease the vehicle for a specified period with an option to purchase it at the end of the lease term. When preparing a King Washington Promissory Note in Connection with Sale of a Vehicle or Automobile, it is crucial to consult with a legal professional to ensure compliance with state laws and to protect the interests of both parties involved in the transaction.A King Washington Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a vehicle or automobile sale, where the buyer agrees to make payments to the seller over a specified period of time. This promissory note serves as evidence of the buyer's promise to pay the agreed amount for the vehicle. The King Washington Promissory Note for the Sale of Vehicle or Automobile includes key information such as the names and addresses of both the buyer and the seller, the vehicle's description (make, model, year, identification number), the purchase price, the down payment, and the interest rate (if applicable). It also lists the repayment schedule and any consequences for late or missed payments. Different types of King Washington Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. King Washington Promissory Note with Balloon Payment: This type of promissory note allows the buyer to make smaller periodic payments for the term of the loan, with a larger final payment (balloon payment) due at the end of the agreed-upon period. 2. King Washington Promissory Note with Collateral: In this case, the promissory note may include provisions that allow the seller to reclaim the vehicle if the buyer defaults on the loan, serving as collateral for the loan. 3. King Washington Promissory Note with Co-Signer: This type of promissory note involves a third party (co-signer) who agrees to be responsible for the loan if the buyer fails to make payments as agreed. 4. King Washington Promissory Note for Lease with Option to Purchase: This variation of the promissory note allows the buyer to lease the vehicle for a specified period with an option to purchase it at the end of the lease term. When preparing a King Washington Promissory Note in Connection with Sale of a Vehicle or Automobile, it is crucial to consult with a legal professional to ensure compliance with state laws and to protect the interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.