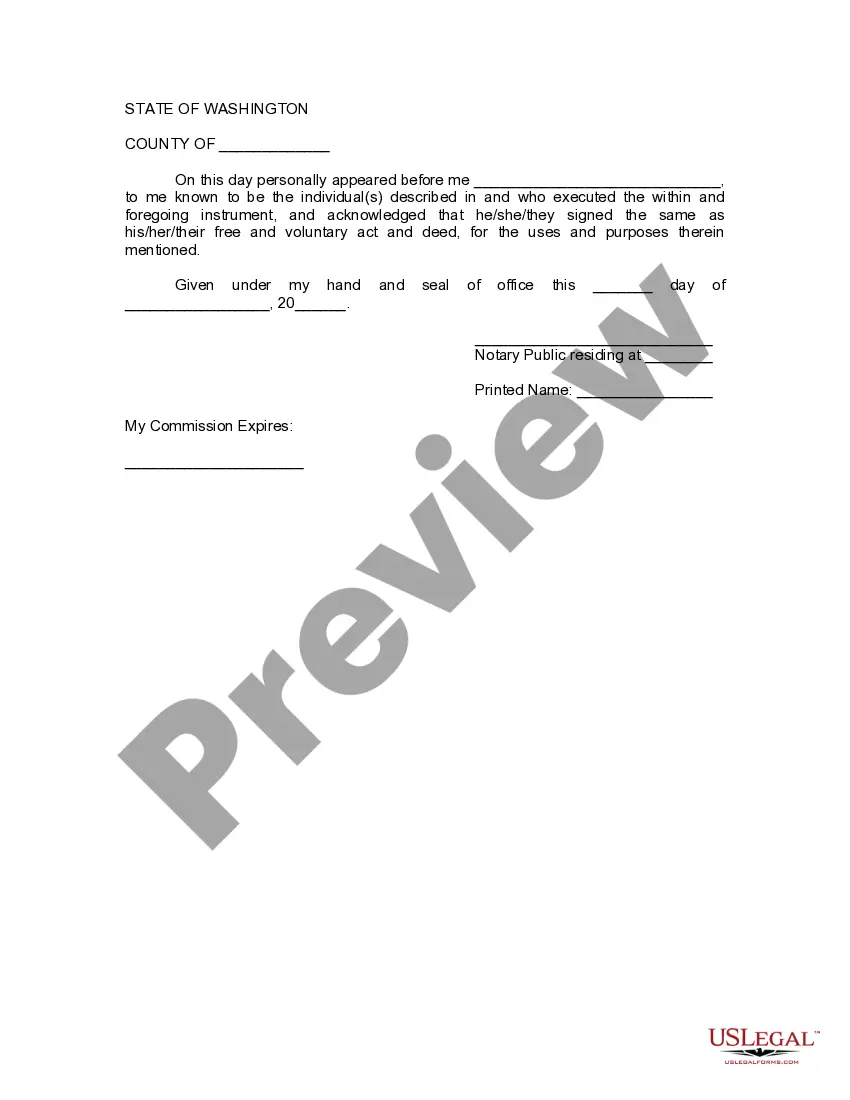

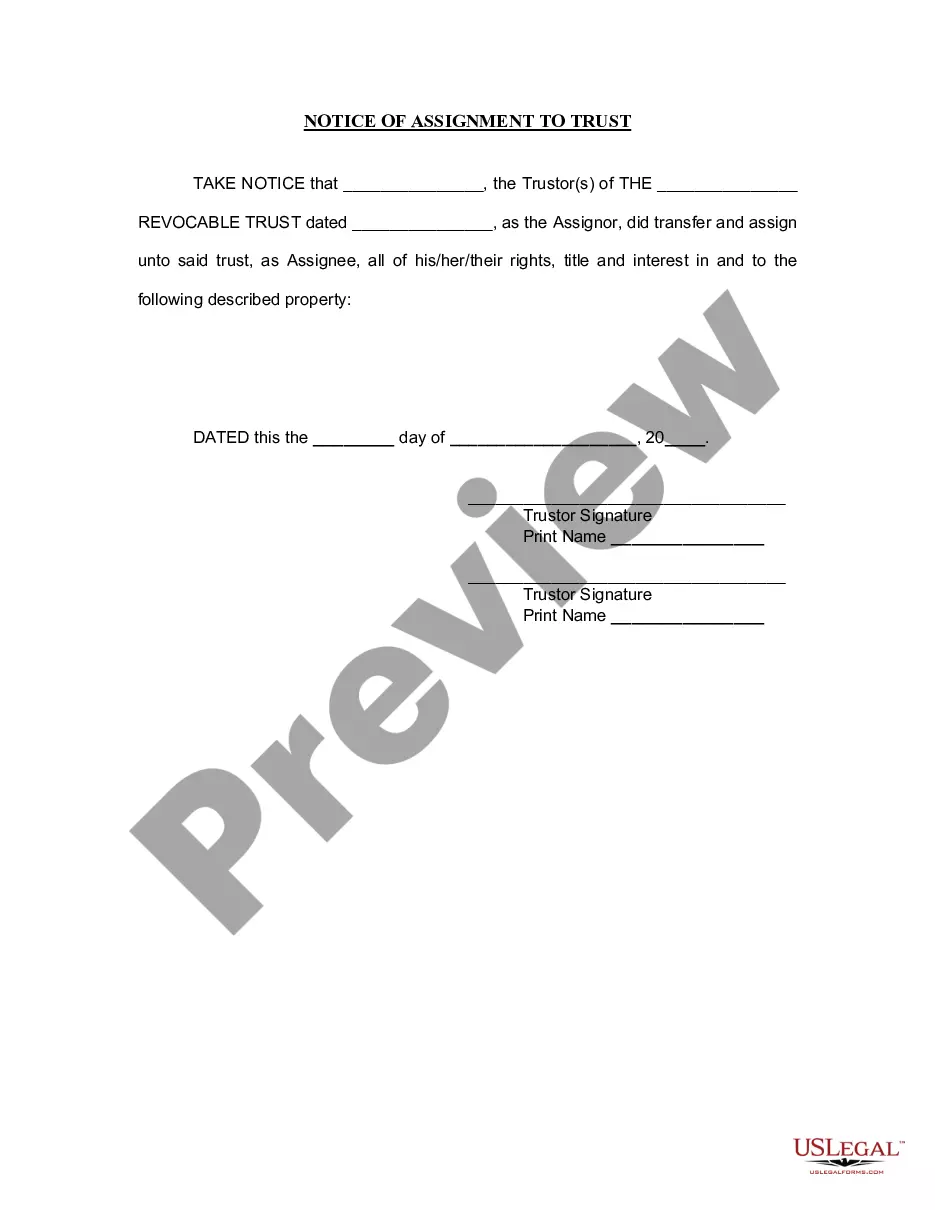

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Bellevue Washington Assignment to Living Trust

Description

How to fill out Washington Assignment To Living Trust?

If you’ve previously made use of our service, Log In to your account and retrieve the Bellevue Washington Assignment to Living Trust on your device by selecting the Download button. Ensure your subscription is active. If not, renew it according to your billing plan.

If this marks your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or business requirements!

- Confirm that you’ve found a suitable document. Review the description and utilize the Preview feature, if accessible, to ascertain if it fulfills your needs. If it doesn’t align with your requirements, use the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or choose the PayPal option to finalize the transaction.

- Receive your Bellevue Washington Assignment to Living Trust. Choose the file format for your document and download it to your device.

- Fill out your template. Print it or use professional online editors to complete it and sign it digitally.

Form popularity

FAQ

One disadvantage of putting your house in a trust is the potential loss of control, as the trustee now manages the property. Additionally, there may be upfront costs associated with creating and funding the trust. However, the benefits of a Bellevue Washington Assignment to Living Trust often outweigh these drawbacks, particularly in estate planning. It's wise to consult with professionals or utilize uslegalforms to fully understand how a trust might impact your situation.

Assets are moved into a trust through a process called funding. This involves re-titling property, such as real estate or bank accounts, in the name of the trust. In the case of the Bellevue Washington Assignment to Living Trust, ensure all documentation is complete to avoid future legal issues. Using resources from uslegalforms can streamline this funding process, ensuring that all your assets are properly allocated.

To put property in a trust in Washington state, start by creating a trust document that defines the terms and conditions. Next, transfer ownership of the property to the trust, which often involves signing a new deed. Ensure you follow the proper legal procedures so that the Bellevue Washington Assignment to Living Trust is valid and effective. For assistance, uslegalforms provides templates and guidance to simplify this process.

