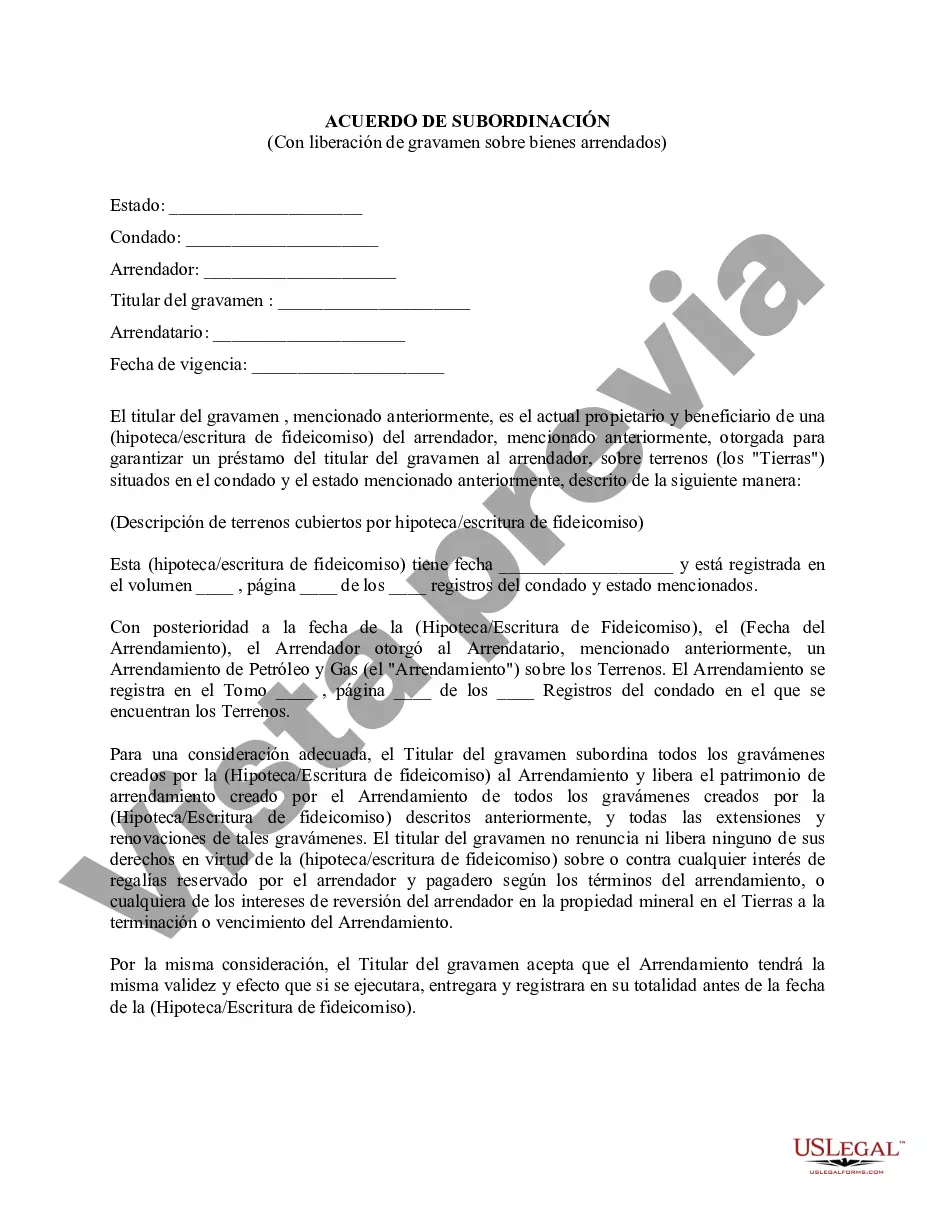

This Lease Subordination Agreement is a lienholder's lien that was created by a (Mortgage/Deed of Trust) and is subordinated to a mineral/oil/gas lease and lienholder releases, said Leasehold from all liens created by said (Mortgage/Deed of Trust), and all extensions and renewals of such liens. Lienholder retains all rights under the (Mortgage/Deed of Trust) against any royalty interest reserved by the lessor in and payable under the terms of the lease, or any of lessor's reversionary interests on the termination or expiration of the lease.

