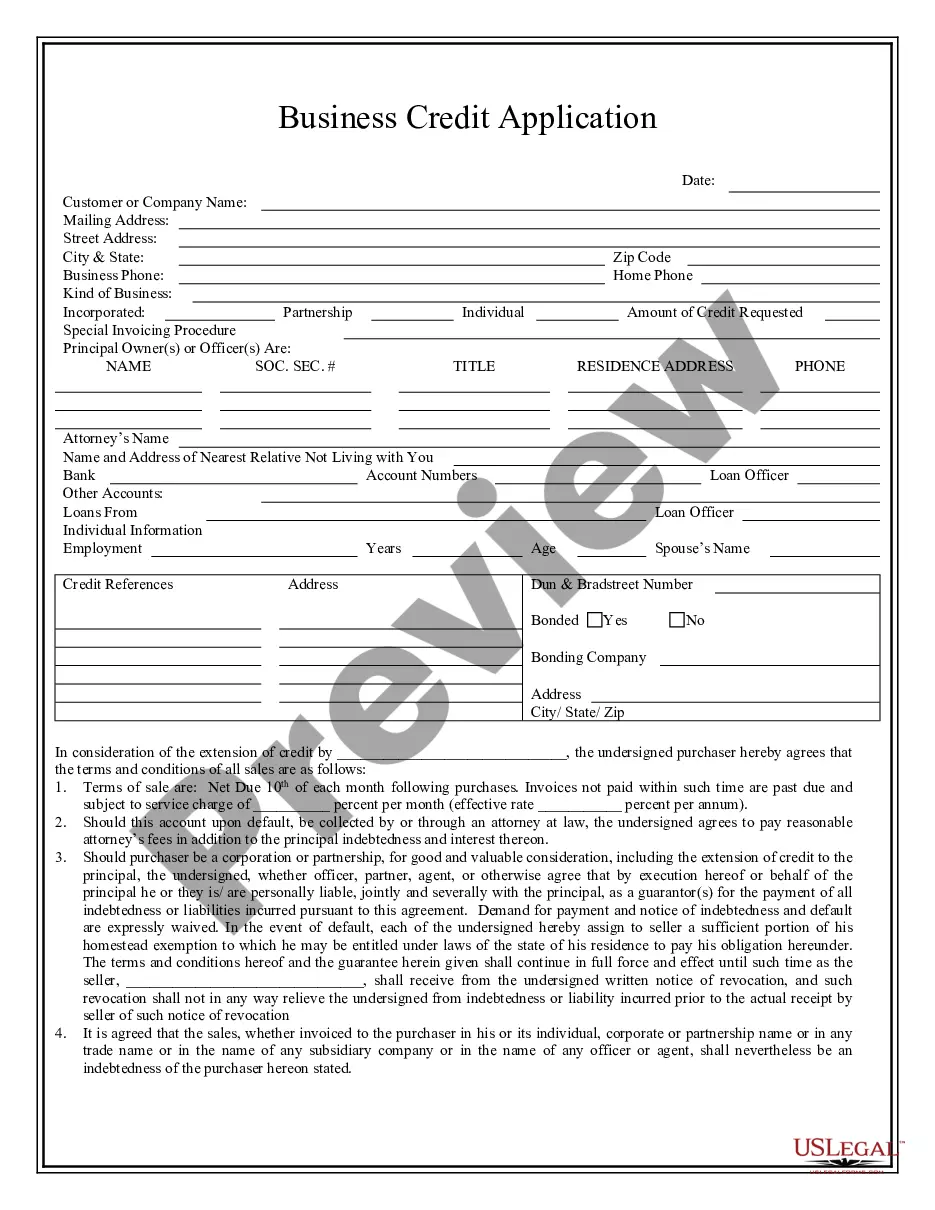

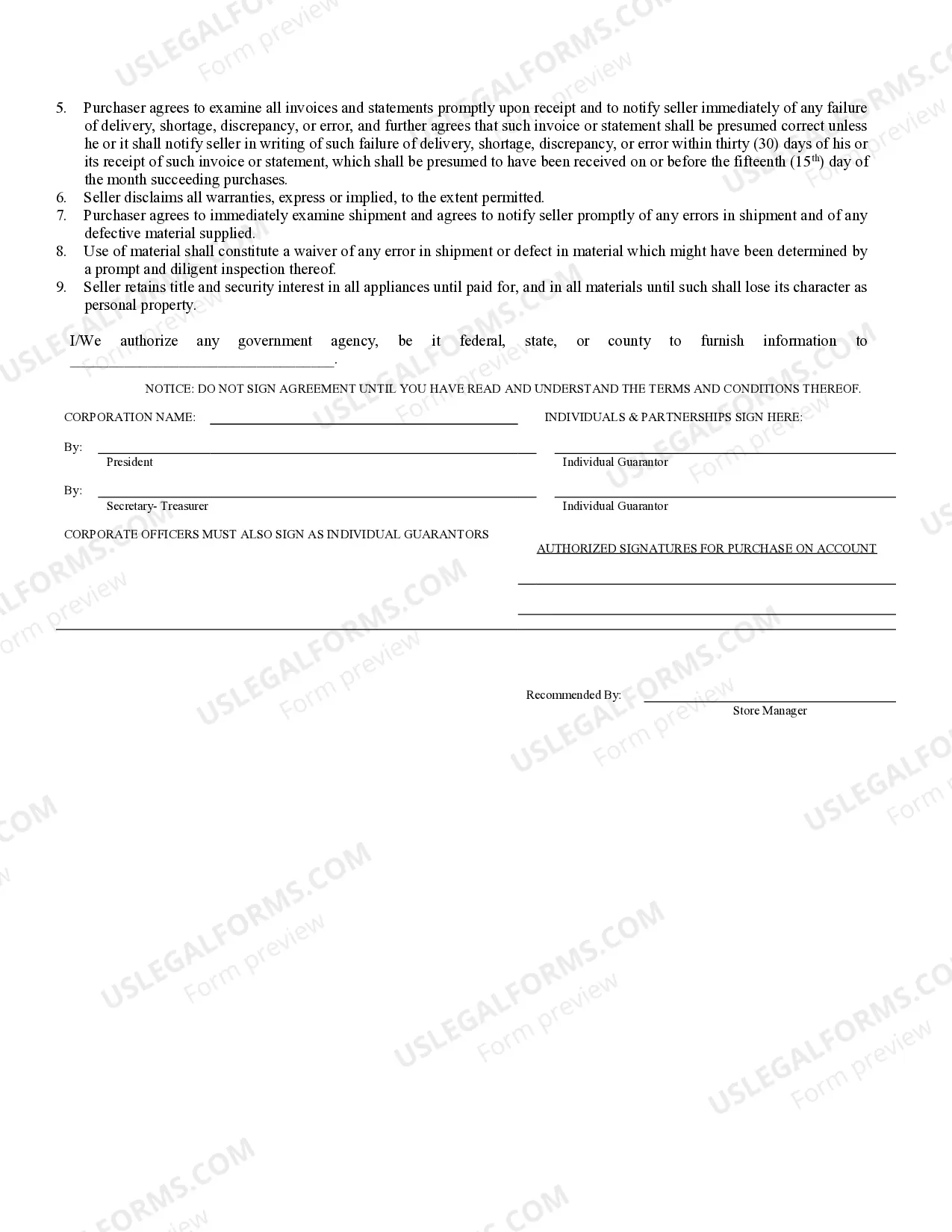

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Description: The Vancouver Washington Business Credit Application is a comprehensive tool designed to assist businesses in Vancouver, Washington, in applying for credit services and financial support. Businesses can utilize this application when seeking credit from financial institutions or other lending agencies to support their operations and business growth. This credit application includes several sections that gather essential information about the business, its financial history, and credit needs. It enables businesses to showcase their stability, growth potential, and creditworthiness to lenders for the purpose of securing loans, lines of credit, or other financial arrangements. Key information fields in the Vancouver Washington Business Credit Application may include: 1. Business Information: — Legabusinessmanam— - Business address and contact details — Business structure (sole proprietorship, partnership, corporation, etc.) — Yearoperationio— - Industry or sector 2. Ownership and Management Details: — Names and details of owners, partners, or key shareholders — Management structure and key personnel 3. Financial Information: — Annual revenue or sale— - Business bank accounts, including names and account numbers — Assets anliabilitiesie— - Business tax identification number 4. Credit Needs and Purpose: — Desired loan amount or credilimitmi— - Purpose of funds (working capital, equipment purchase, expansion, etc.) — Repayment terms preference (fixed interest rate or variable rate, shorter or longer terms) 5. References: — Trade references (names and contact details of suppliers or vendors) — Banking references (names and contact details of banks with which the business has existing or past relationships) Different types of Vancouver Washington Business Credit Applications may be available based on the credit services being sought or the specific lending institutions involved. Some variations may include: 1. Small Business Loan Application: — Tailored for small businesses looking for traditional bank loans or government-backed loan programs. 