Deciding if your parents should place their assets in a trust, such as a Bellevue Washington Assignment to Living Trust, depends on their individual financial situation and goals. Trusts can provide benefits like avoiding probate and ensuring privacy regarding asset distribution. However, it's essential for them to assess their needs and consult with a professional. This way, they can create a strategy that aligns with their wishes and protects their legacy.

One significant mistake parents often make when establishing a trust fund, like a Bellevue Washington Assignment to Living Trust, is failing to communicate their intentions with their heirs. This lack of communication can lead to confusion and conflict among family members. Additionally, neglecting to properly fund the trust or update it as circumstances change can limit its effectiveness. Engaging with a knowledgeable advisor can help avoid these pitfalls.

Transferring property into a trust in Washington state, especially a Bellevue Washington Assignment to Living Trust, begins by drafting the trust document. Next, you will need to execute a deed to transfer property ownership to the trust. This process may require notarization and recording with your local county office, ensuring that the transfer is legally recognized. You can also use platforms like US Legal Forms to streamline this process.

A common downfall of establishing a trust, such as a Bellevue Washington Assignment to Living Trust, is the misconception that it completely avoids estate taxes. While trusts can provide significant benefits, they do not exempt assets from taxation. Furthermore, if the trust is not properly funded or maintained, it may not function as intended, leading to legal complications down the line. Working with professionals can help you navigate these challenges.

When considering a Bellevue Washington Assignment to Living Trust, it is essential to understand the risks involved. One risk is the potential for misunderstandings among beneficiaries regarding the trust's terms. Additionally, there may be ongoing management costs and complexities involved, which could impact the trust's value over time. Seeking professional advice can help mitigate these risks and ensure you make informed decisions.

To transfer your property to a living trust in Washington state, first, you need to create the trust document. This document outlines the trust's terms and specifies the assets included. After establishing the trust, you must execute a Bellevue Washington Assignment to Living Trust by formally changing the title of your property to the trust's name. Additionally, using reputable platforms like US Legal Forms can simplify this process, providing necessary templates and guidance to ensure you complete the assignment correctly.