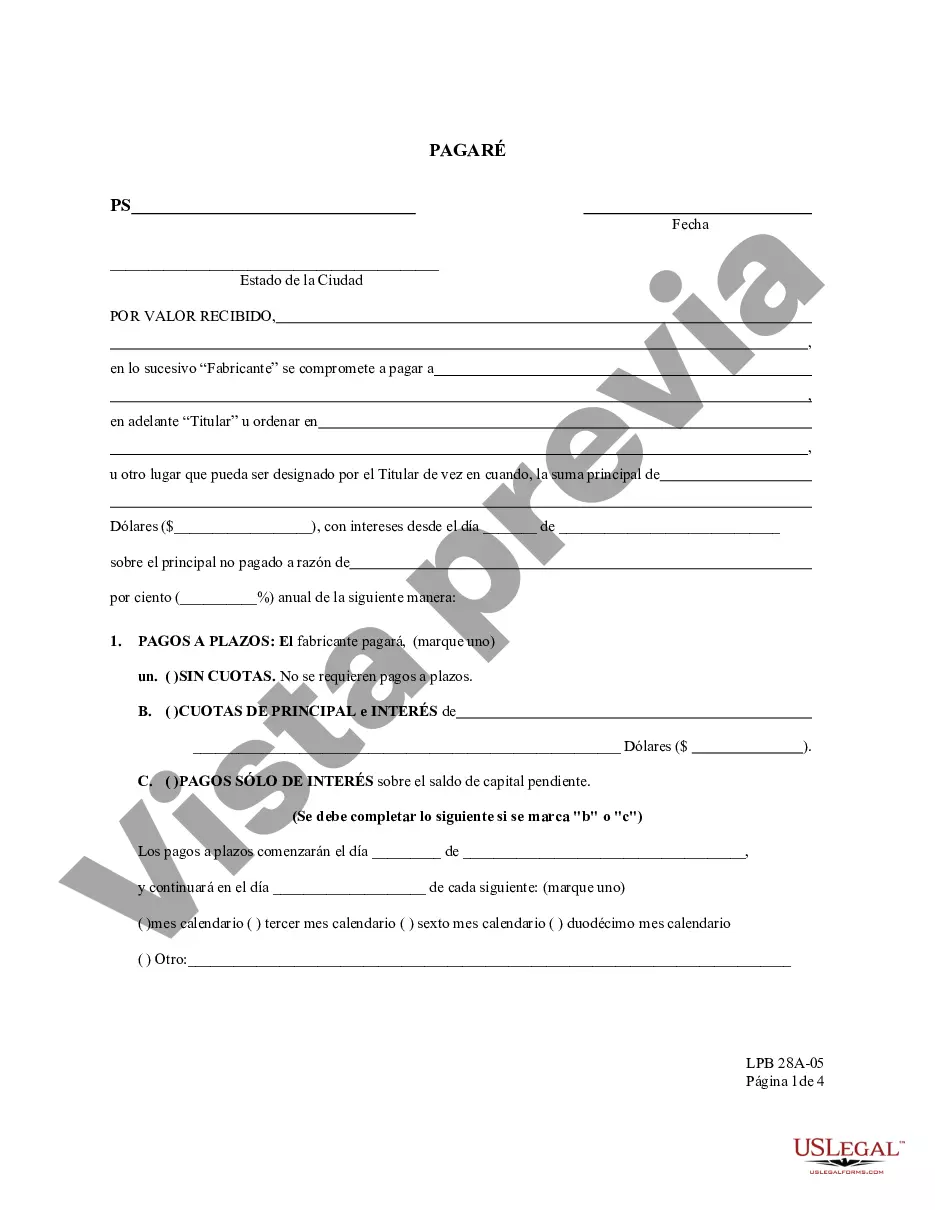

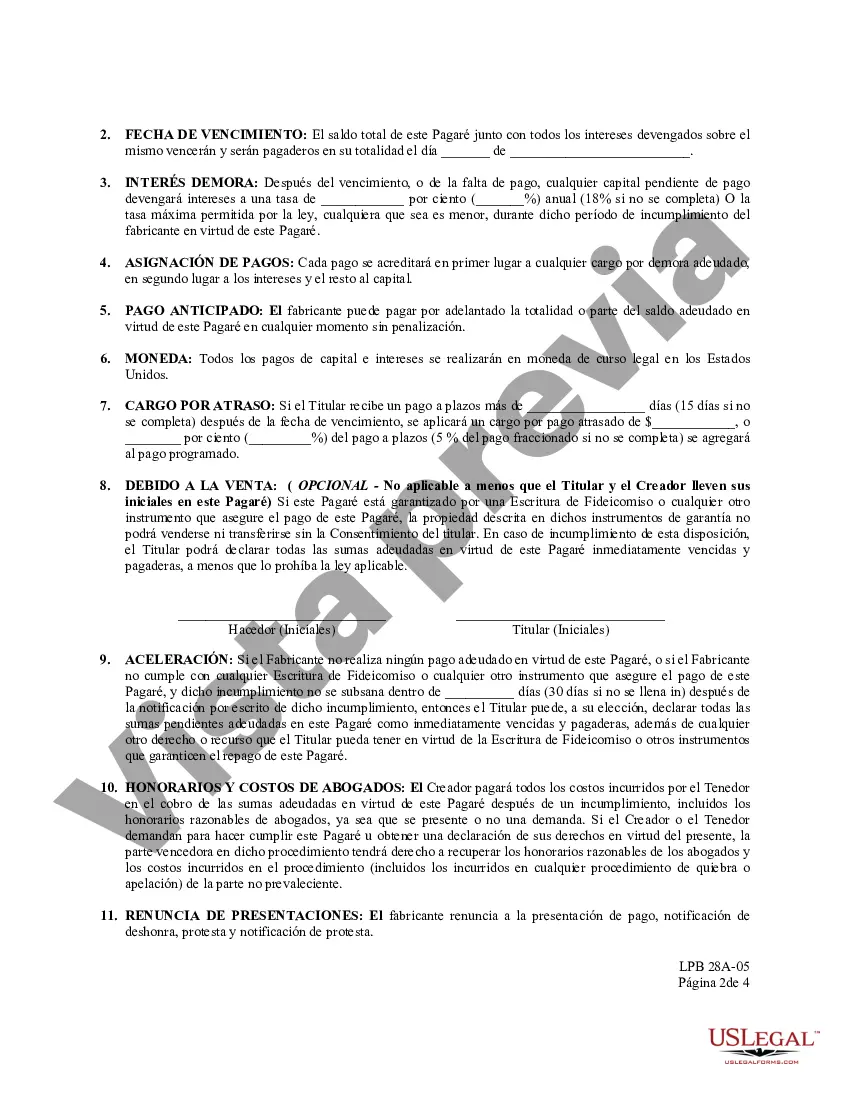

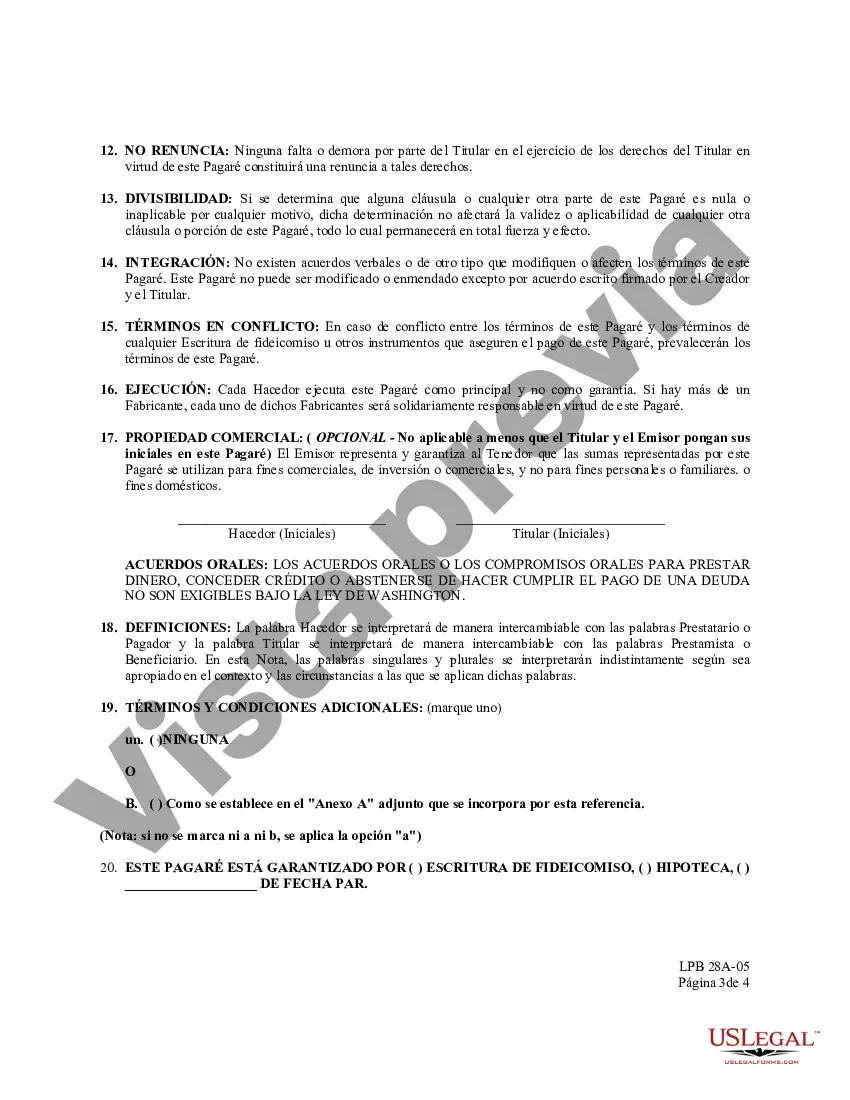

This is an official Washington form for use in land transactions, a Promissory Note.

