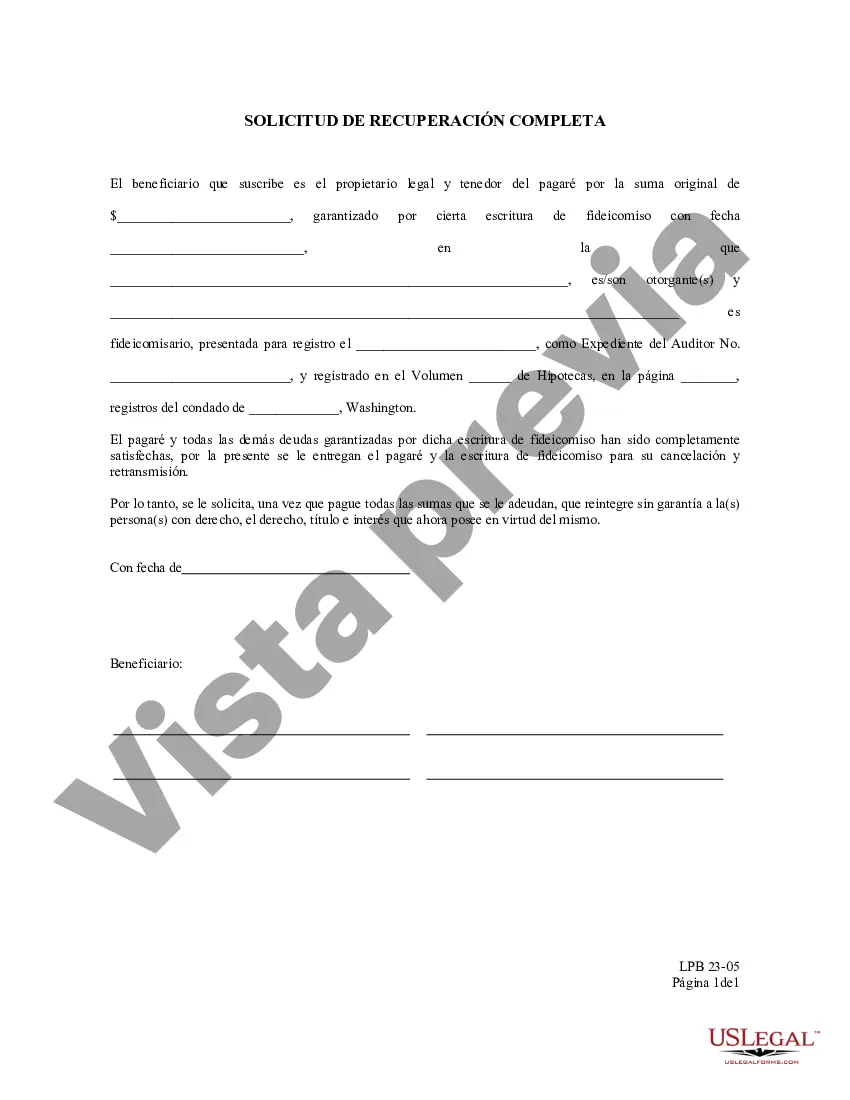

This is an official Washington form for use in land transactions, a Request for Full Reconveyance.

The Seattle Washington Request for Full Re conveyance is a legal document utilized in the state of Washington to officially release a property from a mortgage or deed of trust after it has been fully paid off. This document is submitted to the lender or trustee who holds the loan on the property. A request for full reconveyance is typically initiated by the property owner, and it signifies that the borrower has fulfilled all the financial obligations associated with the mortgage. It is important to understand that a reconveyance is only necessary when a property is subject to a deed of trust, which is a common form of security agreement used in real estate transactions in Washington. The Seattle Washington Request for Full Re conveyance contains key information such as the names of the borrower and lender, the legal description of the property, the recording details of the original deed of trust, and the loan identification number. Additionally, it requires the borrower's signature and notarization. There are different types of Seattle Washington Request for Full Re conveyance based on the various types of loans and lenders involved. For instance, a reconveyance request can be initiated by a bank, credit union, or private lender. The specific type of loan, such as a conventional loan or a Federal Housing Administration (FHA) loan, may also influence the content and requirements of the reconveyance document. The Seattle Washington Request for Full Re conveyance serves an important purpose in ensuring that the borrower's rights to the property are fully restored once the loan is repaid. By requesting a full reconveyance, the property owner eliminates any encumbrances or liens that may have been placed on the property to secure the loan. This is crucial for maintaining a clear title to the property, which allows the owner to freely sell or transfer the property in the future. In summary, the Seattle Washington Request for Full Re conveyance is a vital legal document used in real estate transactions to release a property from a mortgage or deed of trust after the loan is fully repaid. It plays a crucial role in restoring the borrower's rights and ensuring a clean title to the property.The Seattle Washington Request for Full Re conveyance is a legal document utilized in the state of Washington to officially release a property from a mortgage or deed of trust after it has been fully paid off. This document is submitted to the lender or trustee who holds the loan on the property. A request for full reconveyance is typically initiated by the property owner, and it signifies that the borrower has fulfilled all the financial obligations associated with the mortgage. It is important to understand that a reconveyance is only necessary when a property is subject to a deed of trust, which is a common form of security agreement used in real estate transactions in Washington. The Seattle Washington Request for Full Re conveyance contains key information such as the names of the borrower and lender, the legal description of the property, the recording details of the original deed of trust, and the loan identification number. Additionally, it requires the borrower's signature and notarization. There are different types of Seattle Washington Request for Full Re conveyance based on the various types of loans and lenders involved. For instance, a reconveyance request can be initiated by a bank, credit union, or private lender. The specific type of loan, such as a conventional loan or a Federal Housing Administration (FHA) loan, may also influence the content and requirements of the reconveyance document. The Seattle Washington Request for Full Re conveyance serves an important purpose in ensuring that the borrower's rights to the property are fully restored once the loan is repaid. By requesting a full reconveyance, the property owner eliminates any encumbrances or liens that may have been placed on the property to secure the loan. This is crucial for maintaining a clear title to the property, which allows the owner to freely sell or transfer the property in the future. In summary, the Seattle Washington Request for Full Re conveyance is a vital legal document used in real estate transactions to release a property from a mortgage or deed of trust after the loan is fully repaid. It plays a crucial role in restoring the borrower's rights and ensuring a clean title to the property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.