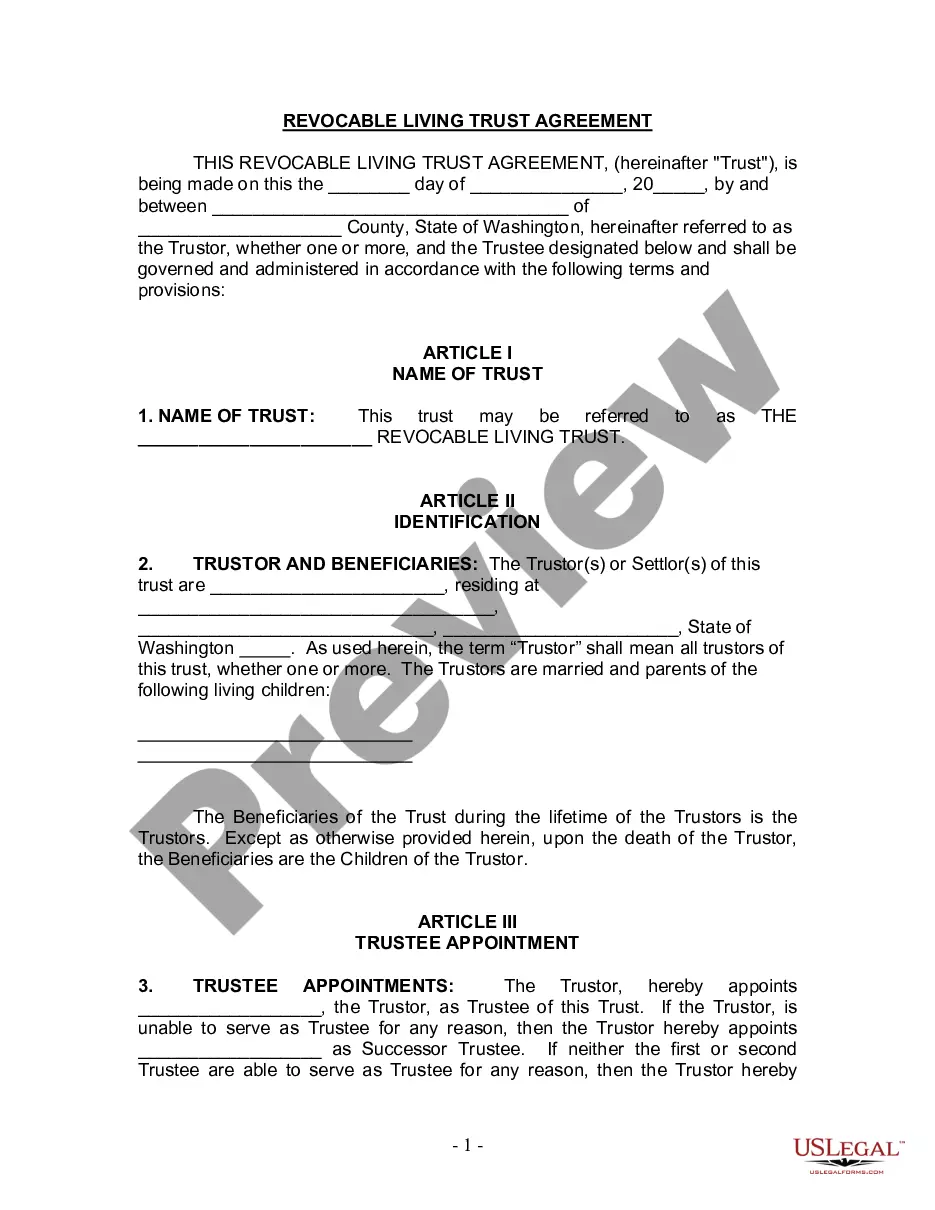

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Bellevue Washington Living Trust for Husband and Wife with One Child

Description

How to fill out Washington Living Trust For Husband And Wife With One Child?

Are you seeking a reliable and affordable legal forms supplier to acquire the Bellevue Washington Living Trust for Husband and Wife with One Child? US Legal Forms is your primary resource.

