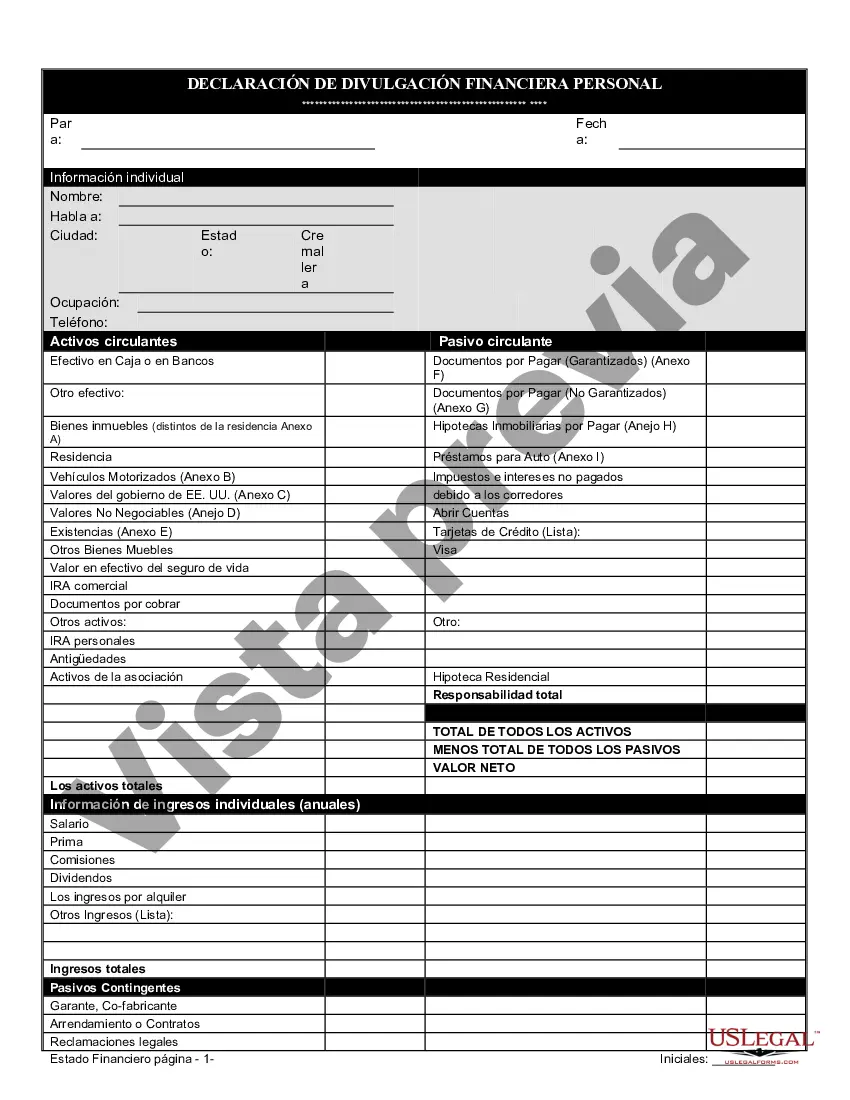

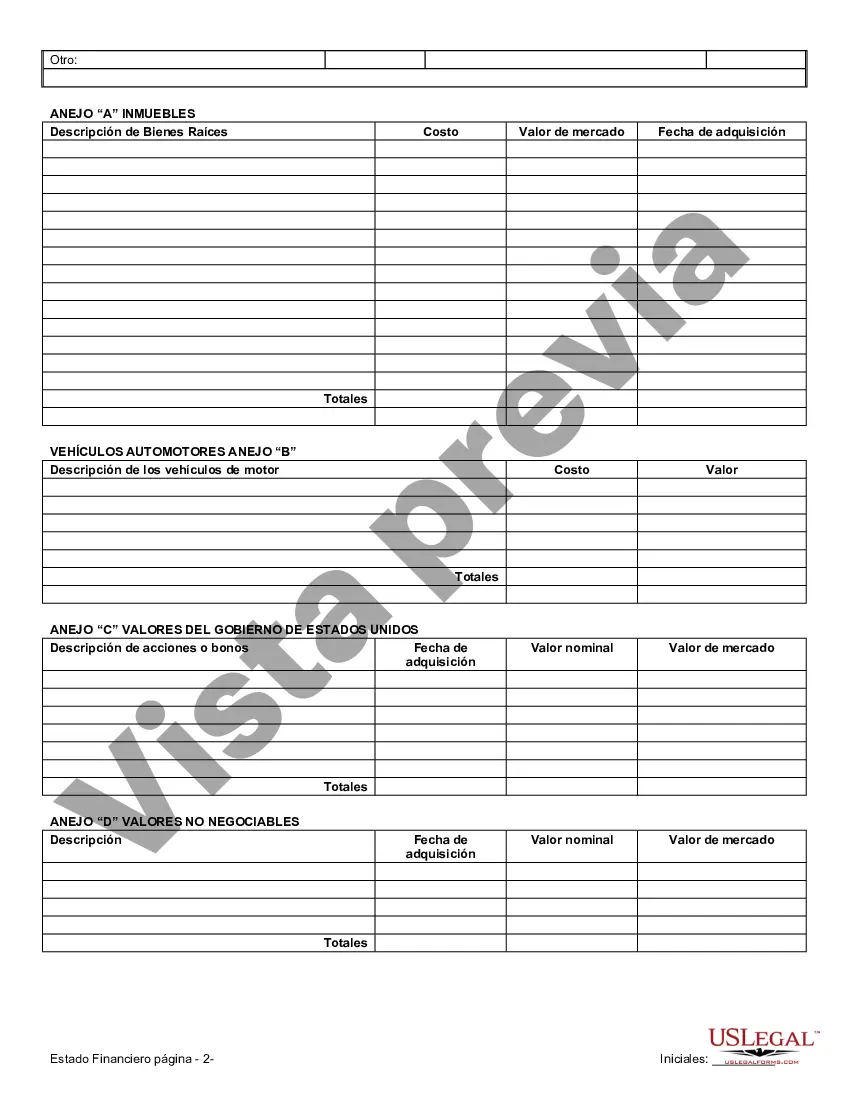

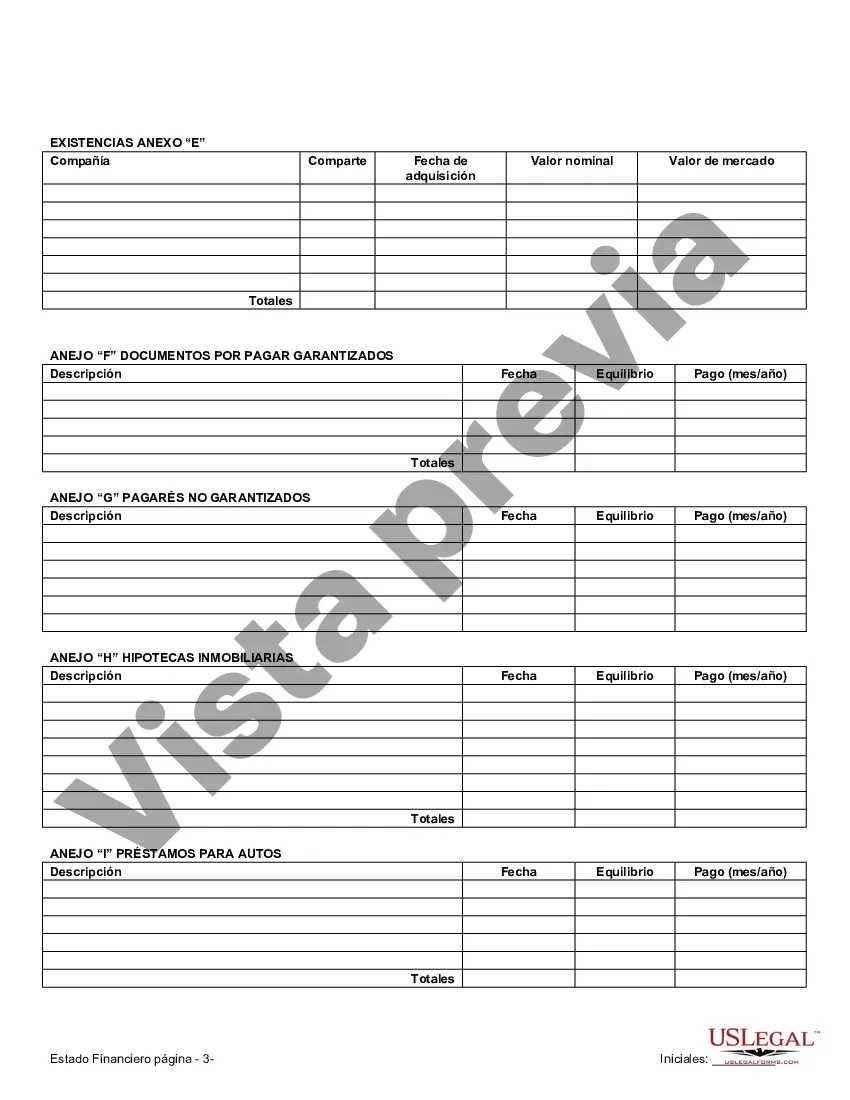

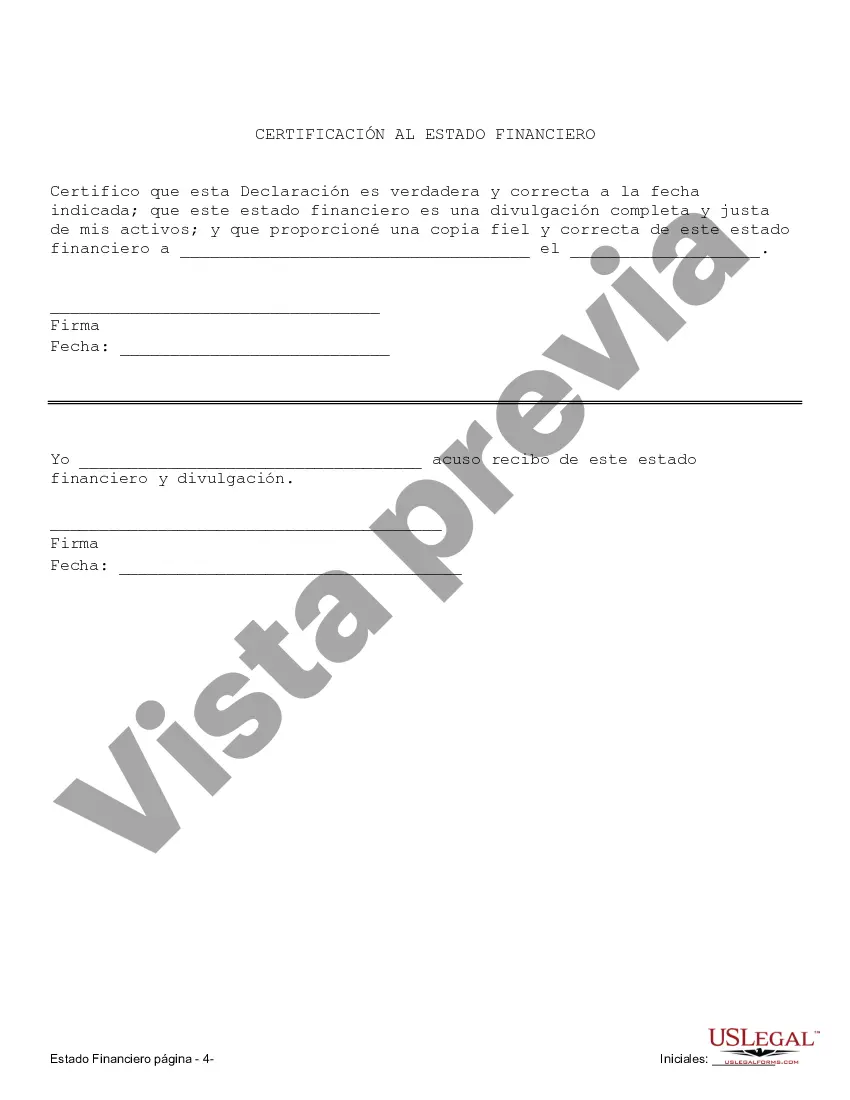

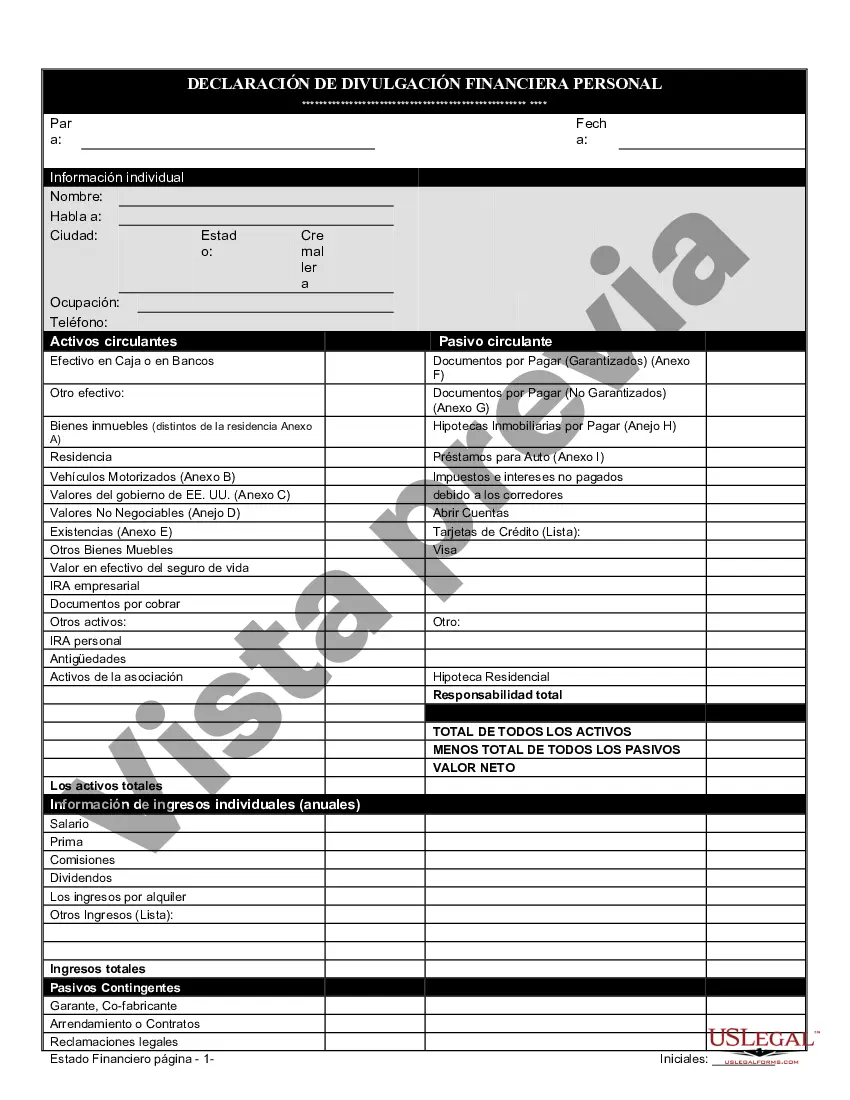

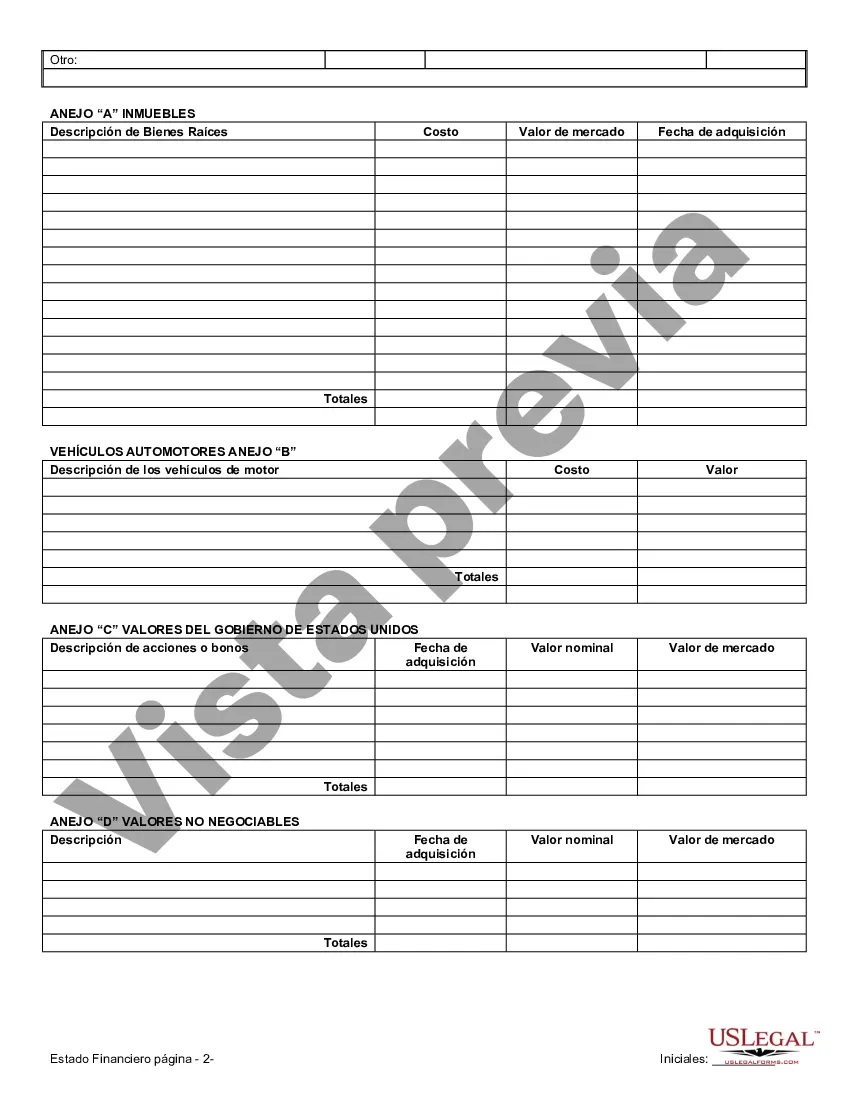

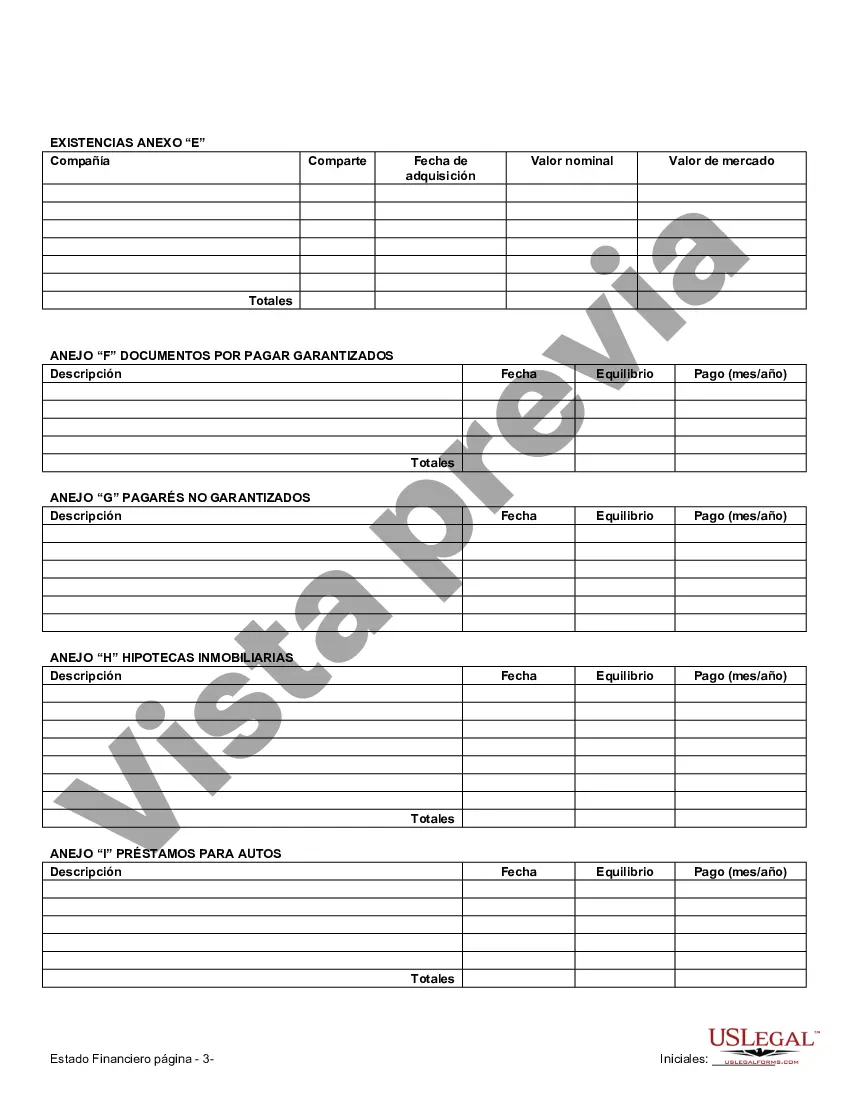

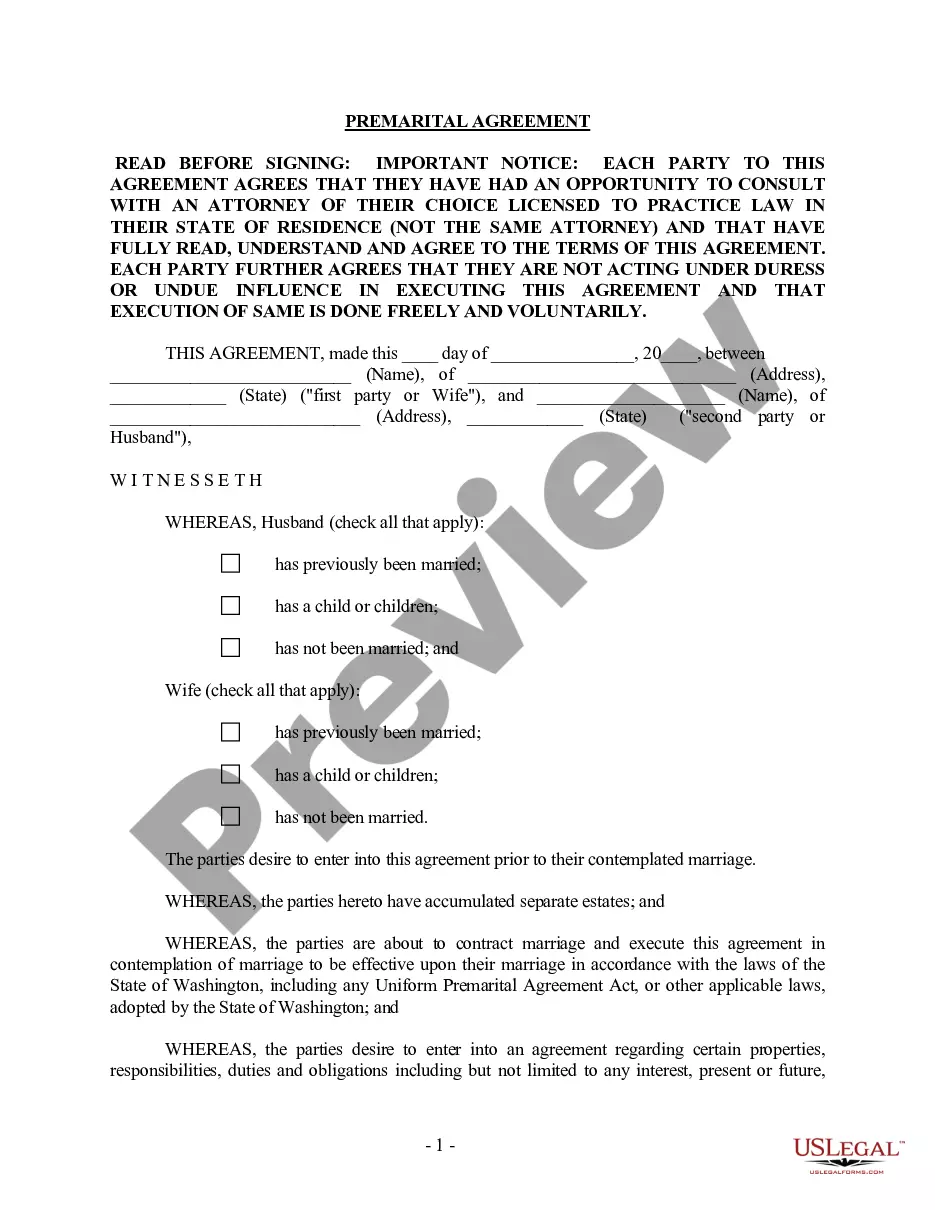

Everett Washington Financial Statements in Connection with Prenuptial Premarital Agreement: An Overview Financial transparency is a crucial aspect of any prenuptial or premarital agreement. In Everett, Washington, couples who are