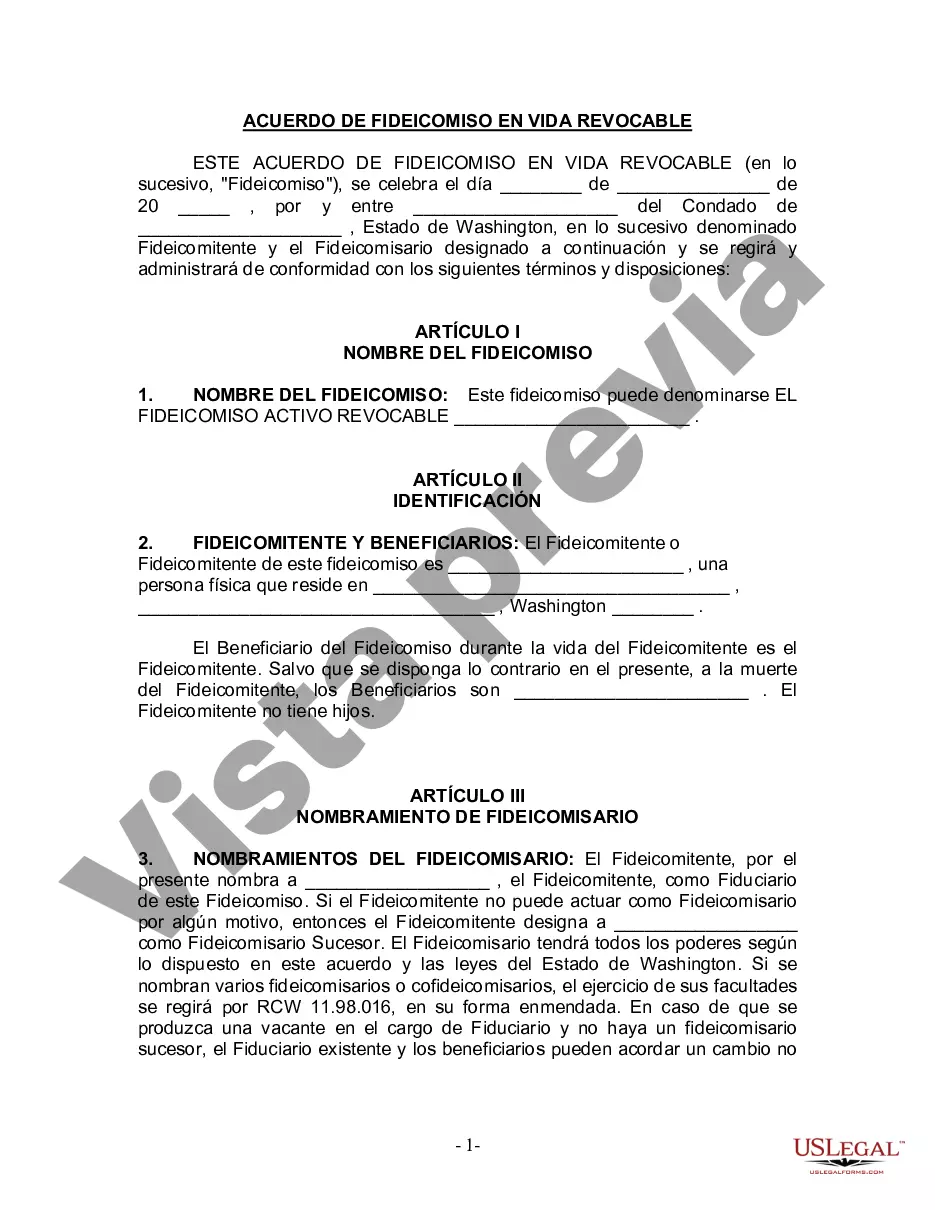

Seattle Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children A Seattle Washington Living Trust is a legal document that allows individuals who are single, divorced, widow, or widower with no children to manage and distribute their assets during their lifetime and after their death. It allows you to have control over your assets and how they are distributed, while also avoiding the probate process. One type of living trust that may be suitable for individuals in Seattle Washington who are single, divorced, widow, or widower with no children is a Revocable Living Trust. With this type of trust, you can maintain full control over your assets and make changes or revoke the trust at any time during your lifetime. It provides flexibility and privacy since the distribution of assets does not need to go through the public probate court process. Another type of living trust that may be beneficial is an Irrevocable Living Trust. This type of trust cannot be modified or revoked without the consent of the beneficiaries, but it offers certain tax benefits and protects assets from potential creditors or lawsuits. It allows for the seamless transfer of assets to the designated beneficiaries, ensuring that your wishes are carried out as intended. By creating a living trust in Seattle Washington, you can also provide for the management of your assets in case of incapacity through the use of a successor trustee. This individual will step in and manage your assets according to your instructions if you become unable to do so yourself. Furthermore, a living trust can help individuals in Seattle Washington plan for the possibility of long-term care needs. By including specific provisions in the trust, you can ensure that your assets are protected and utilized for your benefit if you require long-term care services. In conclusion, a Seattle Washington Living Trust for individuals who are single, divorced, widow, or widower with no children offers numerous advantages. It provides control, flexibility, privacy, and allows for seamless asset distribution. By choosing between a Revocable or Irrevocable Living Trust and including provisions for incapacity and long-term care, you can tailor the trust to your specific needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Seattle Washington Fideicomiso en Vida para Individuos Solteros, Divorciados o Viudos o Viudos sin Hijos - Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

How to fill out Seattle Washington Fideicomiso En Vida Para Individuos Solteros, Divorciados O Viudos O Viudos Sin Hijos?

