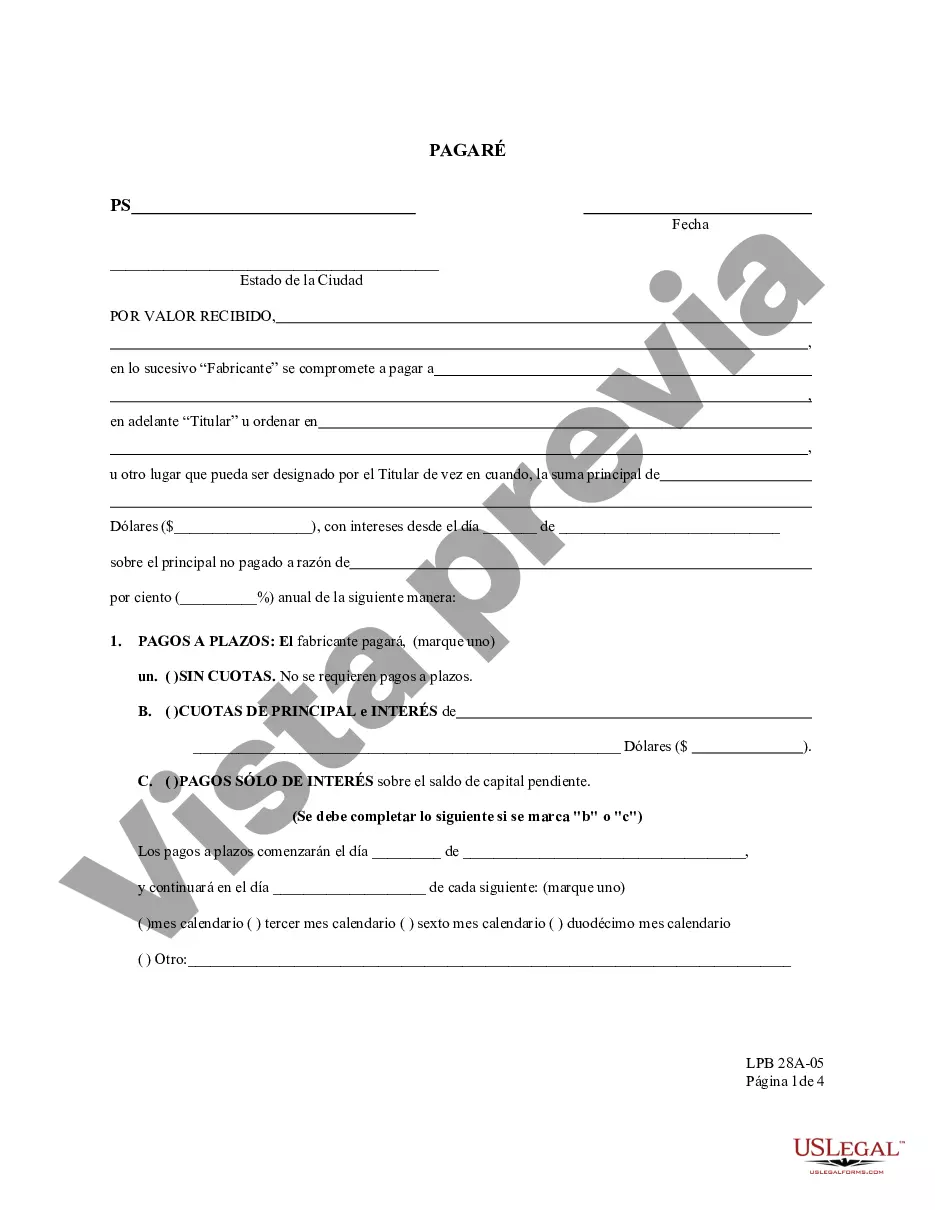

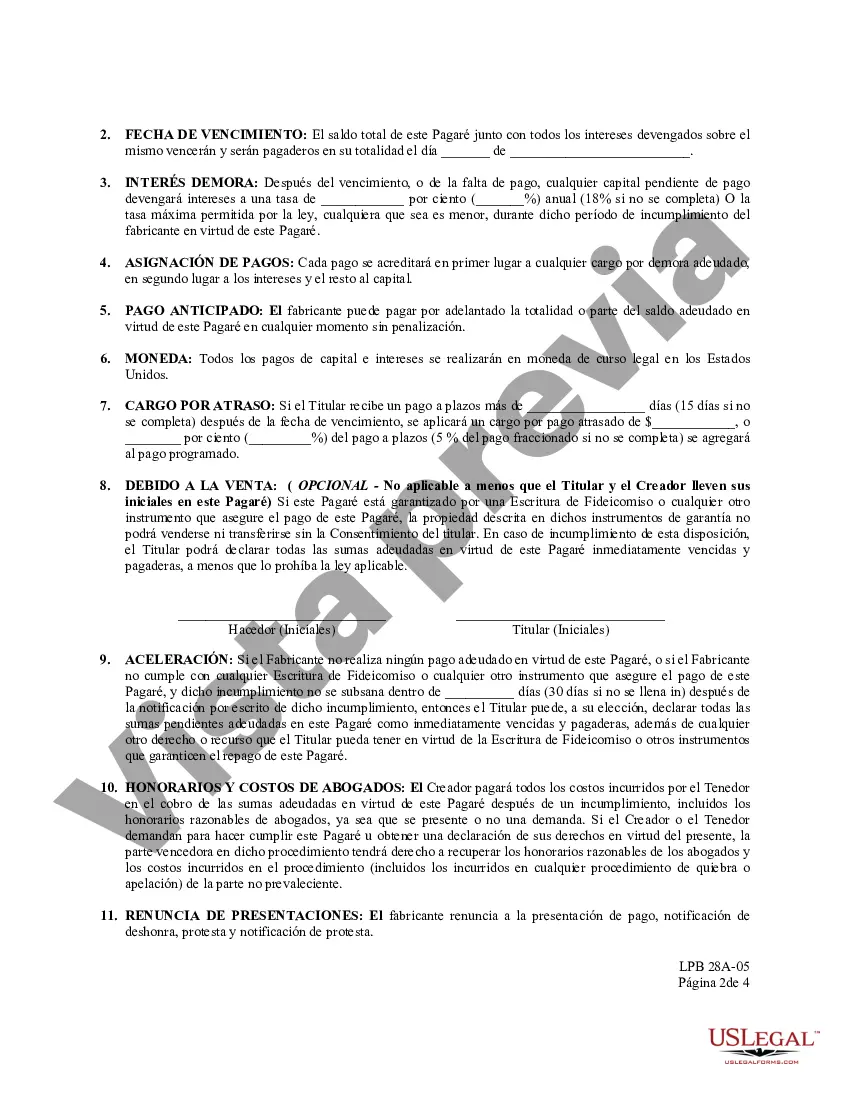

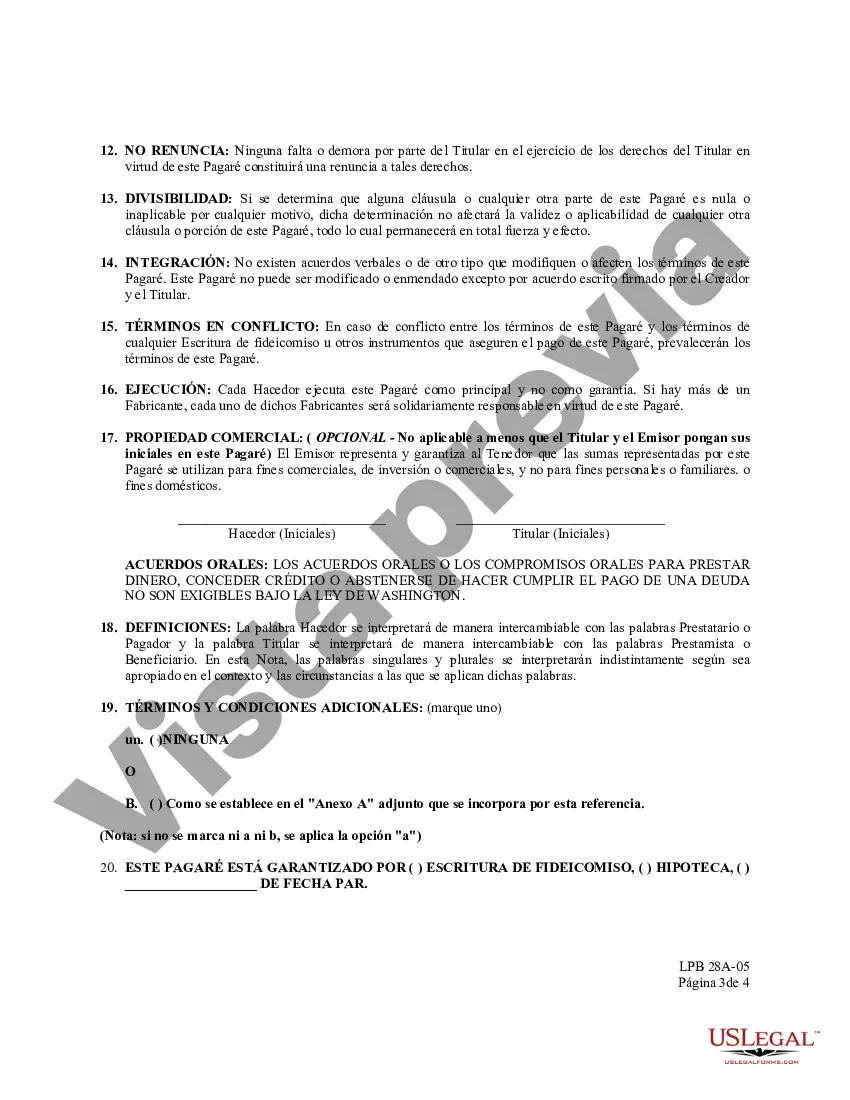

This is an official Washington form for use in land transactions, a Promissory Note.