2. Line of Credit Application: — Geared towards businesses seeking revolving credit lines to manage cash flow fluctuations and short-term financing needs. 3. Equipment Financing Application: — Designed for businesses interested in financing the purchase or lease of equipment or machinery. 4. Business Credit Card Application: — Created for businesses looking to obtain a credit card specifically tailored to their operational needs, generally offering additional perks and rewards. Overall, the Vancouver Washington Business Credit Application helps businesses present a complete and accurate picture of their financial status, creditworthiness, and intentions for utilizing credit services. By providing lenders with this essential information, businesses in Vancouver, Washington, can increase their chances of gaining access to credit facilities that can propel their growth and success.Description: The Vancouver Washington Business Credit Application is a comprehensive tool designed to assist businesses in Vancouver, Washington, in applying for credit services and financial support. Businesses can utilize this application when seeking credit from financial institutions or other lending agencies to support their operations and business growth. This credit application includes several sections that gather essential information about the business, its financial history, and credit needs. It enables businesses to showcase their stability, growth potential, and creditworthiness to lenders for the purpose of securing loans, lines of credit, or other financial arrangements. Key information fields in the Vancouver Washington Business Credit Application may include: 1. Business Information: — Legabusinessmanam— - Business address and contact details — Business structure (sole proprietorship, partnership, corporation, etc.) — Yearoperationio— - Industry