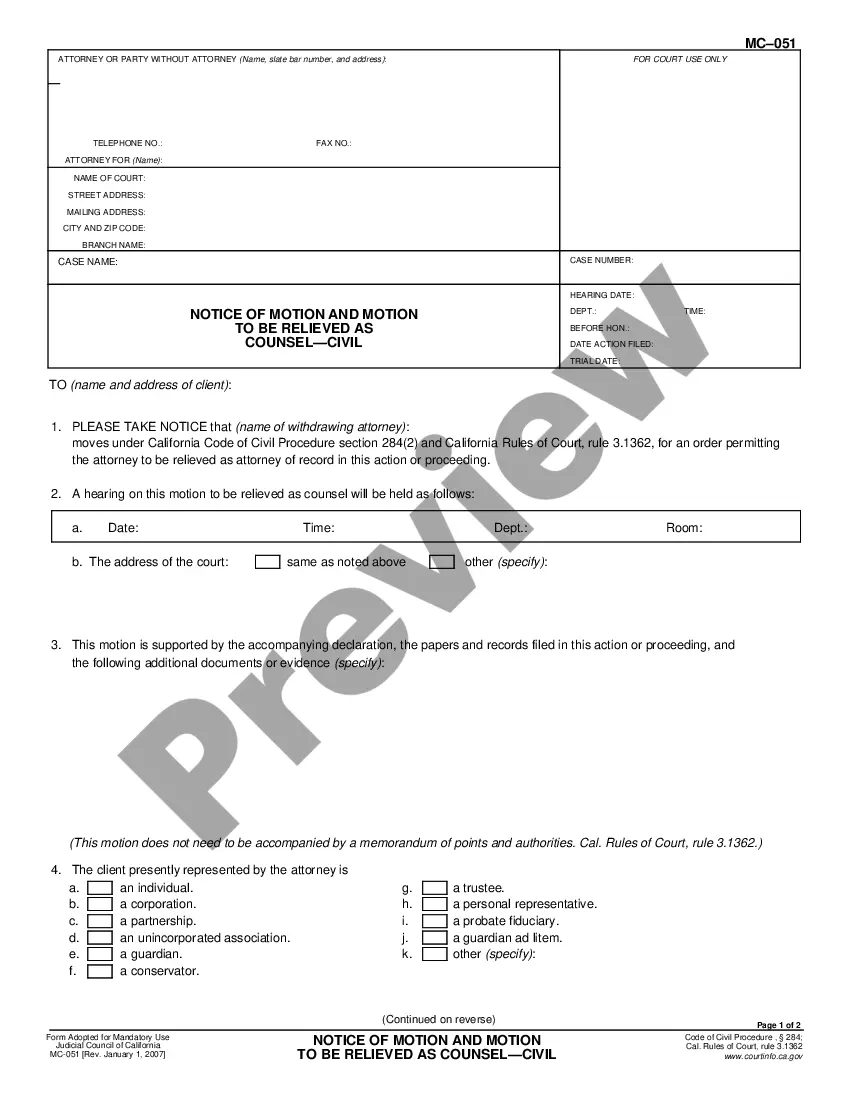

If you are looking for a relevant form template, it’s difficult to find a more convenient platform than the US Legal Forms site – one of the most extensive libraries on the internet. Here you can find a large number of document samples for business and individual purposes by categories and regions, or key phrases. With our advanced search feature, finding the most recent Seattle Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is as easy as 1-2-3. Additionally, the relevance of each and every record is confirmed by a team of skilled