Bellevue Washington Financial Account Transfer to Living Trust: A Comprehensive Overview In Bellevue, Washington, financial account transfer to a living trust offers individuals an effective tool for estate planning and seamless wealth management. This process enables individuals to protect and distribute their assets, avoid probate, minimize taxes, and maintain control over their financial affairs during their lifetime and beyond. This detailed description will delve into the concept of a financial account transfer to a living trust in Bellevue, highlighting its benefits, key considerations, and different types. Key Benefits of Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Avoidance of Probate: By transferring financial accounts to a living trust, individuals can bypass the probate process, which can be time-consuming, costly, and public. This ensures a smooth distribution of assets to beneficiaries without the interference of the court. 2. Privacy and Confidentiality: Unlike a will, which becomes a public record upon probate, a living trust allows individuals to maintain confidentiality. This ensures that personal financial information remains private, protecting the sensitive details of an individual's estate. 3. Asset Protection: Transferring financial accounts to a living trust can shield assets from potential creditors and lawsuits. This protection ensures that beneficiaries receive the intended assets without them being vulnerable to claims from third parties. 4. Incapacity Planning: A living trust enables individuals to plan for potential incapacity. In the event of cognitive decline or disability, a designated successor trustee can seamlessly manage the trust, ensuring continuous financial management and care throughout the individual's lifetime. Key Considerations for Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Consultation with Professionals: Before initiating a financial account transfer to a living trust, it is crucial to consult with an estate planning attorney and a financial advisor experienced in living trusts. These professionals will guide individuals through the process, considering their unique financial circumstances and legal requirements. 2. Legal Documentation: Accurate and legally binding documentation is essential for a successful financial account transfer. This process typically involves obtaining the necessary forms from financial institutions, creating a trust agreement, and properly titling the accounts within the trust's name. 3. Ongoing Management: Once the financial accounts are transferred to the living trust, individuals must actively manage the trust to ensure its effectiveness. This includes funding the trust with any new accounts or assets acquired and regularly reviewing and updating the trust's provisions as needed. Types of Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Bank and Brokerage Accounts: Individuals can transfer various accounts, such as checking, savings, money market, and investment accounts, to their living trusts. This encompasses individual and joint accounts, enabling efficient consolidation and management of financial assets. 2. Retirement Accounts: Depending on specific circumstances and applicable laws, certain retirement accounts like Individual Retirement Accounts (IRAs) or 401(k)s can be transferred to a living trust. However, it is crucial to consult with professionals to understand the tax implications and compliance with retirement account regulations. In conclusion, a Bellevue Washington Financial Account Transfer to Living Trust grants individuals the opportunity to efficiently protect and manage their assets, streamline estate distribution, avoid probate, and plan for potential incapacity. By considering the benefits, key considerations, and different types of financial accounts eligible for transfer, individuals can navigate the estate planning process confidently, ensuring the preservation of their financial legacy and the security of their loved ones.

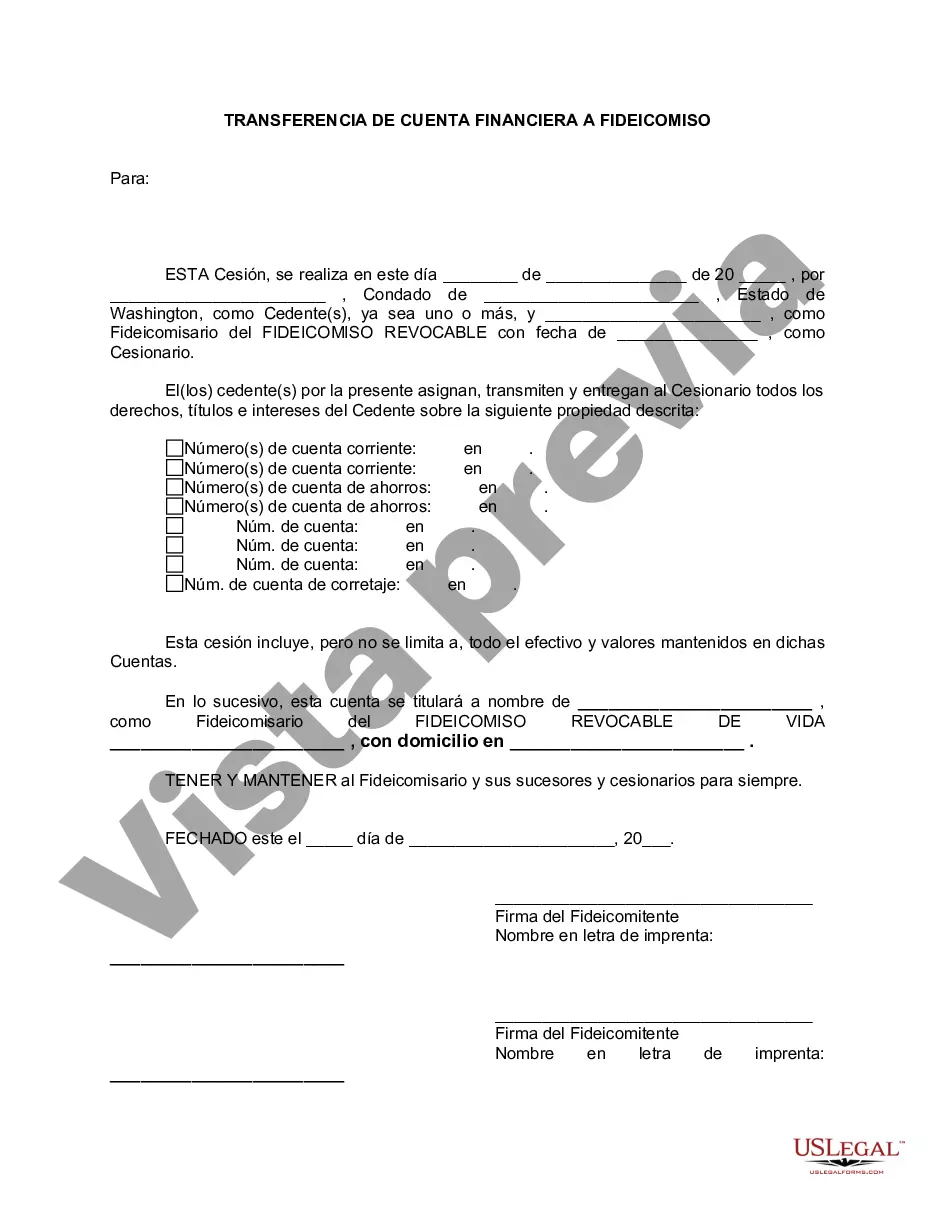

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bellevue Washington Transferencia de cuenta financiera a fideicomiso en vida - Washington Financial Account Transfer to Living Trust

Description

How to fill out Bellevue Washington Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Bellevue Washington Financial Account Transfer to Living Trust or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Bellevue Washington Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Bellevue Washington Financial Account Transfer to Living Trust is proper for your case, you can select the subscription option and make a payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!