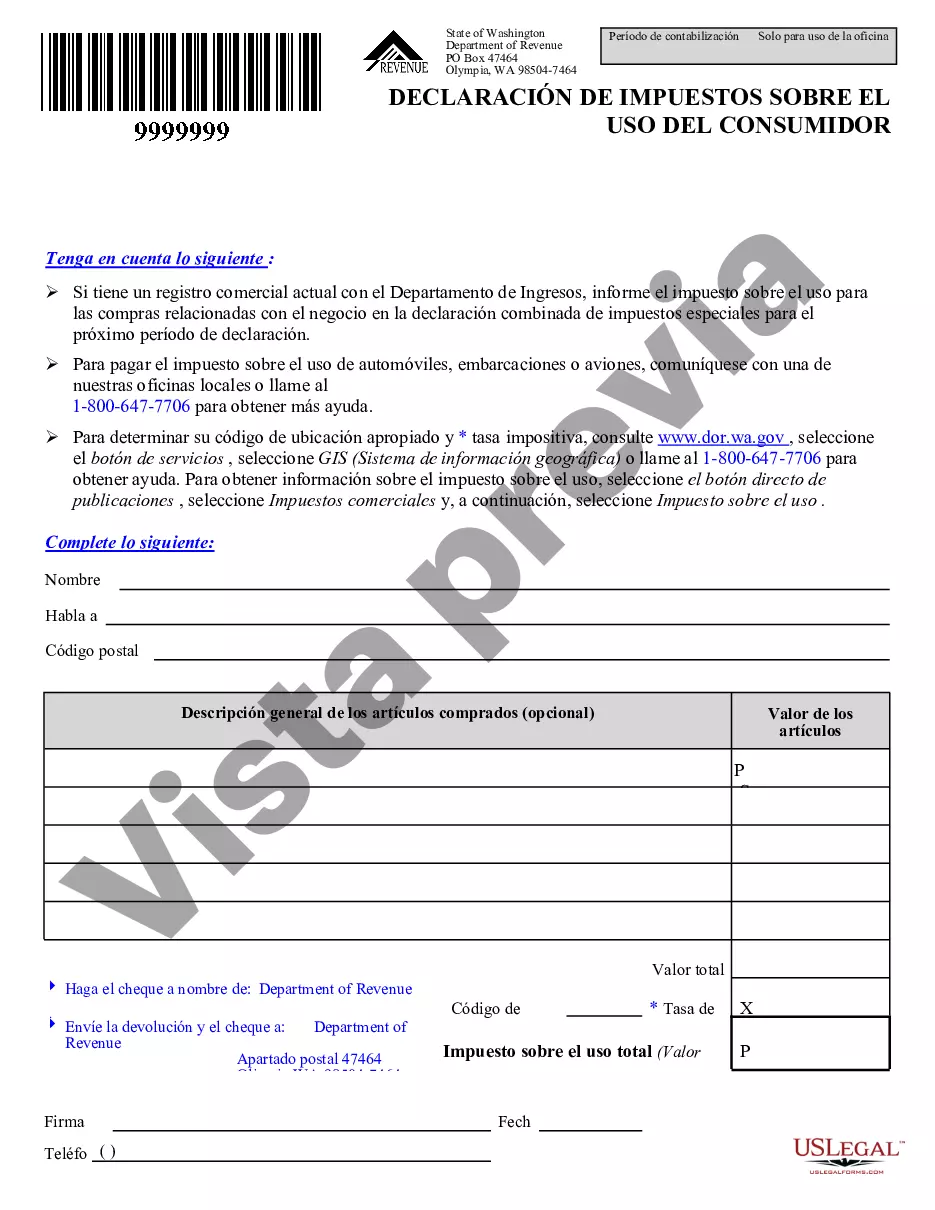

This is an official Washington form for use in land transactions, a Consumer Use Tax Return (Department of Revenue).

