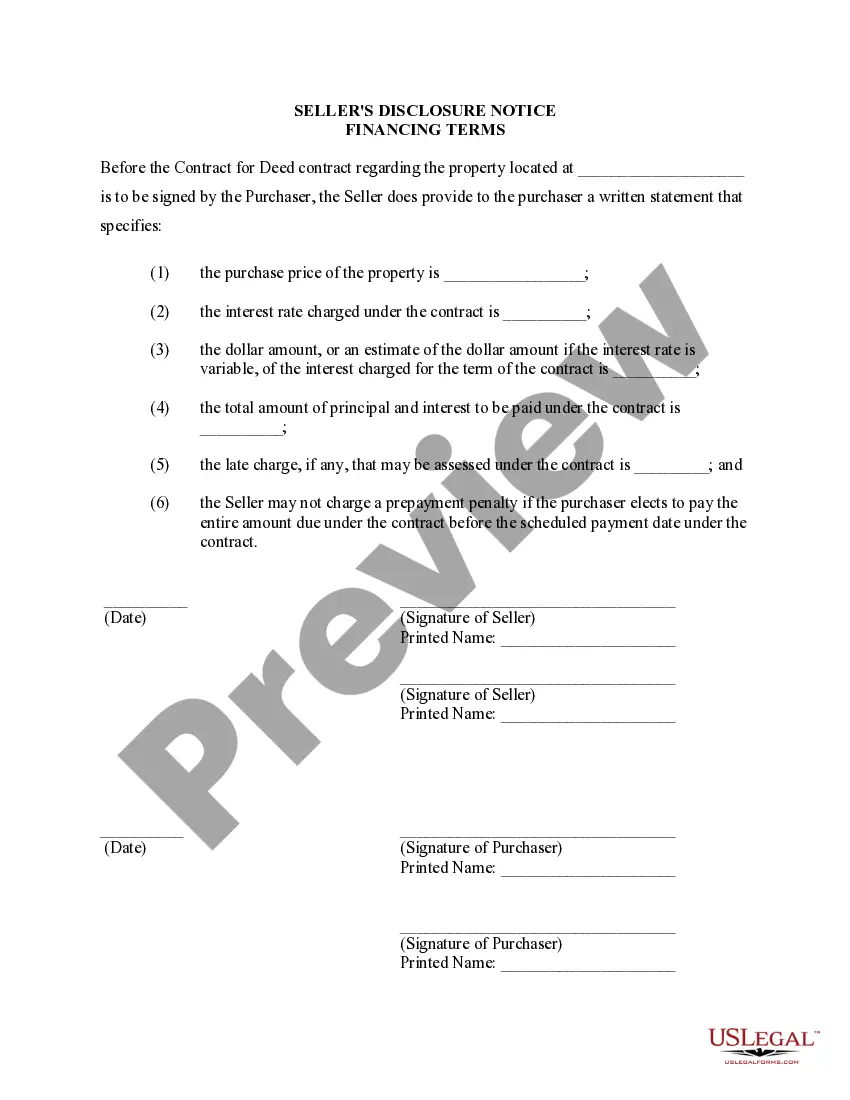

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also commonly referred to as a Land Contract, is a crucial document that outlines the specific financing terms and conditions agreed upon between the seller and buyer for the purchase of a residential property in Bellevue, Washington. This disclosure provides essential information to both parties involved in the transaction, ensuring transparency and clarity throughout the entire process. The Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed covers various aspects of the financing agreement, including the loan terms, payment schedule, interest rate, and any additional costs or fees associated with the arrangement. It ensures that the buyer understands all the financial obligations and responsibilities they will undertake when entering into the contract or agreement. This document aims to protect the interests of both the seller and buyer, as it eliminates any potential misunderstandings or disputes that may arise from unclear financial terms or unexpected costs. By disclosing all relevant financial details upfront, it allows the buyer to make an informed decision regarding their financial obligations and helps the seller sell their property with confidence. Different types of Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include specific clauses or provisions tailored to address unique circumstances or considerations. Some examples of these variations could be: 1. Fixed-Rate Land Contract: This type of disclosure outlines a Land Contract with a fixed interest rate, which remains the same throughout the duration of the contract. It provides stability and predictability for both the seller and buyer. 2. Adjustable-Rate Land Contract: In contrast to a fixed-rate Land Contract, an adjustable-rate Land Contract includes a provision that allows the interest rate to fluctuate over time, often based on an index. This variation may be suitable for buyers who expect interest rates to decrease or are comfortable with potential fluctuations. 3. Balloon Payment Land Contract: This type of disclosure includes a provision for a significantly larger payment, commonly known as a balloon payment, that becomes due at a specified time within the contract. This arrangement may be suitable for buyers who anticipate an increase in income or plan to refinance the property before the balloon payment becomes due. 4. Seller Financing Land Contract: In this variation, the seller acts as the lender, providing financing to the buyer directly. This type of Land Contract often includes specific clauses outlining the terms and conditions of the seller's financing, such as the down payment, interest rate, and repayment schedule. Ultimately, the Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed serves as a crucial document that promotes transparency and protects the interests of both the seller and buyer. It is crucial for all parties involved to carefully review and understand the disclosed financing terms before entering into the contract or agreement.The Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also commonly referred to as a Land Contract, is a crucial document that outlines the specific financing terms and conditions agreed upon between the seller and buyer for the purchase of a residential property in Bellevue, Washington. This disclosure provides essential information to both parties involved in the transaction, ensuring transparency and clarity throughout the entire process. The Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed covers various aspects of the financing agreement, including the loan terms, payment schedule, interest rate, and any additional costs or fees associated with the arrangement. It ensures that the buyer understands all the financial obligations and responsibilities they will undertake when entering into the contract or agreement. This document aims to protect the interests of both the seller and buyer, as it eliminates any potential misunderstandings or disputes that may arise from unclear financial terms or unexpected costs. By disclosing all relevant financial details upfront, it allows the buyer to make an informed decision regarding their financial obligations and helps the seller sell their property with confidence. Different types of Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include specific clauses or provisions tailored to address unique circumstances or considerations. Some examples of these variations could be: 1. Fixed-Rate Land Contract: This type of disclosure outlines a Land Contract with a fixed interest rate, which remains the same throughout the duration of the contract. It provides stability and predictability for both the seller and buyer. 2. Adjustable-Rate Land Contract: In contrast to a fixed-rate Land Contract, an adjustable-rate Land Contract includes a provision that allows the interest rate to fluctuate over time, often based on an index. This variation may be suitable for buyers who expect interest rates to decrease or are comfortable with potential fluctuations. 3. Balloon Payment Land Contract: This type of disclosure includes a provision for a significantly larger payment, commonly known as a balloon payment, that becomes due at a specified time within the contract. This arrangement may be suitable for buyers who anticipate an increase in income or plan to refinance the property before the balloon payment becomes due. 4. Seller Financing Land Contract: In this variation, the seller acts as the lender, providing financing to the buyer directly. This type of Land Contract often includes specific clauses outlining the terms and conditions of the seller's financing, such as the down payment, interest rate, and repayment schedule. Ultimately, the Bellevue Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed serves as a crucial document that promotes transparency and protects the interests of both the seller and buyer. It is crucial for all parties involved to carefully review and understand the disclosed financing terms before entering into the contract or agreement.