considering entering into such agreements often need to provide financial statements that accurately represent their respective assets, liabilities, incomes, and expenses. These financial statements play a pivotal role in ensuring transparency and fairness in the agreement, enabling both parties to make informed decisions. Types of Everett Washington Financial Statements for Prenuptial Premarital Agreement: 1. Personal Balance Sheet: A personal balance sheet is a comprehensive snapshot of an individual's financial position. It includes detailed information about assets, such as properties, investments, bank accounts, and vehicles, along with a breakdown of liabilities, such as debts or mortgages. This statement helps identify each partner's net worth and aids in determining the division of marital property and debts in the event of divorce or separation. 2. Income Statements: Income statements present a summary of all income and expenses during a specific period, typically on an annual basis. These statements provide a clear picture of each individual's earning capacity, sources of income, and ongoing expenses. By analyzing income statements, both parties can assess the financial stability and earning potential of their partner, which may impact decisions related to spousal support or property division in the future. 3. Tax Returns: Tax returns are official documents filed with the Internal Revenue Service (IRS) that showcase an individual's income, deductions, and tax liability for a given year. Providing tax returns enables each partner to assess the other's tax history, potential liabilities, and potential deductions, which may influence future financial decision-making, especially if one partner has significant tax obligations or ongoing audits. 