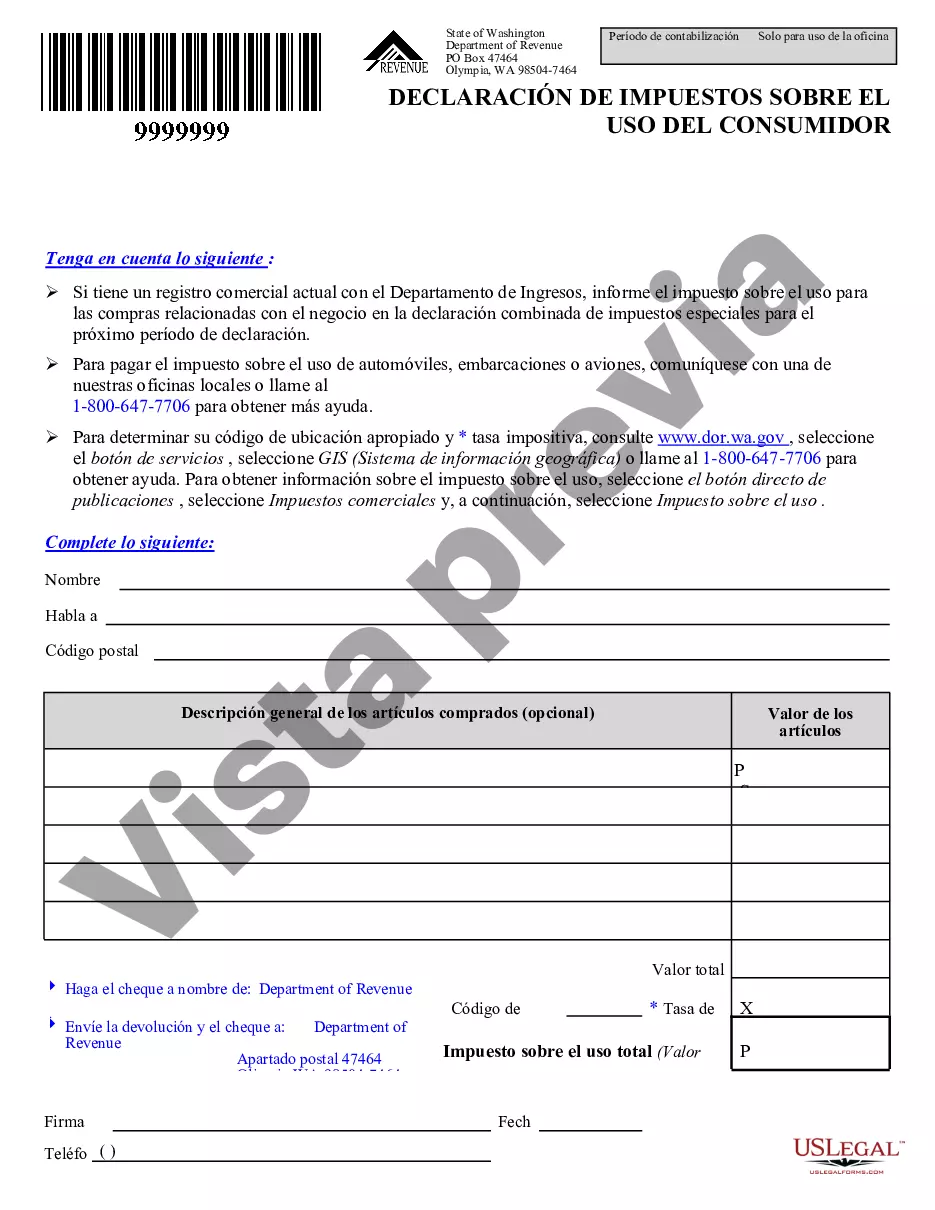

This is an official Washington form for use in land transactions, a Consumer Use Tax Return (Department of Revenue).

