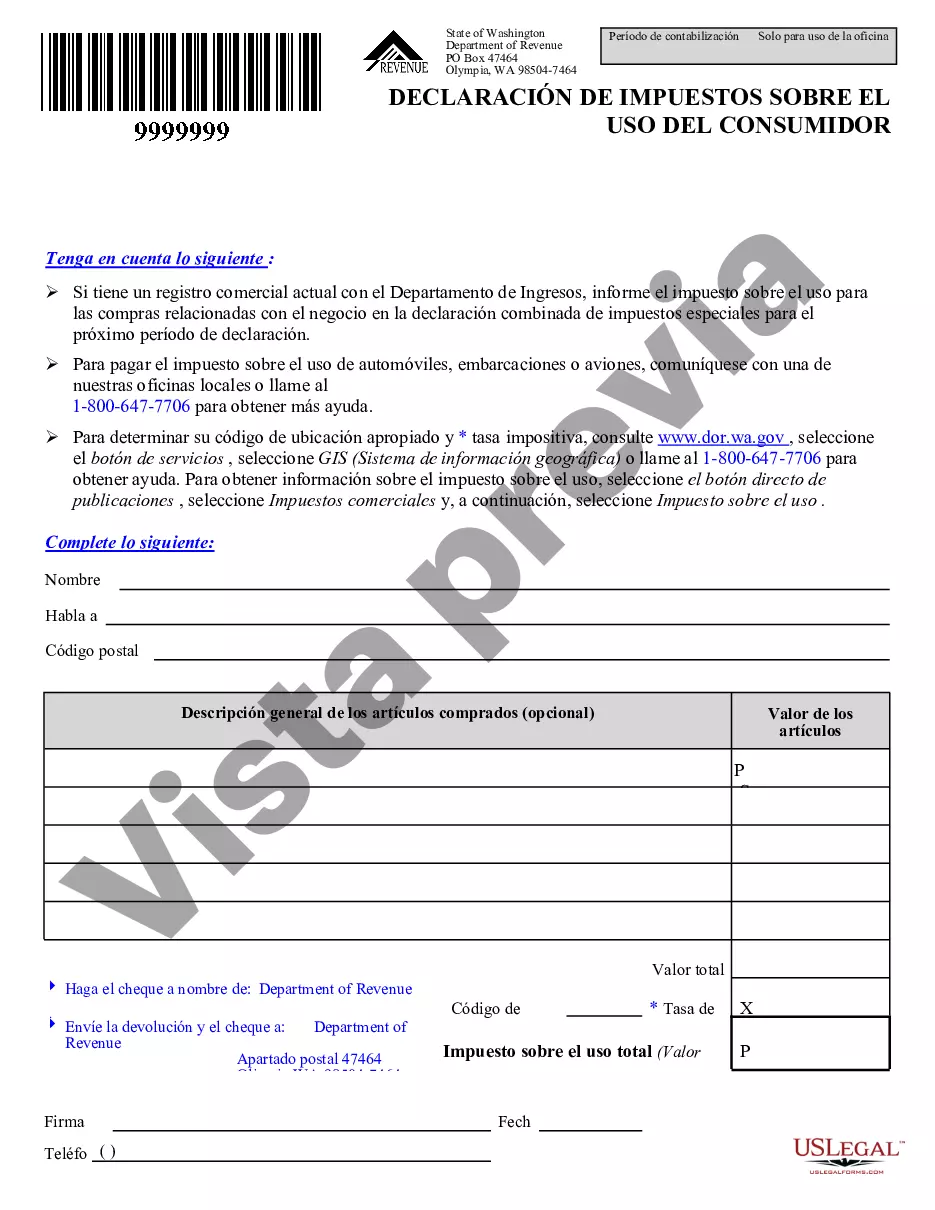

This is an official Washington form for use in land transactions, a Consumer Use Tax Return (Department of Revenue).

