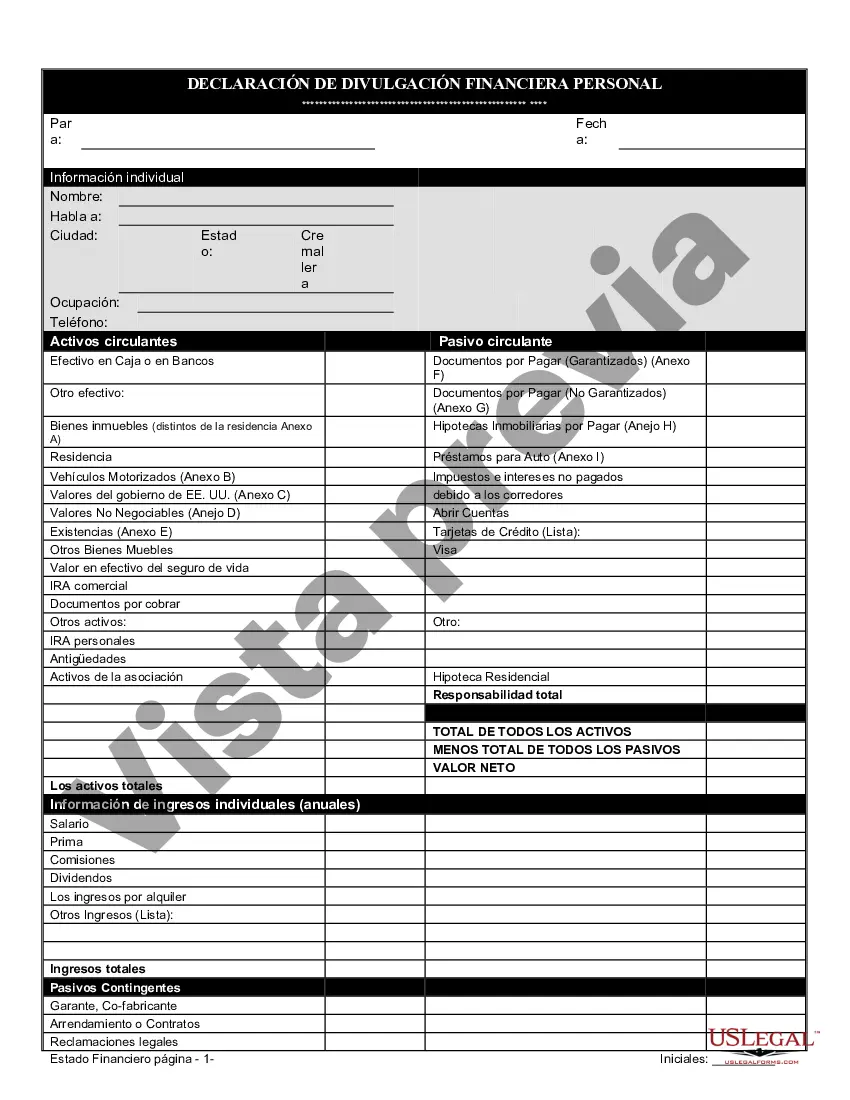

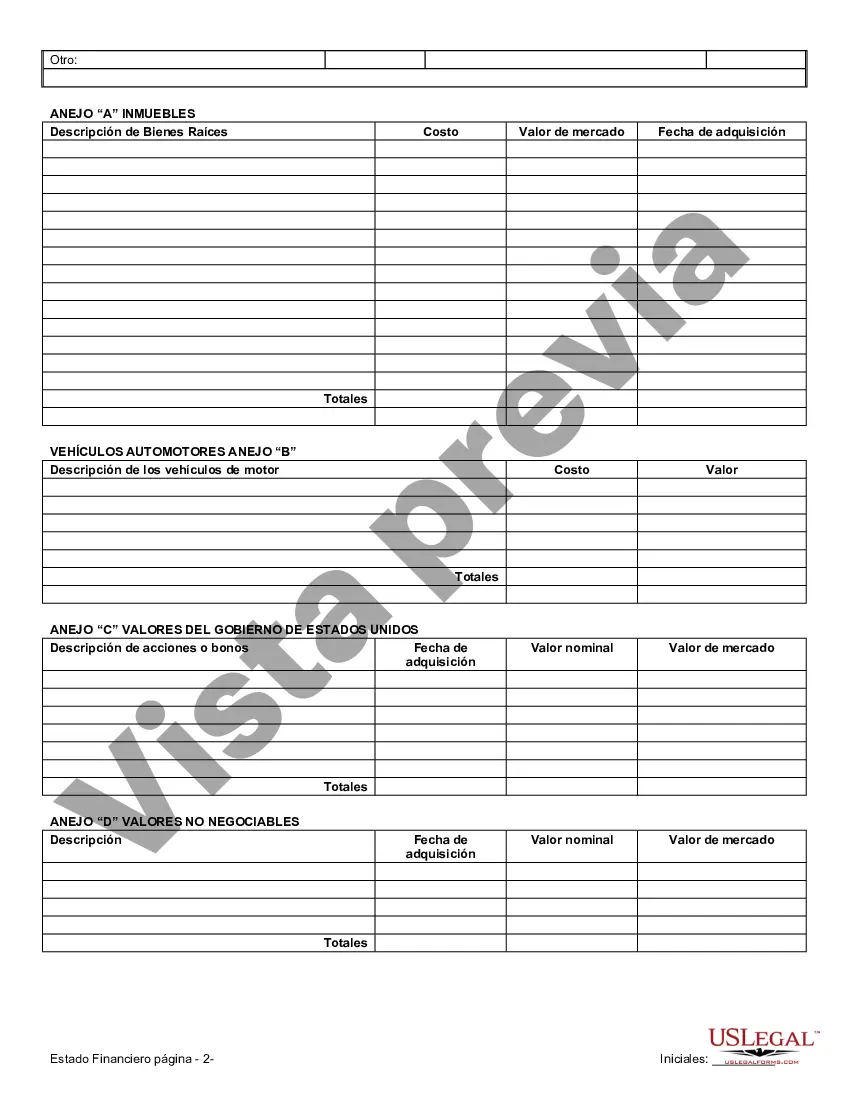

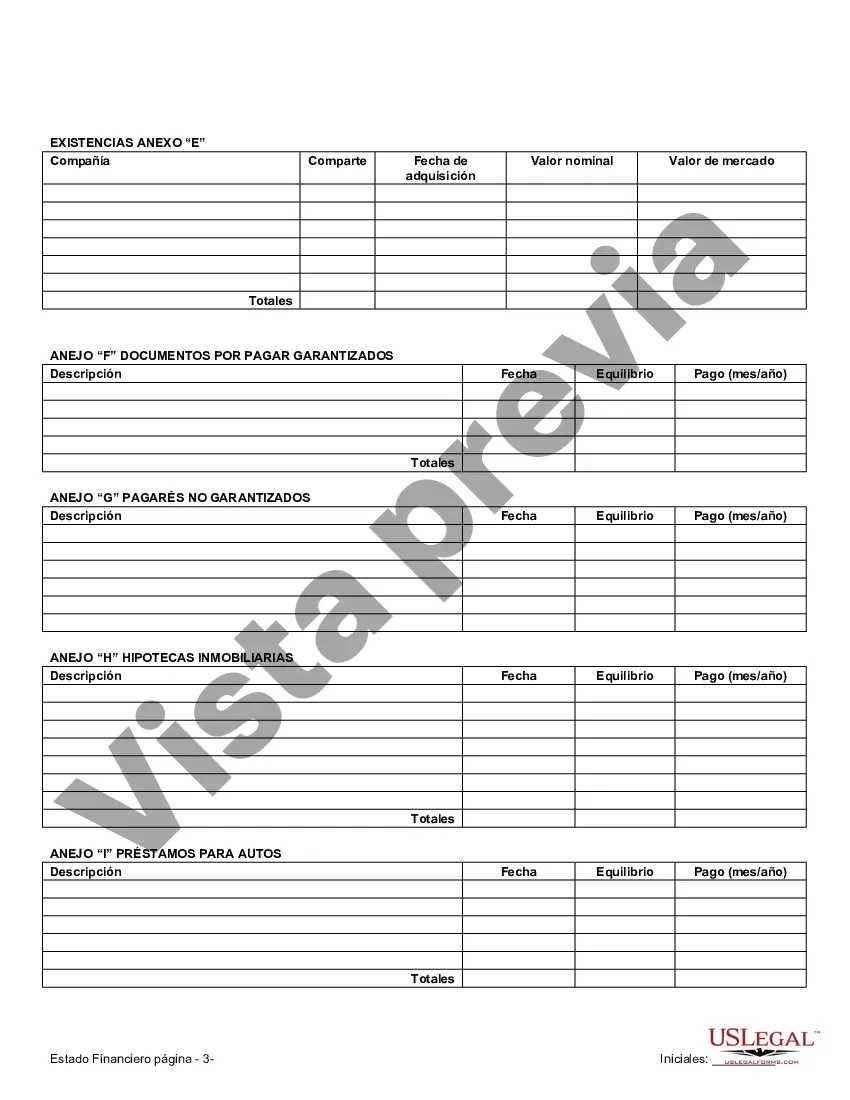

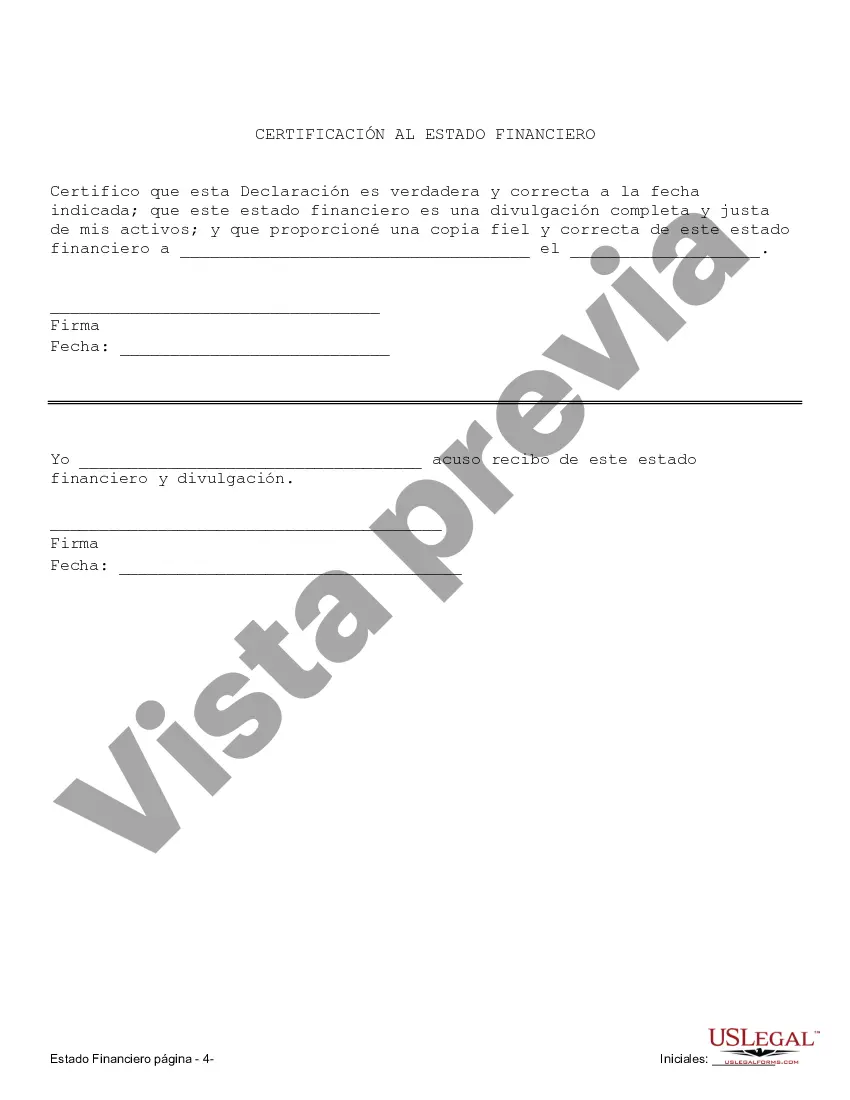

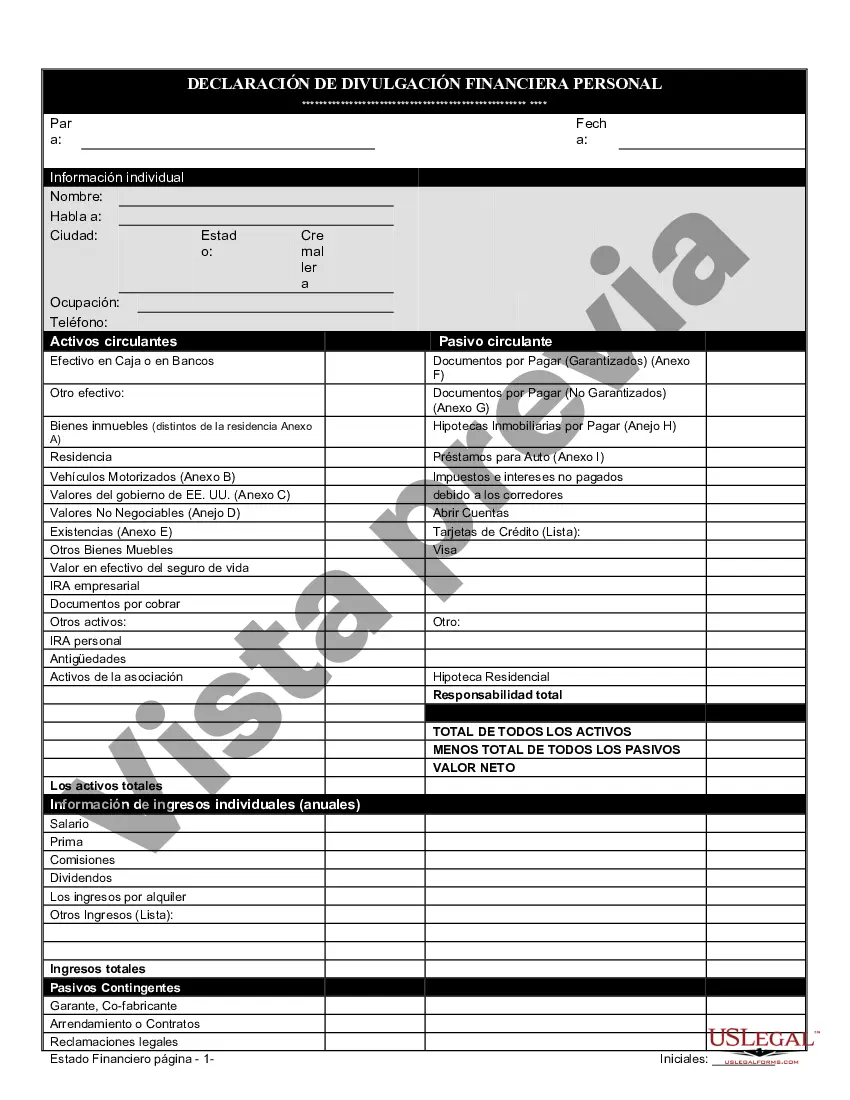

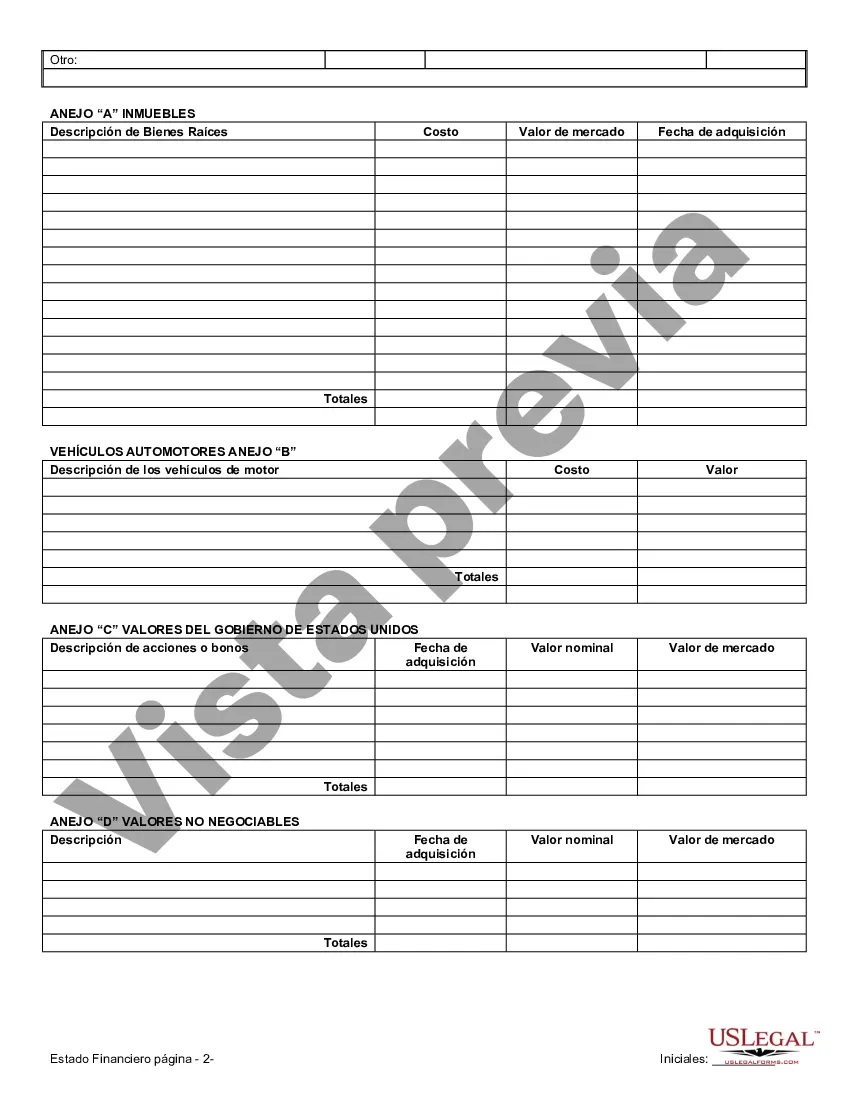

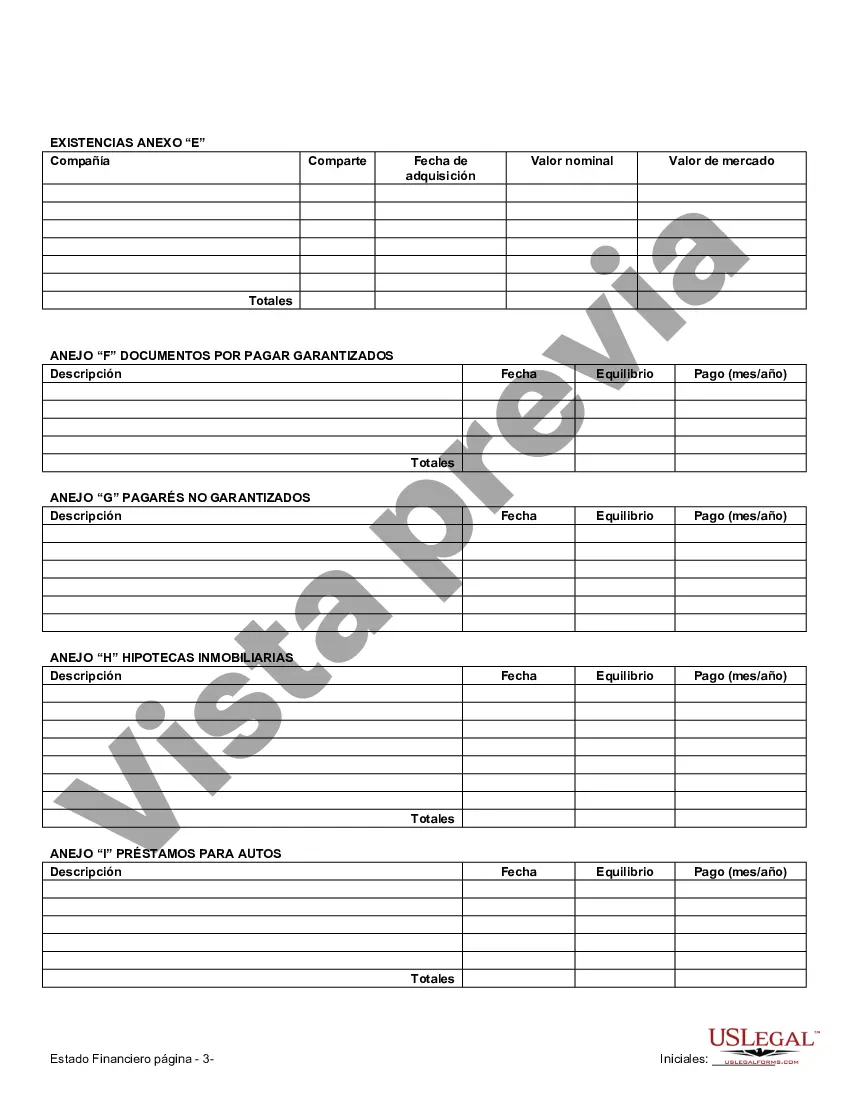

When entering into a prenuptial or premarital agreement in Tacoma, Washington, it is crucial to understand the role and importance of financial statements. Financial statements serve as a vital document in outlining the financial details and assets of both parties involved in the agreement. These statements play a significant role in protecting the rights and interests of individuals within a marriage or partnership. Let's explore the different types of Tacoma Washington Financial Statements exclusively used in