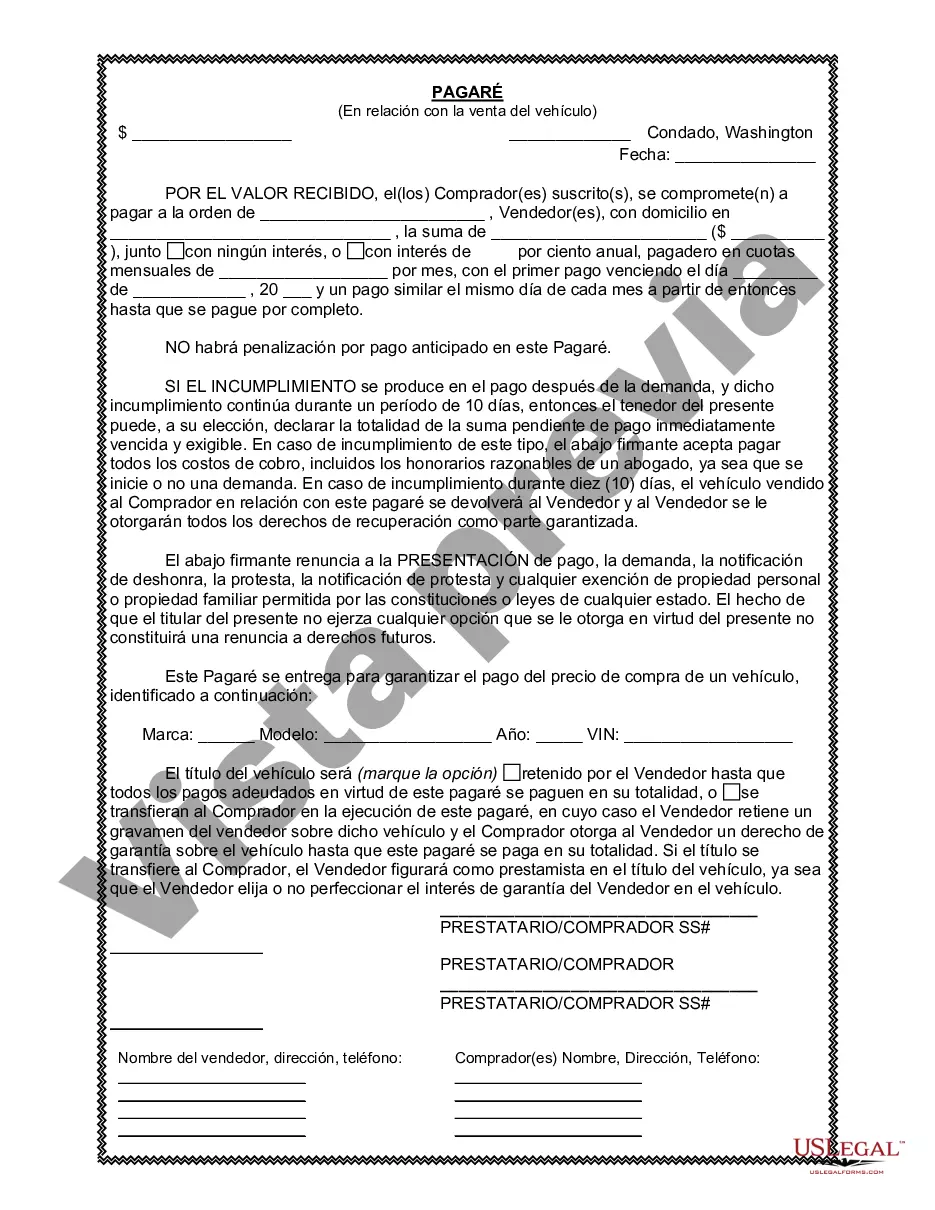

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

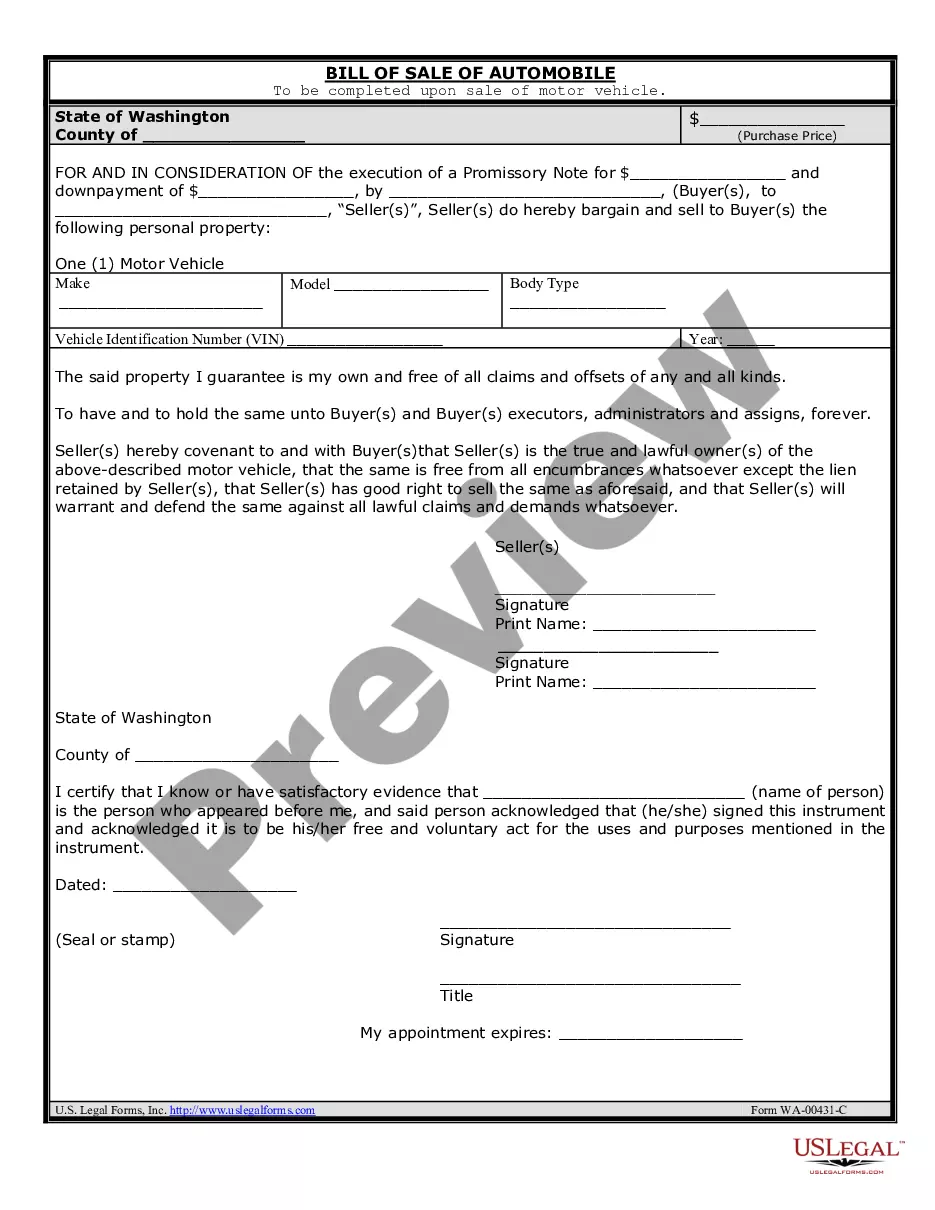

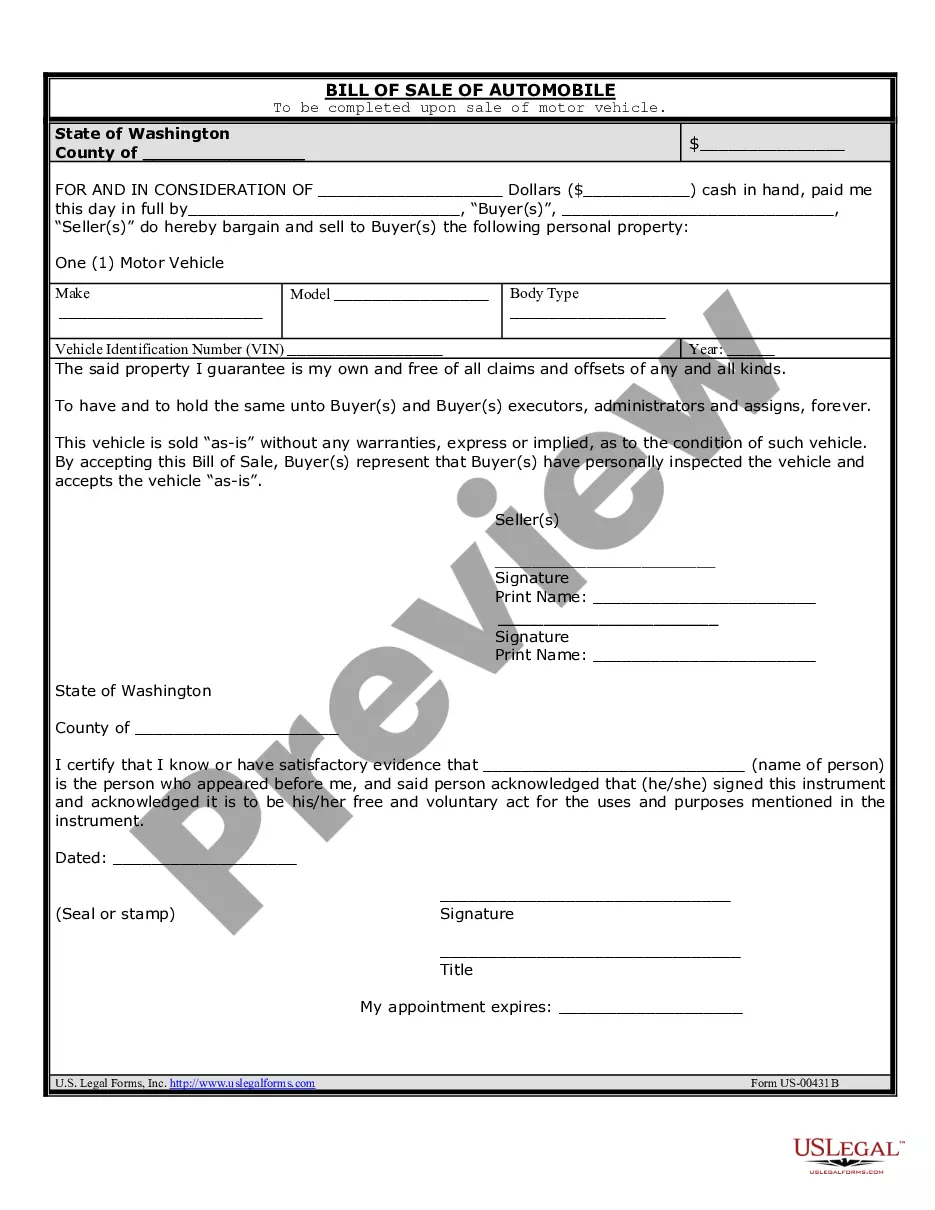

A Spokane Valley Washington Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller in the Spokane Valley area who are engaged in the sale of a vehicle or automobile. This note serves as a binding contract that establishes the repayment schedule and conditions for the buyer to repay the loan amount to the seller, typically with interest. The Promissory Note includes important details such as the names and contact information of both parties involved, the vehicle's description (make, model, year, VIN number, registration number, etc.), the sale price, down payment amount, and any additional terms agreed upon between the buyer and seller. It also specifies the payment method, whether it be in the form of cash, check, or any other mutually acceptable method. There are several types of Promissory Notes that may be used in Spokane Valley, Washington in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of note stipulates a predetermined repayment period, usually with equal monthly installments, over which the buyer must repay the loan amount. 2. Balloon Payment Promissory Note: In this case, the buyer agrees to make regular monthly payments for a certain period, followed by a larger final payment (balloon payment) that covers the remaining balance owed. 3. Secured