4. Personal Investment Statements: Personal investment statements include documentation of any significant investments, such as stocks, bonds, mutual funds, or real estate holdings. These statements display the market value, acquisition cost, and potential returns associated with each investment. By evaluating these statements, partners can better understand each other's investment strategies, potential returns on investments, and overall financial stability. 5. Business Financial Statements: If one or both partners own a business, they may need to provide financial statements related to their business interests. These statements include profit and loss statements, balance sheets, and cash flow statements. Partners can assess the financial health of the business and evaluate the impact it may have on their overall financial stability and obligations. In conclusion, when preparing a prenuptial or premarital agreement in Everett, Washington, financial transparency is key. Providing various types of financial statements, such as personal balance sheets, income statements, tax returns, personal investment statements, and business financial statements, allows couples to fully understand each other's financial positions and make informed decisions about property division, support obligations, and other financial matters in their agreement.

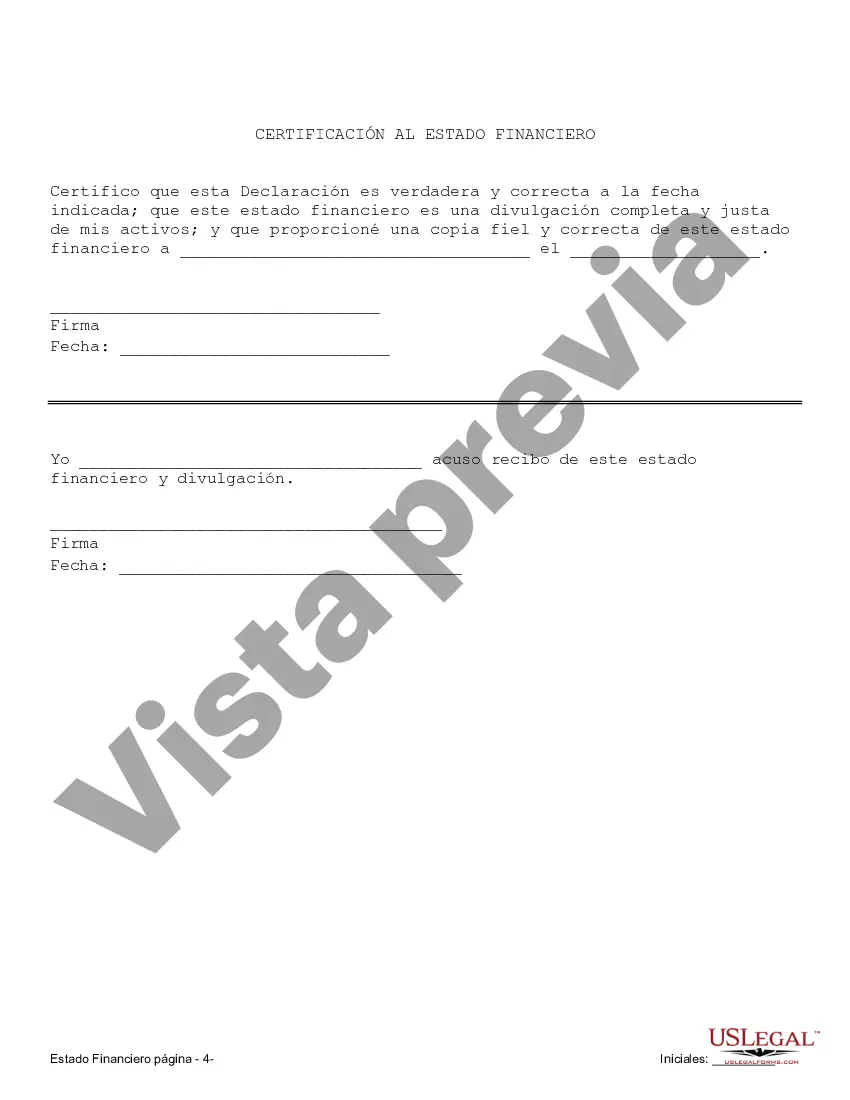

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Everett Washington Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Washington Financial Statements only in Connection with Prenuptial Premarital Agreement