A Vancouver Washington Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Vancouver, Washington area. It serves as evidence of a debt obligation and ensures that both parties are clear on the repayment schedule and the consequences of defaulting on the loan. The promissory note typically includes essential details such as the names and addresses of both the lender and borrower, the loan amount, the interest rate charged, and the repayment terms. It establishes a legal obligation for the borrower to repay the loan and specifies the agreed-upon method of repayment, whether through regular installments or in a lump sum. Vancouver, Washington offers several types of promissory notes to cater to various financial situations and loan arrangements. Some common types include: 1. Secured Promissory Note: This type of promissory note involves pledging collateral, such as property or valuable assets, to secure the loan. In the event of default, the lender has the right to seize the pledged assets to recover the amount owed. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. It relies solely on the borrower's promise to repay the loan according to the agreed-upon terms. Due to the increased risk for the lender, unsecured notes often have higher interest rates. 3. Demand Promissory Note: A demand note allows the lender to demand full repayment of the loan at any time, usually without prior notice. This type of note is commonly used for short-term loans or when the lender wants the flexibility to call in the loan if needed. 4. Installment Promissory Note: This type of promissory note breaks down the loan repayment into periodic installments, typically monthly or quarterly. Each installment consists of a portion of the principal amount plus the accrued interest, allowing borrowers to manage their repayment obligations over a longer period. 5. Balloon Promissory Note: A balloon note involves making smaller regular payments over a specific term, with a large final payment called the "balloon payment" due at the end. This type of note is often used when the borrower anticipates a large influx of funds or plans to refinance before the balloon payment becomes due. Investing in a Vancouver Washington Promissory Note can be a profitable venture for individuals or businesses looking to diversify their investment portfolios. However, it is crucial to engage the services of a qualified attorney or financial advisor to ensure compliance with local laws and to protect the rights and interests of all parties involved.A Vancouver Washington Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the Vancouver, Washington area. It serves as evidence of a debt obligation and ensures that both parties are clear on the repayment schedule and the consequences of defaulting on the loan. The promissory note typically includes essential details such as the names and addresses of both the lender and borrower, the loan amount, the interest rate charged, and the repayment terms. It establishes a legal obligation for the borrower to repay the loan and specifies the agreed-upon method of repayment, whether through regular installments or in a lump sum. Vancouver, Washington offers several types of promissory notes to cater to various financial situations and loan arrangements. Some common types include: 1. Secured Promissory Note: This type of promissory note involves pledging collateral, such as property or valuable assets, to secure the loan. In the event of default, the lender has the right to seize the pledged assets to recover the amount owed. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. It relies solely on the borrower's promise to repay the loan according to the agreed-upon terms. Due to the increased risk for the lender, unsecured notes often have higher interest rates. 3. Demand Promissory Note: A demand note allows the lender to demand full repayment of the loan at any time, usually without prior notice. This type of note is commonly used for short-term loans or when the lender wants the flexibility to call in the loan if needed. 4. Installment Promissory Note: This type of promissory note breaks down the loan repayment into periodic installments, typically monthly or quarterly. Each installment consists of a portion of the principal amount plus the accrued interest, allowing borrowers to manage their repayment obligations over a longer period. 5. Balloon Promissory Note: A balloon note involves making smaller regular payments over a specific term, with a large final payment called the "balloon payment" due at the end. This type of note is often used when the borrower anticipates a large influx of funds or plans to refinance before the balloon payment becomes due. Investing in a Vancouver Washington Promissory Note can be a profitable venture for individuals or businesses looking to diversify their investment portfolios. However, it is crucial to engage the services of a qualified attorney or financial advisor to ensure compliance with local laws and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.