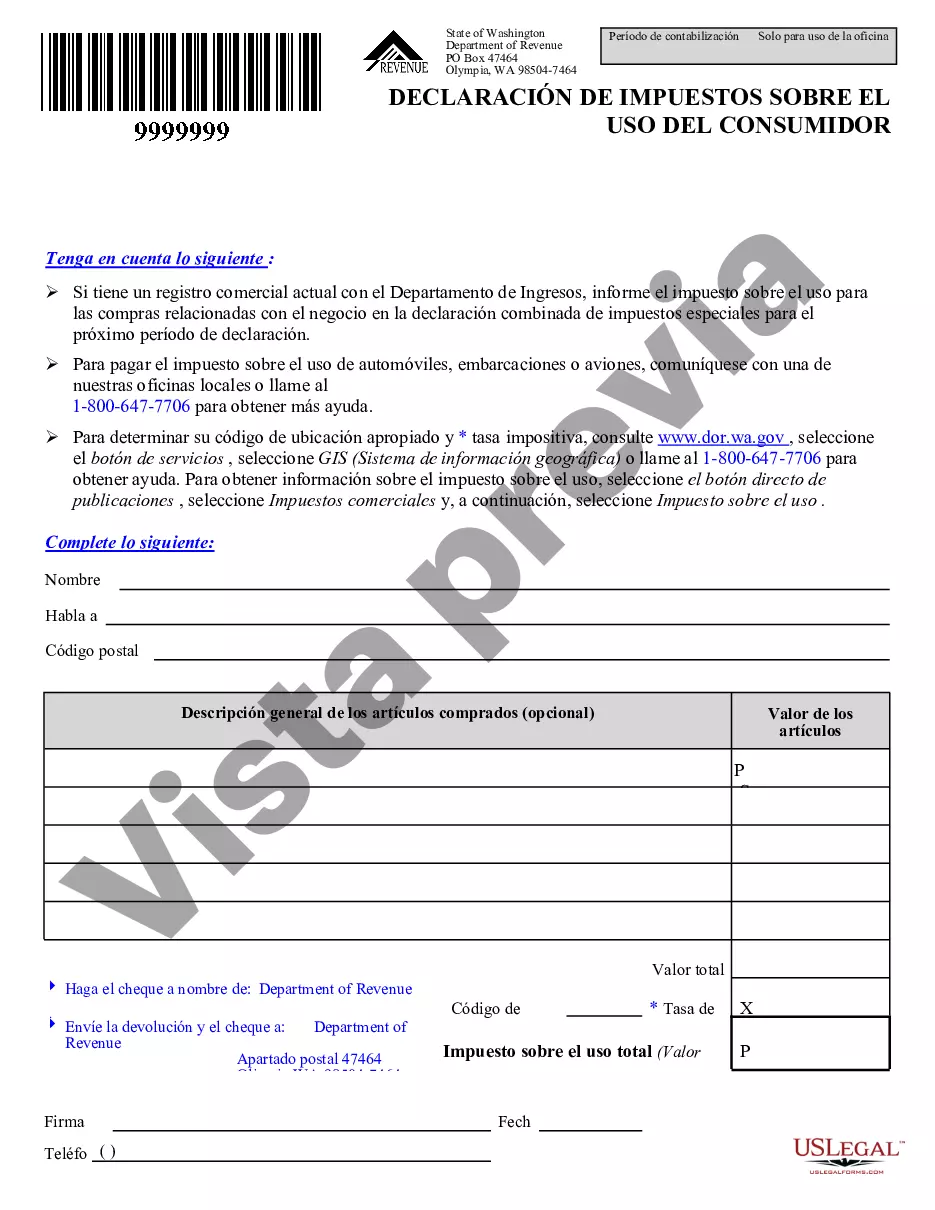

This is an official Washington form for use in land transactions, a Consumer Use Tax Return (Department of Revenue).

The Vancouver Washington Consumer Use Tax Return is a document required by the Department of Revenue for businesses and individuals who have made purchases without paying sales tax to the seller. This tax applies to purchases made outside of Washington state, such as online or out-of-state transactions, where no sales tax was collected at the time of the purchase. The purpose of the Vancouver Washington Consumer Use Tax Return is to report and remit the appropriate amount of tax owed on these purchases. It ensures that the state receives the necessary sales tax revenue even if it was not initially collected by the seller. Individuals and businesses in Vancouver, Washington who have made taxable purchases from out-of-state sellers or online platforms, where sales tax was not charged, are required to file this return and pay the appropriate Consumer Use Tax. There are different types of Vancouver Washington Consumer Use Tax Returns, depending on the filing frequency and the amount of tax liability. For businesses, the most common types include quarterly returns, annual returns, and prepayment returns. Quarterly returns are for businesses with moderate tax liability, while annual returns are for those with low tax liability. Prepayment returns are often for businesses expecting a higher tax liability and are required to make prepayments throughout the year. Individuals, on the other hand, are usually required to file an individual Vancouver Washington Consumer Use Tax Return on an annual basis, regardless of the amount of tax liability. The Vancouver Washington Consumer Use Tax Return form requires detailed information, including the total value of purchases subject to tax, the amount of tax owed, and any exemptions or deductions that may apply. It is crucial to accurately complete and submit the return to avoid penalties or audits by the Department of Revenue. Overall, the Vancouver Washington Consumer Use Tax Return is a crucial tool for the state of Washington to ensure the collection of sales tax on purchases made outside the state. By filing this return, businesses and individuals in Vancouver can fulfill their tax obligations and contribute to the funding of essential public services and infrastructure.The Vancouver Washington Consumer Use Tax Return is a document required by the Department of Revenue for businesses and individuals who have made purchases without paying sales tax to the seller. This tax applies to purchases made outside of Washington state, such as online or out-of-state transactions, where no sales tax was collected at the time of the purchase. The purpose of the Vancouver Washington Consumer Use Tax Return is to report and remit the appropriate amount of tax owed on these purchases. It ensures that the state receives the necessary sales tax revenue even if it was not initially collected by the seller. Individuals and businesses in Vancouver, Washington who have made taxable purchases from out-of-state sellers or online platforms, where sales tax was not charged, are required to file this return and pay the appropriate Consumer Use Tax. There are different types of Vancouver Washington Consumer Use Tax Returns, depending on the filing frequency and the amount of tax liability. For businesses, the most common types include quarterly returns, annual returns, and prepayment returns. Quarterly returns are for businesses with moderate tax liability, while annual returns are for those with low tax liability. Prepayment returns are often for businesses expecting a higher tax liability and are required to make prepayments throughout the year. Individuals, on the other hand, are usually required to file an individual Vancouver Washington Consumer Use Tax Return on an annual basis, regardless of the amount of tax liability. The Vancouver Washington Consumer Use Tax Return form requires detailed information, including the total value of purchases subject to tax, the amount of tax owed, and any exemptions or deductions that may apply. It is crucial to accurately complete and submit the return to avoid penalties or audits by the Department of Revenue. Overall, the Vancouver Washington Consumer Use Tax Return is a crucial tool for the state of Washington to ensure the collection of sales tax on purchases made outside the state. By filing this return, businesses and individuals in Vancouver can fulfill their tax obligations and contribute to the funding of essential public services and infrastructure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.