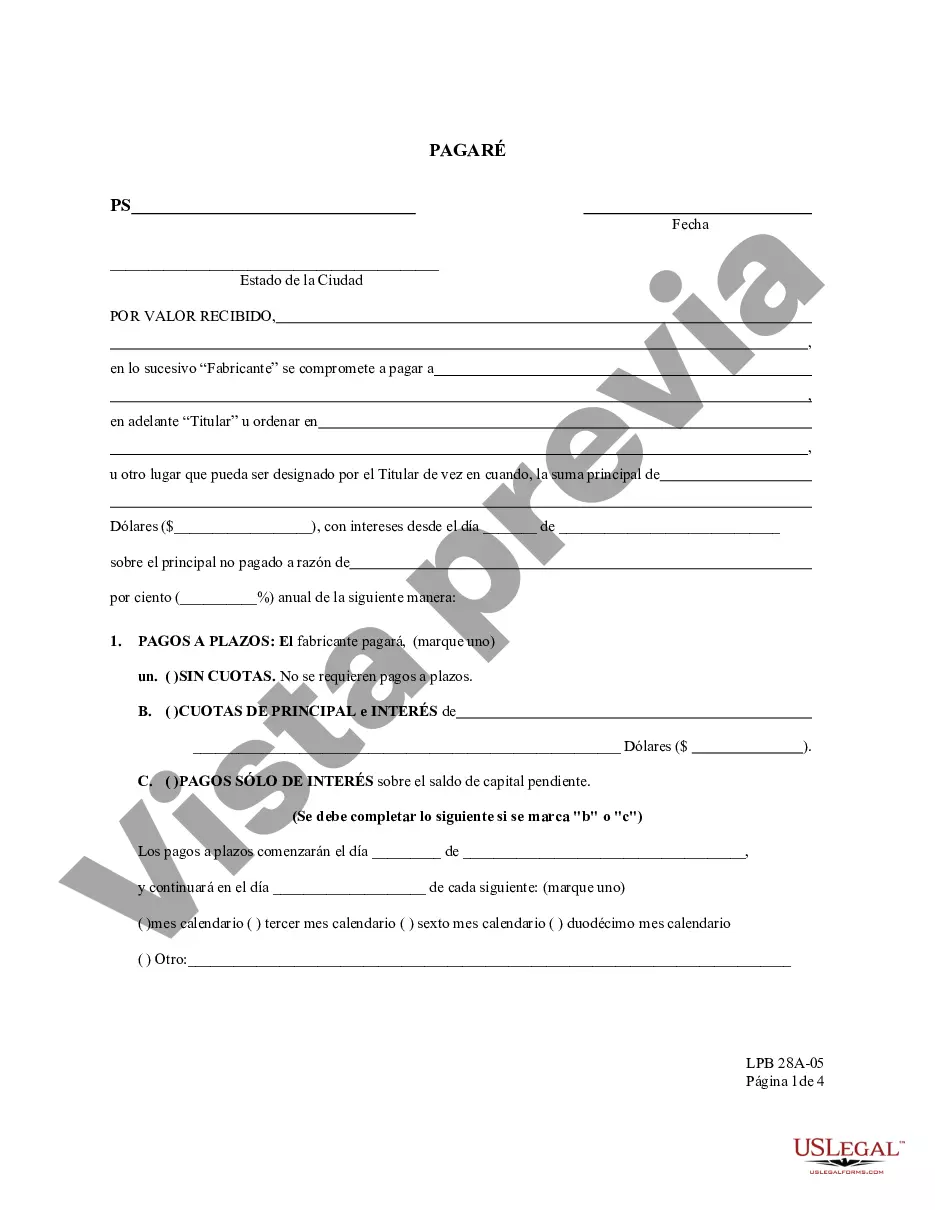

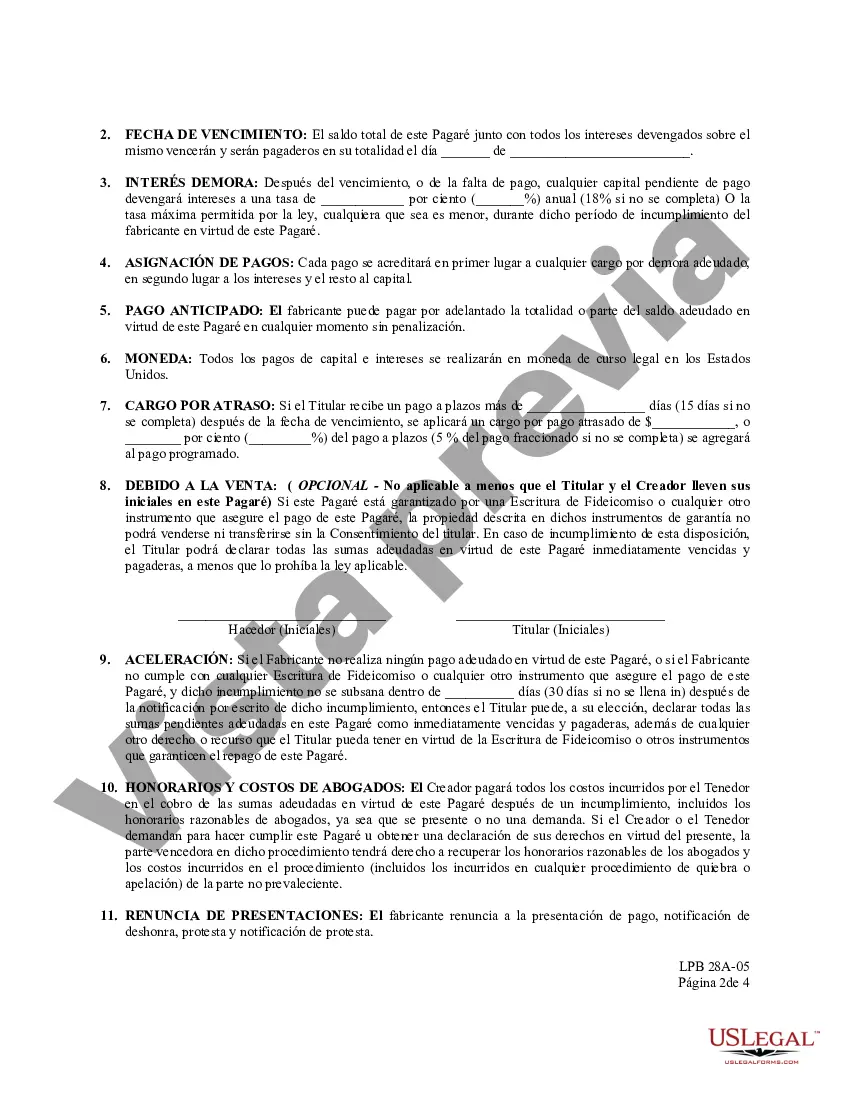

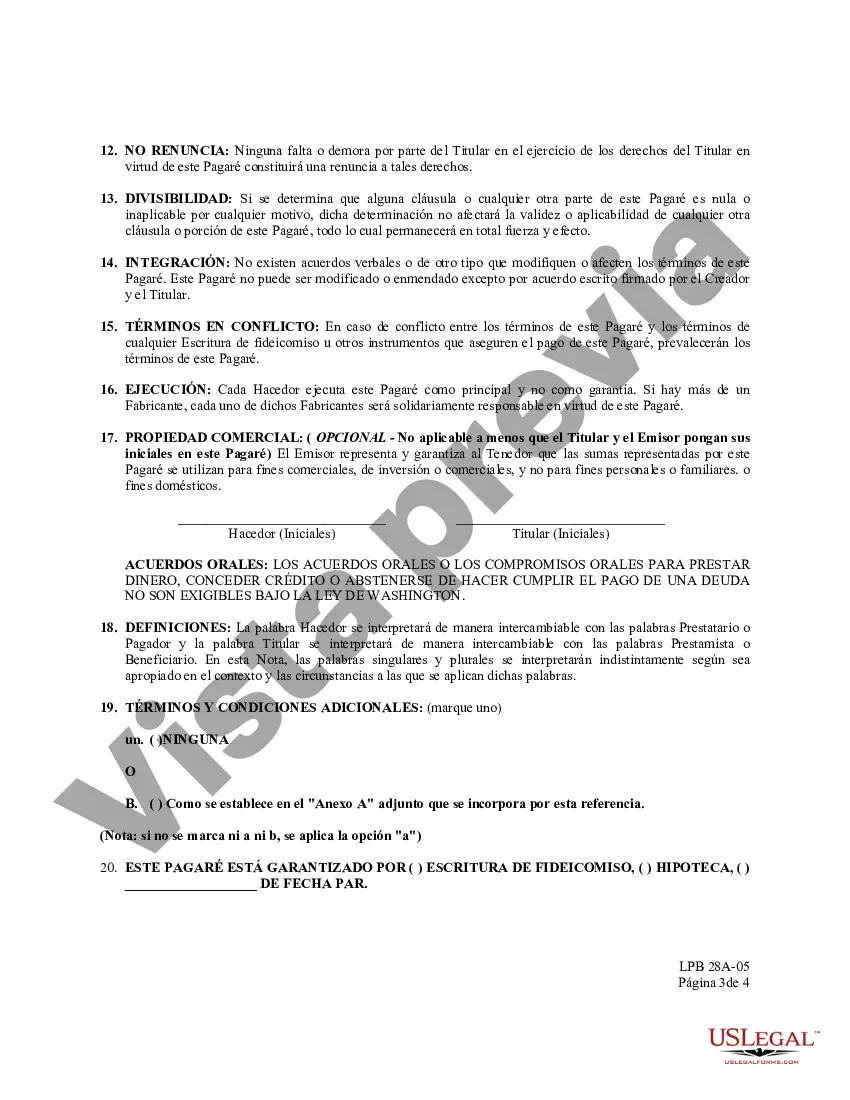

This is an official Washington form for use in land transactions, a Promissory Note.

