The King Washington Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an important document that signifies the borrower's failure to make timely payments under the agreed contract terms. This notice serves as a warning to the borrower that they are facing potential legal consequences and foreclosure if immediate action is not taken to rectify the default. A Contract for Deed is a type of financing arrangement where the seller acts as the lender, allowing the buyer to make payments over time instead of obtaining traditional mortgage financing. This type of agreement allows individuals with less than perfect credit or limited financing options to be able to purchase a property. The Final Notice of Default is a legal and formal step taken by the lender/seller after the borrower fails to fulfill their payment obligations as outlined in the Contract for Deed. It is typically the last step before the lender/seller initiates foreclosure proceedings in order to recoup their investment and reclaim the property. The specific types of King Washington Final Notice of Default for Past Due Payments in connection with a Contract for Deed might include: 1. King Washington Final Notice of Default — Initial Warning: This notice is sent to the borrower when they first miss a payment or fall behind on their payment schedule. It serves as an initial warning, urging them to make the payment promptly and avoid further consequences. 2. King Washington Final Notice of Default — Escalation: If the borrower fails to respond or rectify the payment default after receiving the initial warning notice, the lender/seller may send an escalated notice, emphasizing the severity of the situation and the potential legal actions that may follow. 3. King Washington Final Notice of Default — Legal Action Imminent: This notice is sent when the lender/seller is preparing to initiate formal legal proceedings to enforce the terms of the Contract for Deed. It warns the borrower of the impending legal action and strongly advises them to resolve the payment default urgently. 4. King Washington Final Notice of Default — Foreclosure Initiation: This notice is sent as a last resort when all previous attempts to rectify the payment default have failed. It informs the borrower that the lender/seller has officially filed for foreclosure and provides a timeline for the foreclosure process to commence. It is crucial for borrowers who receive a King Washington Final Notice of Default for Past Due Payments in connection with a Contract for Deed to promptly seek legal advice or explore available options to avoid foreclosure and find a resolution with the lender/seller. Taking immediate action can protect the borrower's rights and may provide an opportunity for negotiation or repayment plans to mitigate the default.

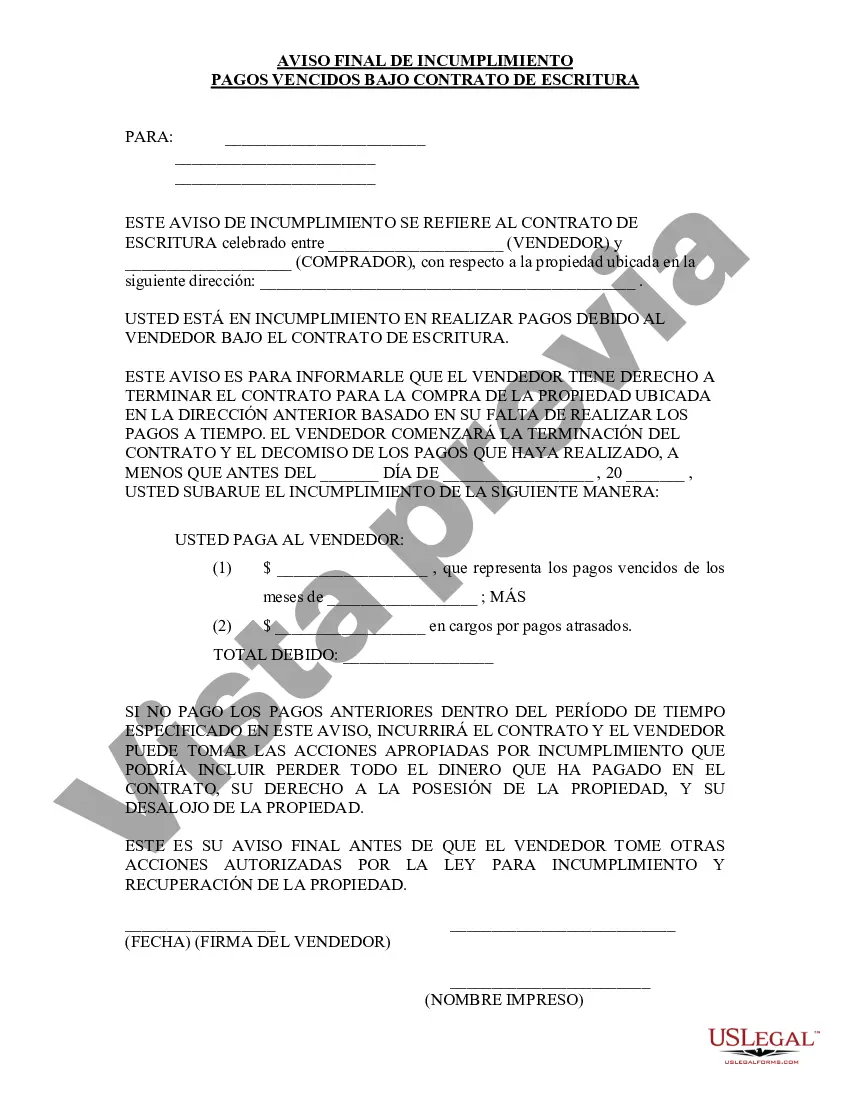

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out King Washington Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

Do you need a reliable and inexpensive legal forms supplier to buy the King Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to solution.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a package of documents to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the required template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the King Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the King Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed in any provided file format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal papers online for good.