The King Washington Consumer Use Tax Return is a documentation required by the Department of Revenue in Washington. This tax return form is designed specifically for consumers residing or conducting business within the King County region of Washington state. It enables consumers to report and remit the applicable consumer use tax owed. Consumer Use Tax, also known as a “use tax,” is a complementary tax to sales tax and is imposed on taxable goods and services purchased out of state or online, where sales tax has not been paid. In Washington, the responsibility of paying the consumer use tax lies with the buyer or consumer rather than the seller. The King Washington Consumer Use Tax Return serves as an avenue for individuals and businesses to accurately report their out-of-state purchases during the tax year and fulfill their tax obligations to the state. By diligently completing this return, taxpayers contribute to the funding of various public services and infrastructure developments within King County. The Department of Revenue in Washington may introduce different variations or types of the King Washington Consumer Use Tax Return based on specific requirements or changes in tax regulations. These variations could include updated forms or separate forms applicable to different industries or categories of taxpayers, such as businesses, individuals, or nonprofits. It is crucial for taxpayers to be aware of the specific form requirements and updates to ensure compliance with the Department of Revenue's guidelines. The information required on the King Washington Consumer Use Tax Return typically includes the taxpayer's personal or business details, such as name, address, and taxpayer identification number. Taxpayers are then required to provide a detailed breakdown of their out-of-state purchases, including the purchase dates, vendors, and related sales amounts. Depending on the circumstances, certain exempt purchases or deductions may apply, and taxpayers should carefully review current tax laws or consult with tax professionals to ensure accurate completion of the return. Filing deadlines for the King Washington Consumer Use Tax Return may vary depending on individual circumstances and changes in tax law. The Department of Revenue often provides specific guidelines or instructions accompanying the tax return forms to assist taxpayers in meeting their filing obligations accurately and on time. In summary, the King Washington Consumer Use Tax Return is a vital document required by the Department of Revenue to report and remit consumer use tax owed by individuals and businesses in King County, Washington. It allows taxpayers to fulfill their tax obligations and contribute to the funding of public services while ensuring compliance with state tax laws.The King Washington Consumer Use Tax Return is a documentation required by the Department of Revenue in Washington. This tax return form is designed specifically for consumers residing or conducting business within the King County region of Washington state. It enables consumers to report and remit the applicable consumer use tax owed. Consumer Use Tax, also known as a “use tax,” is a complementary tax to sales tax and is imposed on taxable goods and services purchased out of state or online, where sales tax has not been paid. In Washington, the responsibility of paying the consumer use tax lies with the buyer or consumer rather than the seller. The King Washington Consumer Use Tax Return serves as an avenue for individuals and businesses to accurately report their out-of-state purchases during the tax year and fulfill their tax obligations to the state. By diligently completing this return, taxpayers contribute to the funding of various public services and infrastructure developments within King County. The Department of Revenue in Washington may introduce different variations or types of the King Washington Consumer Use Tax Return based on specific requirements or changes in tax regulations. These variations could include updated forms or separate forms applicable to different industries or categories of taxpayers, such as businesses, individuals, or nonprofits. It is crucial for taxpayers to be aware of the specific form requirements and updates to ensure compliance with the Department of Revenue's guidelines. The information required on the King Washington Consumer Use Tax Return typically includes the taxpayer's personal or business details, such as name, address, and taxpayer identification number. Taxpayers are then required to provide a detailed breakdown of their out-of-state purchases, including the purchase dates, vendors, and related sales amounts. Depending on the circumstances, certain exempt purchases or deductions may apply, and taxpayers should carefully review current tax laws or consult with tax professionals to ensure accurate completion of the return. Filing deadlines for the King Washington Consumer Use Tax Return may vary depending on individual circumstances and changes in tax law. The Department of Revenue often provides specific guidelines or instructions accompanying the tax return forms to assist taxpayers in meeting their filing obligations accurately and on time. In summary, the King Washington Consumer Use Tax Return is a vital document required by the Department of Revenue to report and remit consumer use tax owed by individuals and businesses in King County, Washington. It allows taxpayers to fulfill their tax obligations and contribute to the funding of public services while ensuring compliance with state tax laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.