A Spokane Valley Washington Promissory Note is a legal document used to outline the terms and conditions of a loan agreement in Spokane Valley, Washington. It serves as a written promise to repay a specific amount of money borrowed from one party (the lender) to another party (the borrower) within a defined timeframe, along with the agreed-upon interest rate and any other applicable fees or penalties. The Promissory Note is a crucial document that provides legal protection to both the lender and borrower, ensuring that the loan transaction is properly recorded and enforced. It establishes a clear record of the loan amount, repayment schedule, interest rate, and any collateral offered by the borrower to secure the loan. There are different types of Spokane Valley Washington Promissory Notes that can be utilized based on specific borrowing needs and circumstances. Some common types include: 1. Installment Promissory Note: This type of promissory note involves the borrower repaying the loan amount in fixed, regular installments over a specified period. Each installment consists of a portion of the principal amount plus interest, ensuring that the loan is repaid in full by the end of the term. 2. Demand Promissory Note: Unlike an installment note, a demand promissory note gives the lender the authority to demand full repayment of the outstanding loan amount at any time, also known as "on-demand." This type of note provides flexibility to the lender if they require immediate repayment, but it also puts the borrower at risk of having to repay the loan without prior notice. 3. Secured Promissory Note: This type of promissory note includes a provision where the borrower pledges collateral, such as real estate, a vehicle, or other valuable assets, to secure the loan. In the event of default, the lender can seize the collateral to satisfy the outstanding debt. 4. Unsecured Promissory Note: In contrast to a secured note, an unsecured promissory note does not require any collateral. It is solely based on the borrower's creditworthiness and trustworthiness. However, due to the higher risk involved for the lender, an unsecured note may have a higher interest rate than a secured note. It is essential for both parties to carefully review and understand the terms and conditions outlined in the Spokane Valley Washington Promissory Note before signing. Additionally, seeking legal advice prior to entering into a promissory note agreement is recommended to ensure compliance with state laws and protect the rights and interests of both parties involved in the loan transaction.A Spokane Valley Washington Promissory Note is a legal document used to outline the terms and conditions of a loan agreement in Spokane Valley, Washington. It serves as a written promise to repay a specific amount of money borrowed from one party (the lender) to another party (the borrower) within a defined timeframe, along with the agreed-upon interest rate and any other applicable fees or penalties. The Promissory Note is a crucial document that provides legal protection to both the lender and borrower, ensuring that the loan transaction is properly recorded and enforced. It establishes a clear record of the loan amount, repayment schedule, interest rate, and any collateral offered by the borrower to secure the loan. There are different types of Spokane Valley Washington Promissory Notes that can be utilized based on specific borrowing needs and circumstances. Some common types include: 1. Installment Promissory Note: This type of promissory note involves the borrower repaying the loan amount in fixed, regular installments over a specified period. Each installment consists of a portion of the principal amount plus interest, ensuring that the loan is repaid in full by the end of the term. 2. Demand Promissory Note: Unlike an installment note, a demand promissory note gives the lender the authority to demand full repayment of the outstanding loan amount at any time, also known as "on-demand." This type of note provides flexibility to the lender if they require immediate repayment, but it also puts the borrower at risk of having to repay the loan without prior notice. 3. Secured Promissory Note: This type of promissory note includes a provision where the borrower pledges collateral, such as real estate, a vehicle, or other valuable assets, to secure the loan. In the event of default, the lender can seize the collateral to satisfy the outstanding debt. 4. Unsecured Promissory Note: In contrast to a secured note, an unsecured promissory note does not require any collateral. It is solely based on the borrower's creditworthiness and trustworthiness. However, due to the higher risk involved for the lender, an unsecured note may have a higher interest rate than a secured note. It is essential for both parties to carefully review and understand the terms and conditions outlined in the Spokane Valley Washington Promissory Note before signing. Additionally, seeking legal advice prior to entering into a promissory note agreement is recommended to ensure compliance with state laws and protect the rights and interests of both parties involved in the loan transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.