or sector 2. Ownership and Management Details: — Names and details of owners, partners, or key shareholders — Management structure and key personnel 3. Financial Information: — Annual revenue or sale— - Business bank accounts, including names and account numbers — Assets anliabilitiesie— - Business tax identification number 4. Credit Needs and Purpose: — Desired loan amount or credilimitmi— - Purpose of funds (working capital, equipment purchase, expansion, etc.) — Repayment terms preference (fixed interest rate or variable rate, shorter or longer terms) 5. References: — Trade references (names and contact details of suppliers or vendors) — Banking references (names and contact details of banks with which the business has existing or past relationships) Different types of Vancouver Washington Business Credit Applications may be available based on the credit services being sought or the specific lending institutions involved. Some variations may include: 1. Small Business Loan Application: — Tailored for small businesses looking for traditional bank loans or government-backed loan programs. 2. Line of Credit Application: — Geared towards businesses seeking revolving credit lines to manage cash flow fluctuations and short-term financing needs. 3. Equipment Financing Application: — Designed for businesses interested in financing the purchase or lease of equipment or machinery. 4. Business Credit Card Application: — Created for businesses looking to obtain a credit card specifically tailored to their operational needs, generally offering additional perks and rewards. Overall, the Vancouver Washington Business Credit Application helps businesses present a complete and accurate picture of their financial status, creditworthiness, and intentions for utilizing credit services. By providing lenders with this essential information, businesses in Vancouver, Washington, can increase their chances of gaining access to credit facilities that can propel their growth and success.