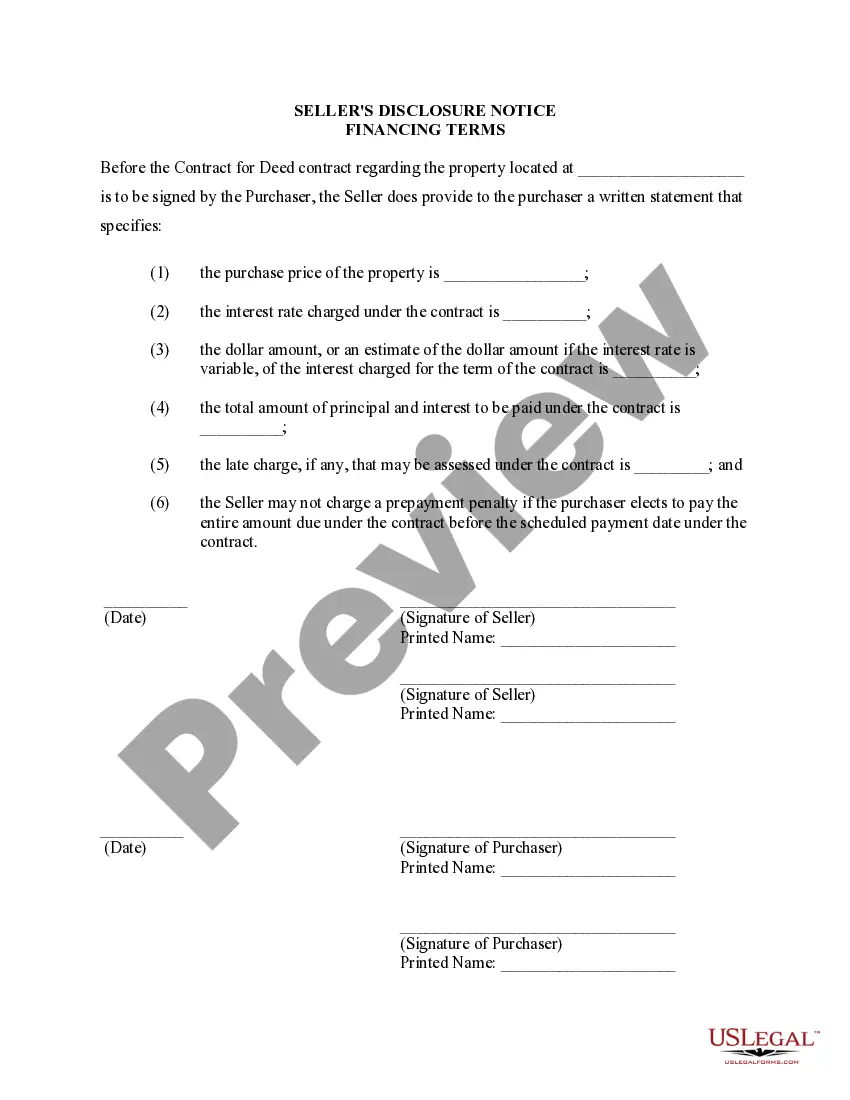

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Vancouver Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a legally binding document that outlines the specific financing terms and conditions associated with the purchase of a residential property through a contract or agreement for deed. This disclosure is crucial for ensuring transparency and protecting the rights of both the seller and the buyer. It provides all relevant details regarding the financing arrangement, allowing both parties to fully understand their rights and obligations. One type of Vancouver Washington Seller's Disclosure of Financing Terms for Residential Property is the Fixed-Rate Land Contract. In this scenario, the buyer agrees to make fixed monthly payments to the seller over an agreed-upon period of time. The interest rate remains constant throughout the contract, providing stability and predictability for both parties. Another type is the Adjustable-Rate Land Contract. In this case, the interest rate fluctuates based on an agreed-upon index. The buyer's monthly payments may vary over time, depending on the market conditions, but the terms are clearly defined in the disclosure. The disclosure also includes information about the down payment required, any prepayment penalties, and details about taxes and insurance. It outlines the consequences for late payments or default, empowering both parties with the knowledge they need to make informed decisions. Furthermore, the Vancouver Washington Seller's Disclosure highlights any potential risks associated with the financing arrangement. It may include clauses about the seller's recourse in the event of default, the buyer's rights to cure any breaches, and the possibility of foreclosure or forfeiture of the property. By providing this comprehensive disclosure, the seller ensures that the buyer is fully aware of the financing terms before committing to the contract or agreement for deed. This disclosure protects the seller's interests by clearly defining their rights and expectations throughout the transaction. In conclusion, the Vancouver Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a vital document that outlines the specific financing details associated with a residential property purchase. It safeguards the interests of both the seller and the buyer, ensuring transparency and mitigating potential risks.The Vancouver Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a legally binding document that outlines the specific financing terms and conditions associated with the purchase of a residential property through a contract or agreement for deed. This disclosure is crucial for ensuring transparency and protecting the rights of both the seller and the buyer. It provides all relevant details regarding the financing arrangement, allowing both parties to fully understand their rights and obligations. One type of Vancouver Washington Seller's Disclosure of Financing Terms for Residential Property is the Fixed-Rate Land Contract. In this scenario, the buyer agrees to make fixed monthly payments to the seller over an agreed-upon period of time. The interest rate remains constant throughout the contract, providing stability and predictability for both parties. Another type is the Adjustable-Rate Land Contract. In this case, the interest rate fluctuates based on an agreed-upon index. The buyer's monthly payments may vary over time, depending on the market conditions, but the terms are clearly defined in the disclosure. The disclosure also includes information about the down payment required, any prepayment penalties, and details about taxes and insurance. It outlines the consequences for late payments or default, empowering both parties with the knowledge they need to make informed decisions. Furthermore, the Vancouver Washington Seller's Disclosure highlights any potential risks associated with the financing arrangement. It may include clauses about the seller's recourse in the event of default, the buyer's rights to cure any breaches, and the possibility of foreclosure or forfeiture of the property. By providing this comprehensive disclosure, the seller ensures that the buyer is fully aware of the financing terms before committing to the contract or agreement for deed. This disclosure protects the seller's interests by clearly defining their rights and expectations throughout the transaction. In conclusion, the Vancouver Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a vital document that outlines the specific financing details associated with a residential property purchase. It safeguards the interests of both the seller and the buyer, ensuring transparency and mitigating potential risks.