A Bellevue Washington Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Bellevue area of Washington State. This document serves as a binding contract, ensuring that both parties understand their rights and responsibilities. There are various types of Bellevue Washington Promissory Notes, each designed to meet specific lending needs. Some common types include: 1. Bellevue Washington Secured Promissory Note: This type of promissory note is backed by collateral, such as real estate or personal property. If the borrower defaults on the loan, the lender has the right to seize the specified assets to recover their investment. 2. Bellevue Washington Unsecured Promissory Note: Unlike a secured promissory note, this type does not require collateral. Lenders often use creditworthiness to assess the borrower's ability to repay the loan. However, in the event of default, the lender might need to resort to legal measures to recover the owed amount. 3. Bellevue Washington Demand Promissory Note: A demand note allows the lender to request repayment at any time, usually without prior notice. While this provides flexibility for the lender, the borrower should be prepared to repay the loan balance promptly upon receiving a demand. 4. Bellevue Washington Installment Promissory Note: With this type of promissory note, the borrower repays the loan amount and interest in regular installments over a specified period. This provides a structured repayment plan for both parties. In a Bellevue Washington Promissory Note, key details include the loan amount, interest rate, repayment schedule, late payment penalties, and any conditions or contingencies. The note may also include provisions for prepayment or the transfer of the note to another party. It is crucial for both parties to carefully review and understand the terms before signing the document. When preparing or executing a Bellevue Washington Promissory Note, it is recommended to consult with a qualified attorney or legal professional familiar with lending laws in Washington State to ensure compliance and protect the interests of both parties involved.A Bellevue Washington Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Bellevue area of Washington State. This document serves as a binding contract, ensuring that both parties understand their rights and responsibilities. There are various types of Bellevue Washington Promissory Notes, each designed to meet specific lending needs. Some common types include: 1. Bellevue Washington Secured Promissory Note: This type of promissory note is backed by collateral, such as real estate or personal property. If the borrower defaults on the loan, the lender has the right to seize the specified assets to recover their investment. 2. Bellevue Washington Unsecured Promissory Note: Unlike a secured promissory note, this type does not require collateral. Lenders often use creditworthiness to assess the borrower's ability to repay the loan. However, in the event of default, the lender might need to resort to legal measures to recover the owed amount. 3. Bellevue Washington Demand Promissory Note: A demand note allows the lender to request repayment at any time, usually without prior notice. While this provides flexibility for the lender, the borrower should be prepared to repay the loan balance promptly upon receiving a demand. 4. Bellevue Washington Installment Promissory Note: With this type of promissory note, the borrower repays the loan amount and interest in regular installments over a specified period. This provides a structured repayment plan for both parties. In a Bellevue Washington Promissory Note, key details include the loan amount, interest rate, repayment schedule, late payment penalties, and any conditions or contingencies. The note may also include provisions for prepayment or the transfer of the note to another party. It is crucial for both parties to carefully review and understand the terms before signing the document. When preparing or executing a Bellevue Washington Promissory Note, it is recommended to consult with a qualified attorney or legal professional familiar with lending laws in Washington State to ensure compliance and protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.