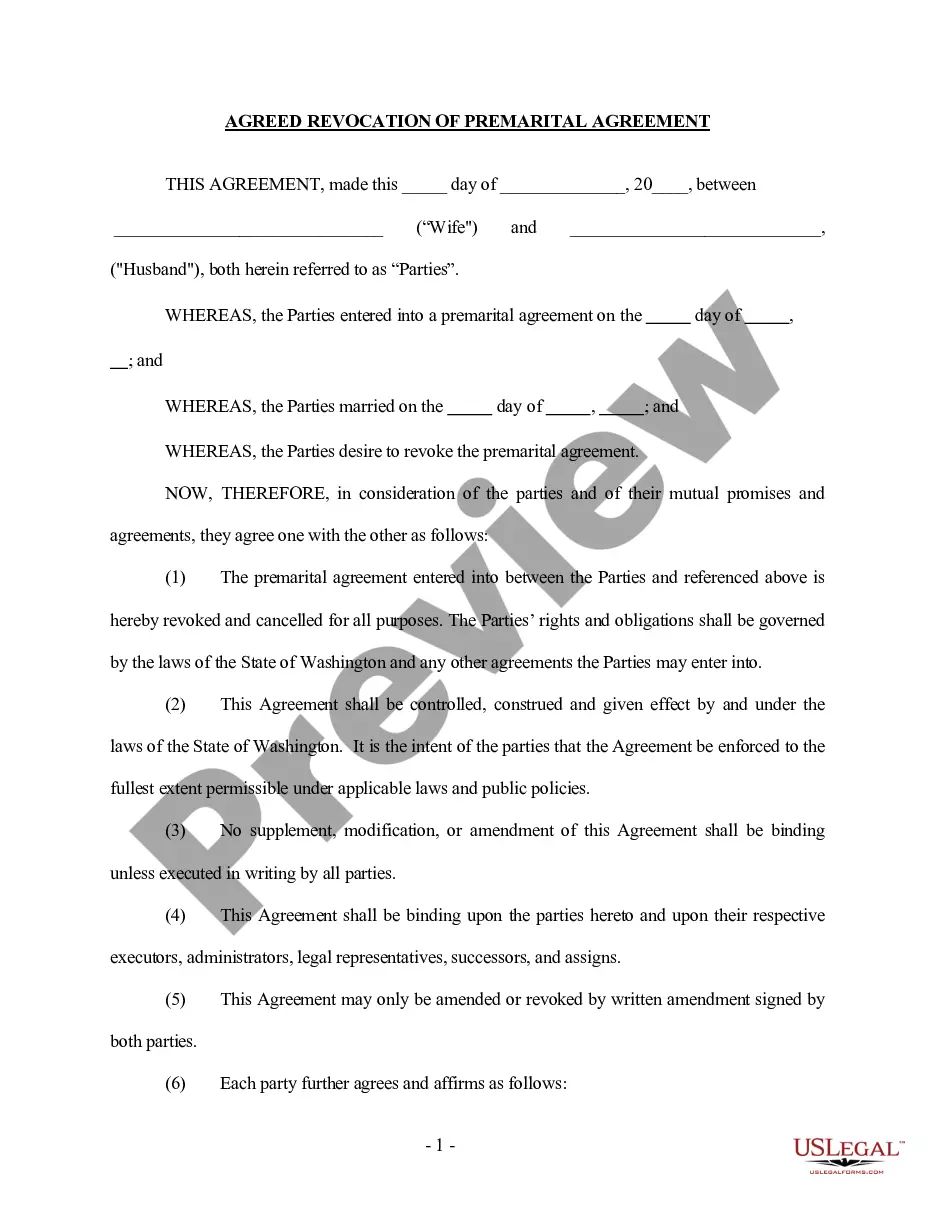

Description

How to fill out Everett Washington Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Everett Washington Financial Statements only in Connection with Prenuptial Premarital Agreement becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Everett Washington Financial Statements only in Connection with Prenuptial Premarital Agreement takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Everett Washington Financial Statements only in Connection with Prenuptial Premarital Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!