The Everett Washington Consumer Use Tax Return is a document provided by the Department of Revenue in Washington state. It is designed specifically for taxpayers in Everett, Washington, who need to report and remit consumer use tax. This tax applies to purchases made from out-of-state businesses or retailers that did not collect sales tax. The Everett Washington Consumer Use Tax Return serves as a way for individuals and businesses to report their out-of-state purchases and calculate the appropriate use tax owed. It ensures compliance with Washington state law, which requires residents to pay use tax on eligible purchases. Key features of the Everett Washington Consumer Use Tax Return include: 1. Reporting Purchases: Taxpayers must provide a detailed list of all out-of-state purchases made during the reporting period. This includes the description of the items, purchase dates, and the total amount spent. 2. Calculation of Use Tax: The return provides a section where taxpayers can calculate the use tax owed on their out-of-state purchases. This is based on the total purchase price and the applicable tax rate. 3. Payment Instructions: The return contains instructions for making use tax payments to the Department of Revenue. It outlines various payment methods, including electronic payment options, checks, or money orders. 4. Filing Deadlines: The Department of Revenue assigns specific filing deadlines for the Everett Washington Consumer Use Tax Return. It is crucial for taxpayers to submit their returns and payments on time to avoid penalties or interest charges. Different types of Everett Washington Consumer Use Tax Return may include variations for different tax years or specific forms for businesses and individuals. For example, there may be a separate form for businesses with higher purchasing volumes or specific reporting requirements. Moreover, taxpayers may also encounter specific forms for certain industries or types of purchases. For instance, there might be specialized forms for motor vehicle purchases or construction equipment acquisitions. In summary, the Everett Washington Consumer Use Tax Return is a necessary filing document issued by the Department of Revenue. It ensures taxpayer compliance with Washington state law and assists in calculating and reporting consumer use tax owed on out-of-state purchases. Keep in mind that the Department of Revenue may release different forms and variations, aiming to accommodate diverse taxpayers and industries.The Everett Washington Consumer Use Tax Return is a document provided by the Department of Revenue in Washington state. It is designed specifically for taxpayers in Everett, Washington, who need to report and remit consumer use tax. This tax applies to purchases made from out-of-state businesses or retailers that did not collect sales tax. The Everett Washington Consumer Use Tax Return serves as a way for individuals and businesses to report their out-of-state purchases and calculate the appropriate use tax owed. It ensures compliance with Washington state law, which requires residents to pay use tax on eligible purchases. Key features of the Everett Washington Consumer Use Tax Return include: 1. Reporting Purchases: Taxpayers must provide a detailed list of all out-of-state purchases made during the reporting period. This includes the description of the items, purchase dates, and the total amount spent. 2. Calculation of Use Tax: The return provides a section where taxpayers can calculate the use tax owed on their out-of-state purchases. This is based on the total purchase price and the applicable tax rate. 3. Payment Instructions: The return contains instructions for making use tax payments to the Department of Revenue. It outlines various payment methods, including electronic payment options, checks, or money orders. 4. Filing Deadlines: The Department of Revenue assigns specific filing deadlines for the Everett Washington Consumer Use Tax Return. It is crucial for taxpayers to submit their returns and payments on time to avoid penalties or interest charges. Different types of Everett Washington Consumer Use Tax Return may include variations for different tax years or specific forms for businesses and individuals. For example, there may be a separate form for businesses with higher purchasing volumes or specific reporting requirements. Moreover, taxpayers may also encounter specific forms for certain industries or types of purchases. For instance, there might be specialized forms for motor vehicle purchases or construction equipment acquisitions. In summary, the Everett Washington Consumer Use Tax Return is a necessary filing document issued by the Department of Revenue. It ensures taxpayer compliance with Washington state law and assists in calculating and reporting consumer use tax owed on out-of-state purchases. Keep in mind that the Department of Revenue may release different forms and variations, aiming to accommodate diverse taxpayers and industries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.