Whether you require a simple agreement to establish guidelines for living together with your spouse or a set of documents to process your separation or divorce through the court, we have you covered. Our site offers over 85,000 current legal document templates for personal and business needs. All templates we provide access to are not generic and are tailored based on the demands of specific states and counties.

To obtain the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can access your previously purchased form templates at any time from the My documents tab.

Is this your first visit to our platform? No need to worry. You can set up an account in minutes, but before you do so, ensure you follow these steps: Check if the Bellevue Washington Living Trust for Husband and Wife with One Child complies with the laws of your state and locality. Review the form’s specifics (if available) to determine who and what the document is intended for. Restart your search if the template does not suit your legal needs.

Try US Legal Forms today, and eliminate the hassle of spending your valuable time searching for legal documents online for good.

- Now you can create your account.

- Next, choose your subscription plan and continue to payment.

- Once the payment is finalized, download the Bellevue Washington Living Trust for Husband and Wife with One Child in any available format.

- You can revisit the website whenever necessary and redownload the document without any additional charges.

- Finding current legal forms has never been simpler.

Form popularity

FAQ

Setting up a trust in Washington state involves several key steps, starting with choosing the right type of trust for your needs. You will need to draft the trust document, appoint a trustee, and transfer your assets into the trust. For a Bellevue Washington Living Trust for Husband and Wife with One Child, consider using USLegalForms to guide you through the paperwork and ensure everything is properly configured.

The choice between a will and a trust in Washington state often depends on your specific situation. A trust can provide faster asset distribution and avoid probate, while a will is simpler and less costly to create. For a Bellevue Washington Living Trust for Husband and Wife with One Child, a trust generally provides more control and benefits for your child. Evaluate your family's needs to choose the best option.

Yes, you can create your own living trust in Washington state. However, it requires careful planning to ensure it meets legal standards and serves your intentions effectively. A Bellevue Washington Living Trust for Husband and Wife with One Child can provide customized benefits for your family. Consider using resources like USLegalForms to simplify the process and ensure compliance with state laws.

Certain assets should generally be excluded from a trust, such as retirement accounts, life insurance policies, and certain types of jointly owned property. These assets may have their own beneficiary designations that take precedence over a Bellevue Washington Living Trust for Husband and Wife with One Child. It’s wise to review your asset list carefully and consult with USLegalForms for personalized advice.

Filling out a living trust involves providing detailed information about your assets and defining the terms of the trust. Be sure to include the names of trustees, beneficiaries, and the specific instructions for managing the Bellevue Washington Living Trust for Husband and Wife with One Child. Accessing templates and guidance from USLegalForms can help you complete this process accurately and efficiently.

To place everything into a living trust, begin by identifying your assets, such as real estate, bank accounts, and personal property. Next, you transfer these assets into the trust by changing titles and beneficiary designations, ensuring that your Bellevue Washington Living Trust for Husband and Wife with One Child includes everything you intend. Utilizing a service like USLegalForms can simplify this process, guiding you through each step.

Yes, you can write your own trust in Washington state, but it's important to ensure that it meets the legal requirements. This Bellevue Washington Living Trust for Husband and Wife with One Child should be clear, specific, and properly executed. Consider using resources like USLegalForms to help you navigate the document preparation process and minimize potential pitfalls.

Placing your home in a Bellevue Washington Living Trust for Husband and Wife with One Child can present some disadvantages, such as potential complications when transferring title. If not done correctly, it may trigger reassessments of property tax in certain jurisdictions. Additionally, there is the ongoing responsibility of updating the trust as personal circumstances change, which can be overlooked without proper attention.

Certain assets may not be suitable for inclusion in a Bellevue Washington Living Trust for Husband and Wife with One Child. For example, retirement accounts that require designated beneficiaries should generally remain outside the trust to ensure the assets pass efficiently. Additionally, some types of insurance policies should also be maintained separately to avoid complications.

Whether a husband and wife should have separate living trusts depends on their unique financial situations and asset structures. In many cases, a joint Bellevue Washington Living Trust for Husband and Wife with One Child is more efficient and simplifies the estate planning process. However, if they have significant separate assets, individual trusts might better address their specific needs.