attorneys that on a regular basis check the templates on our website and update them in accordance with the latest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Seattle Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the sample you want. Read its information and utilize the Preview function (if available) to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the appropriate file.

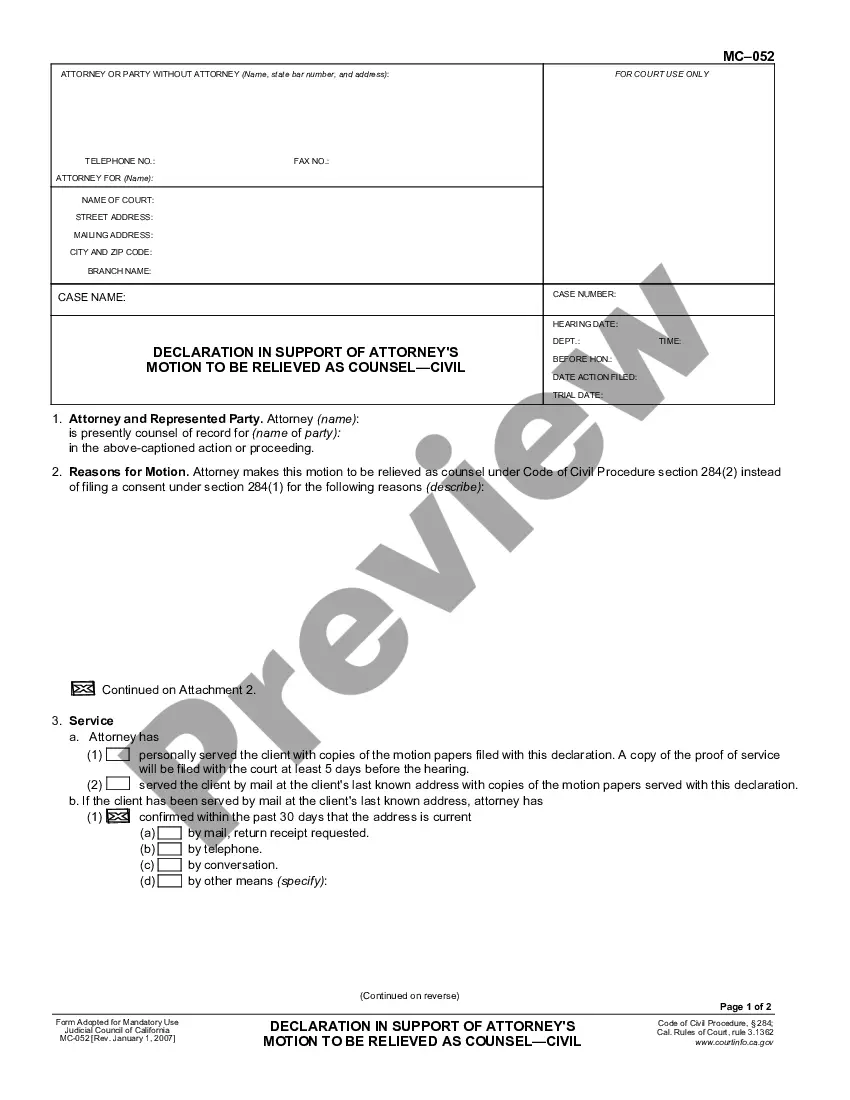

- Affirm your selection. Click the Buy now button. Next, pick the preferred subscription plan and provide credentials to sign up for an account.