The Tacoma Washington Consumer Use Tax Return is a crucial document that taxpayers residing in Tacoma, Washington need to file with the Department of Revenue. This return is specifically designed to report and remit the consumer use tax owed to the state. Consumer use tax is a type of tax imposed on tangible personal property or specific services purchased from out-of-state retailers that did not collect sales tax. It is imposed to ensure fairness and to prevent tax avoidance by individuals who make purchases online or from other states where sales tax is not collected. This tax is intended to parallel the sales tax, ensuring that all taxable goods and services are subject to taxation regardless of their origin. Filing the Tacoma Washington Consumer Use Tax Return is essential for individuals who have made purchases exceeding $2,000 in a calendar year from out-of-state retailers and have not paid sales tax on those transactions. It is crucial for taxpayers to accurately report their purchases and calculate the appropriate use tax owed based on the taxable purchases made throughout the year. While there may not be different types of Tacoma Washington Consumer Use Tax Returns, it is important to note that there might be variations in the reporting requirements and tax rates applicable to different types of goods or services. Taxpayers should consult the Department of Revenue's guidelines and instructions to ensure they accurately report and calculate the consumer use tax owed. The Department of Revenue provides comprehensive resources, including online forms and instructions, to assist taxpayers in understanding and fulfilling their obligations. It is worth mentioning that the Tacoma Washington Consumer Use Tax Return plays a significant role in funding essential state services and infrastructure. By properly reporting and remitting the consumer use tax, taxpayers contribute to the economic well-being of the state and local communities. It also ensures a level playing field for local businesses that are subject to sales tax, preventing unfair competition from out-of-state retailers. In conclusion, the Tacoma Washington Consumer Use Tax Return is a critical document that taxpayers must file with the Department of Revenue. It is specifically designed to report and remit the consumer use tax owed on out-of-state purchases. By accurately reporting their purchases, taxpayers contribute to the state's revenue and support essential services. Complying with the consumer use tax regulations not only ensures fairness but also helps local businesses thrive.The Tacoma Washington Consumer Use Tax Return is a crucial document that taxpayers residing in Tacoma, Washington need to file with the Department of Revenue. This return is specifically designed to report and remit the consumer use tax owed to the state. Consumer use tax is a type of tax imposed on tangible personal property or specific services purchased from out-of-state retailers that did not collect sales tax. It is imposed to ensure fairness and to prevent tax avoidance by individuals who make purchases online or from other states where sales tax is not collected. This tax is intended to parallel the sales tax, ensuring that all taxable goods and services are subject to taxation regardless of their origin. Filing the Tacoma Washington Consumer Use Tax Return is essential for individuals who have made purchases exceeding $2,000 in a calendar year from out-of-state retailers and have not paid sales tax on those transactions. It is crucial for taxpayers to accurately report their purchases and calculate the appropriate use tax owed based on the taxable purchases made throughout the year. While there may not be different types of Tacoma Washington Consumer Use Tax Returns, it is important to note that there might be variations in the reporting requirements and tax rates applicable to different types of goods or services. Taxpayers should consult the Department of Revenue's guidelines and instructions to ensure they accurately report and calculate the consumer use tax owed. The Department of Revenue provides comprehensive resources, including online forms and instructions, to assist taxpayers in understanding and fulfilling their obligations. It is worth mentioning that the Tacoma Washington Consumer Use Tax Return plays a significant role in funding essential state services and infrastructure. By properly reporting and remitting the consumer use tax, taxpayers contribute to the economic well-being of the state and local communities. It also ensures a level playing field for local businesses that are subject to sales tax, preventing unfair competition from out-of-state retailers. In conclusion, the Tacoma Washington Consumer Use Tax Return is a critical document that taxpayers must file with the Department of Revenue. It is specifically designed to report and remit the consumer use tax owed on out-of-state purchases. By accurately reporting their purchases, taxpayers contribute to the state's revenue and support essential services. Complying with the consumer use tax regulations not only ensures fairness but also helps local businesses thrive.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.