connection with prenuptial and premarital agreements: 1. Income and Expense Statement: This financial statement outlines the income and expenses of each party separately. It includes information about earnings, investments, debts, and monthly expenses. This statement provides a comprehensive snapshot of the individual's financial position. 2. Balance Sheet: The balance sheet focuses on capturing the assets and liabilities of both parties involved. This statement highlights various financial aspects such as real estate, retirement accounts, stocks, savings, debts, and other major assets. The balance sheet can help determine the ownership and distribution of assets during a divorce or separation. 3. Cash Flow Statement: A cash flow statement represents the movement of funds in and out of each individual's accounts. It showcases the income received, expenses paid, and overall cash flow. This statement assists in understanding the financial stability and liquidity of each party and their ability to meet obligations. 4. Tax Returns and W-2 Forms: Tax returns and W-2 forms help in determining the income, deductions, and tax liabilities of each individual. These documents provide a clear picture of an individual's financial status and are crucial in evaluating the impact of taxes on the prenuptial agreement. 5. Business Financial Statements: If either party owns a business, business financial statements, such as profit and loss statements, balance sheets, and cash flow statements associated with the business, may be required. These statements determine the value and financial health of the business that may be considered during asset division. 6. Retirement Account Statements: Retirement account statements, such as those for 401(k)s, IRAs, and pension plans, provide information on the accumulated assets within these accounts. These statements guide the division of retirement assets in the prenuptial agreement and ensure fairness for both parties. It is crucial to consult with a professional attorney or financial advisor in Tacoma, Washington, who specializes in prenuptial and premarital agreements. They can guide you through the process and ensure that all necessary financial statements are properly completed, allowing for a comprehensive and fair agreement that protects both parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tacoma Washington Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Washington Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Tacoma Washington Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Regardless of social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone with no law background to draft such paperwork from scratch, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Tacoma Washington Financial Statements only in Connection with Prenuptial Premarital Agreement or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Tacoma Washington Financial Statements only in Connection with Prenuptial Premarital Agreement in minutes employing our trusted service. In case you are presently an existing customer, you can proceed to log in to your account to get the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps before obtaining the Tacoma Washington Financial Statements only in Connection with Prenuptial Premarital Agreement:

- Be sure the template you have chosen is good for your location considering that the rules of one state or county do not work for another state or county.

- Review the form and go through a brief outline (if available) of cases the paper can be used for.

- In case the form you chosen doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- Log in to your account login information or create one from scratch.

- Choose the payment method and proceed to download the Tacoma Washington Financial Statements only in Connection with Prenuptial Premarital Agreement as soon as the payment is through.

You’re all set! Now you can proceed to print the form or fill it out online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.