- Make the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the form. Choose the file format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Seattle Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children.

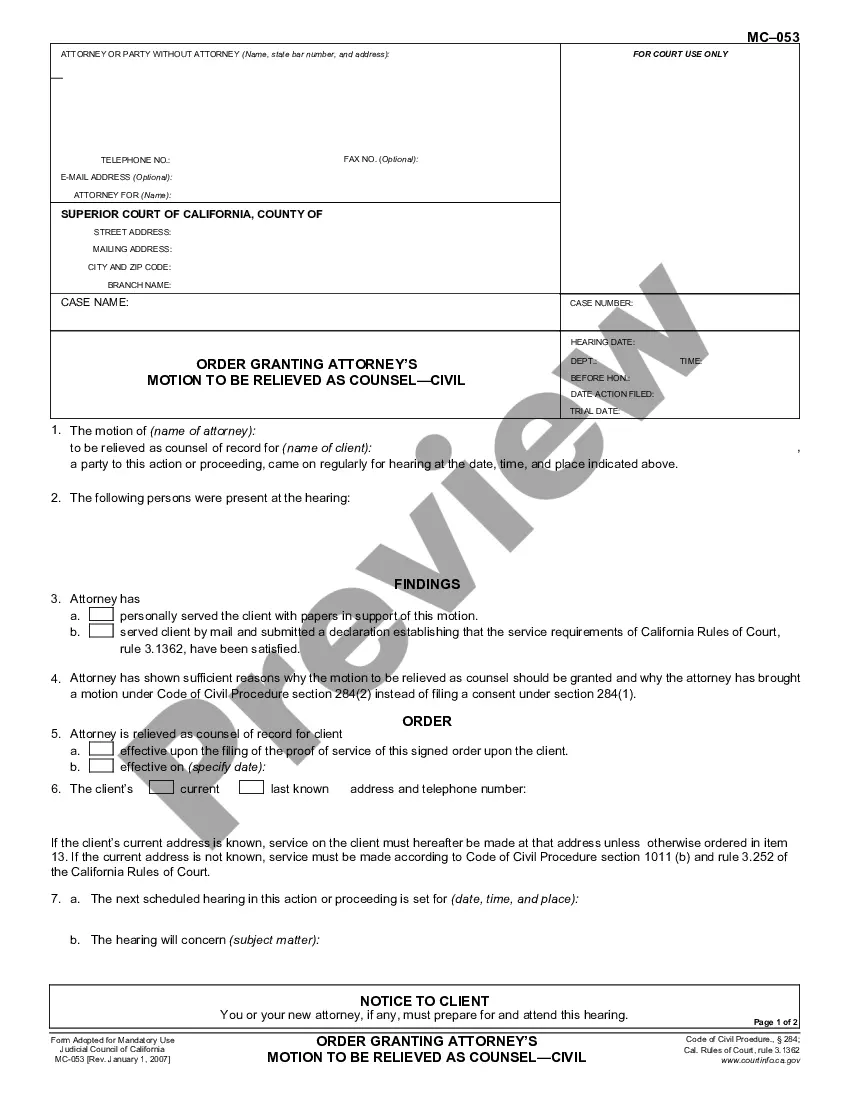

Each and every form you save in your profile does not have an expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you want to get an additional version for modifying or printing, feel free to return and save it again anytime.

Take advantage of the US Legal Forms professional library to get access to the Seattle Washington Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children you were looking for and a large number of other professional and state-specific templates in a single place!