Promissory Note: This type of note includes a collateral clause, where the vehicle being sold serves as security or collateral for the loan. If the buyer fails to make the agreed-upon payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: In contrast to a secured note, an unsecured note does not involve collateral. The buyer's promise to repay the loan is solely based on their creditworthiness and trustworthiness. It is essential for both the buyer and seller to carefully review and understand the terms stated in the Promissory Note before signing it. Seeking legal advice or consulting an attorney specializing in contract law is highly recommended ensuring the agreement is fair, enforceable, and compliant with the applicable laws and regulations in Spokane Valley, Washington.A Spokane Valley Washington Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller in the Spokane Valley area who are engaged in the sale of a vehicle or automobile. This note serves as a binding contract that establishes the repayment schedule and conditions for the buyer to repay the loan amount to the seller, typically with interest. The Promissory Note includes important details such as the names and contact information of both parties involved, the vehicle's description (make, model, year, VIN number, registration number, etc.), the sale price, down payment amount, and any additional terms agreed upon between the buyer and seller. It also specifies the payment method, whether it be in the form of cash, check, or any other mutually acceptable method. There are several types of Promissory Notes that may be used in Spokane Valley, Washington in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of note stipulates a predetermined repayment period, usually with equal monthly installments, over which the buyer must repay the loan amount. 2. Balloon Payment Promissory Note: In this case, the buyer agrees to make regular monthly payments for a certain period, followed by a larger final payment (balloon payment) that covers the remaining balance owed. 3. Secured Promissory Note: This type of note includes a collateral clause, where the vehicle being sold serves as security or collateral for the loan. If the buyer fails to make the agreed-upon payments, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: In contrast to a secured note, an unsecured note does not involve collateral. The buyer's promise to repay the loan is solely based on their creditworthiness and trustworthiness. It is essential for both the buyer and seller to carefully review and understand the terms stated in the Promissory Note before signing it. Seeking legal advice or consulting an attorney specializing in contract law is highly recommended ensuring the agreement is fair, enforceable, and compliant with the applicable laws and regulations in Spokane Valley, Washington.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.