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

A Seattle Washington Lease Subordination Agreement refers to a legal contract that modifies the existing lease agreement between a landlord and a tenant by granting a higher priority to another party's lien or mortgage. This agreement is common in real estate transactions and can have various types based on the specific circumstances. In Seattle, Washington, there are primarily three types of Lease Subordination Agreements: 1. Commercial Lease Subordination Agreement: This type of agreement is most common in commercial real estate. It allows a commercial tenant to subordinate their lease rights to a lender's mortgage or lien on the property. By doing so, the lender's interest becomes superior to that of the tenant's lease rights. This agreement protects the lender's investment in case of default and provides a clear order of priority for any subsequent creditors or interests. 2. Residential Lease Subordination Agreement: Although less frequent, residential lease subordination agreements can also be found in Seattle, Washington. This type of agreement operates similarly to commercial lease subordination insurance, where a residential tenant agrees to subordinate their leasehold interest to a lender's mortgage or lien. This is typically done when a landlord wishes to secure financing against the property or if the property is being sold with an existing mortgage in place. 3. Leasehold Mortgage Subordination Agreement: This agreement is specific to situations where a tenant has obtained a mortgage or lien against their leasehold interest in a property. By signing a leasehold mortgage subordination agreement, the tenant gives priority to any pre-existing mortgage or lien on the property, safeguarding the lender's rights. This agreement is crucial in leasehold financing scenarios, allowing the tenant to obtain a loan secured by their leasehold interest while ensuring the lender's position remains protected. Seattle Washington Lease Subordination Agreements play a significant role in determining the order of priority among different parties' interests in real estate transactions. These agreements not only protect the rights of lenders and landlords but also offer clarity and peace of mind to all involved parties. It is crucial for tenants, landlords, and lenders to fully understand the terms and implications of their specific lease subordination agreement to avoid any complications in the future.A Seattle Washington Lease Subordination Agreement refers to a legal contract that modifies the existing lease agreement between a landlord and a tenant by granting a higher priority to another party's lien or mortgage. This agreement is common in real estate transactions and can have various types based on the specific circumstances. In Seattle, Washington, there are primarily three types of Lease Subordination Agreements: 1. Commercial Lease Subordination Agreement: This type of agreement is most common in commercial real estate. It allows a commercial tenant to subordinate their lease rights to a lender's mortgage or lien on the property. By doing so, the lender's interest becomes superior to that of the tenant's lease rights. This agreement protects the lender's investment in case of default and provides a clear order of priority for any subsequent creditors or interests. 2. Residential Lease Subordination Agreement: Although less frequent, residential lease subordination agreements can also be found in Seattle, Washington. This type of agreement operates similarly to commercial lease subordination insurance, where a residential tenant agrees to subordinate their leasehold interest to a lender's mortgage or lien. This is typically done when a landlord wishes to secure financing against the property or if the property is being sold with an existing mortgage in place. 3. Leasehold Mortgage Subordination Agreement: This agreement is specific to situations where a tenant has obtained a mortgage or lien against their leasehold interest in a property. By signing a leasehold mortgage subordination agreement, the tenant gives priority to any pre-existing mortgage or lien on the property, safeguarding the lender's rights. This agreement is crucial in leasehold financing scenarios, allowing the tenant to obtain a loan secured by their leasehold interest while ensuring the lender's position remains protected. Seattle Washington Lease Subordination Agreements play a significant role in determining the order of priority among different parties' interests in real estate transactions. These agreements not only protect the rights of lenders and landlords but also offer clarity and peace of mind to all involved parties. It is crucial for tenants, landlords, and lenders to fully understand the terms and implications of their specific lease subordination agreement to avoid any complications in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.