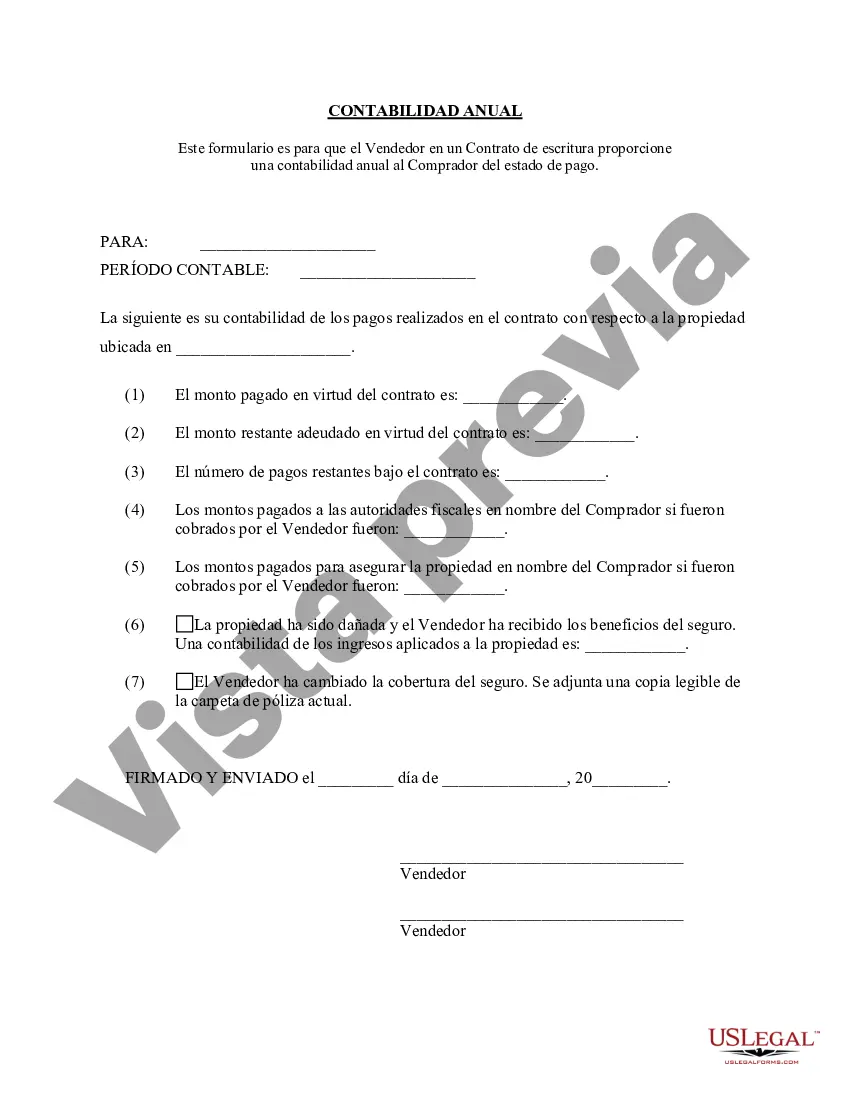

The Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statement is a crucial document intended to provide a detailed overview of financial transactions and obligations between the seller and the buyer in a contract for deed agreement. This statement serves as an essential tool to maintain transparency and ensure compliance with the terms of the contract. It outlines the various types of income, expenses, and payments associated with the contract for deed. Key components included in the Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statement might include: 1. Total Purchase Price: This section accounts for the entire cost of the property as agreed upon in the contract for deed, including any interest or financing charges, if applicable. 2. Down Payment: Details of the initial payment made by the buyer to the seller, usually expressed as a percentage of the total purchase price. 3. Monthly Installments: A breakdown of the regular payments made by the buyer to the seller, including the principal amount and any interest charged. This section also mentions the due dates for each installment. 4. Taxes and Insurance: In this section, the statement outlines the property taxes and insurance premiums paid by the seller on behalf of the buyer. It may include the property tax amount, the insurance premium, and the dates of payment. 5. Maintenance and Repairs: This component records any expenses incurred by the seller for necessary repairs, maintenance, or improvements to the property outlined in the contract for deed. It generally includes the nature of the expense, the amount paid, and the date of payment. 6. Late Fees and Penalties: If the buyer fails to adhere to the agreed-upon payment schedule, the seller may charge late fees or penalties. This section captures such additional charges, specifying the date and reason for levying them. 7. Outstanding Balance: This section provides an up-to-date account of the remaining balance owed by the buyer to the seller. It factors in all payments made thus far and any interest accrued. 8. Escrow Account Details: If an escrow account has been established to manage payments for taxes, insurance, or additional fees, this section will provide a detailed breakdown of the account's activity. Different variations or types of Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statements may arise based on specific contractual terms or unique clauses agreed upon by both parties. For instance: — Escrow Variation: This type of statement might include additional information on the escrow account activities or outline any specific conditions for the use of funds. — Interest-only Variation: In cases where the contract for deed agreement specifies interest-only payments for a certain period, the statement may reflect this arrangement by categorizing payments accordingly. — Balloon Payment Variation: If the contract for deed involves a balloon payment due at a specific point during the contract's tenure, the accounting statement may require adjustments to accommodate this payment and its associated calculations. In summary, the Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a snapshot of all financial activities within a contract for deed agreement. It helps both the seller and buyer monitor payment obligations and ensures transparency throughout the contract term.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Spokane Valley Washington Contrato de Escrituración Estado Contable Anual del Vendedor - Washington Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Spokane Valley Washington Contrato De Escrituración Estado Contable Anual Del Vendedor?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statement gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statement takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Spokane Valley Washington Contract for Deed Seller's Annual Accounting Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!