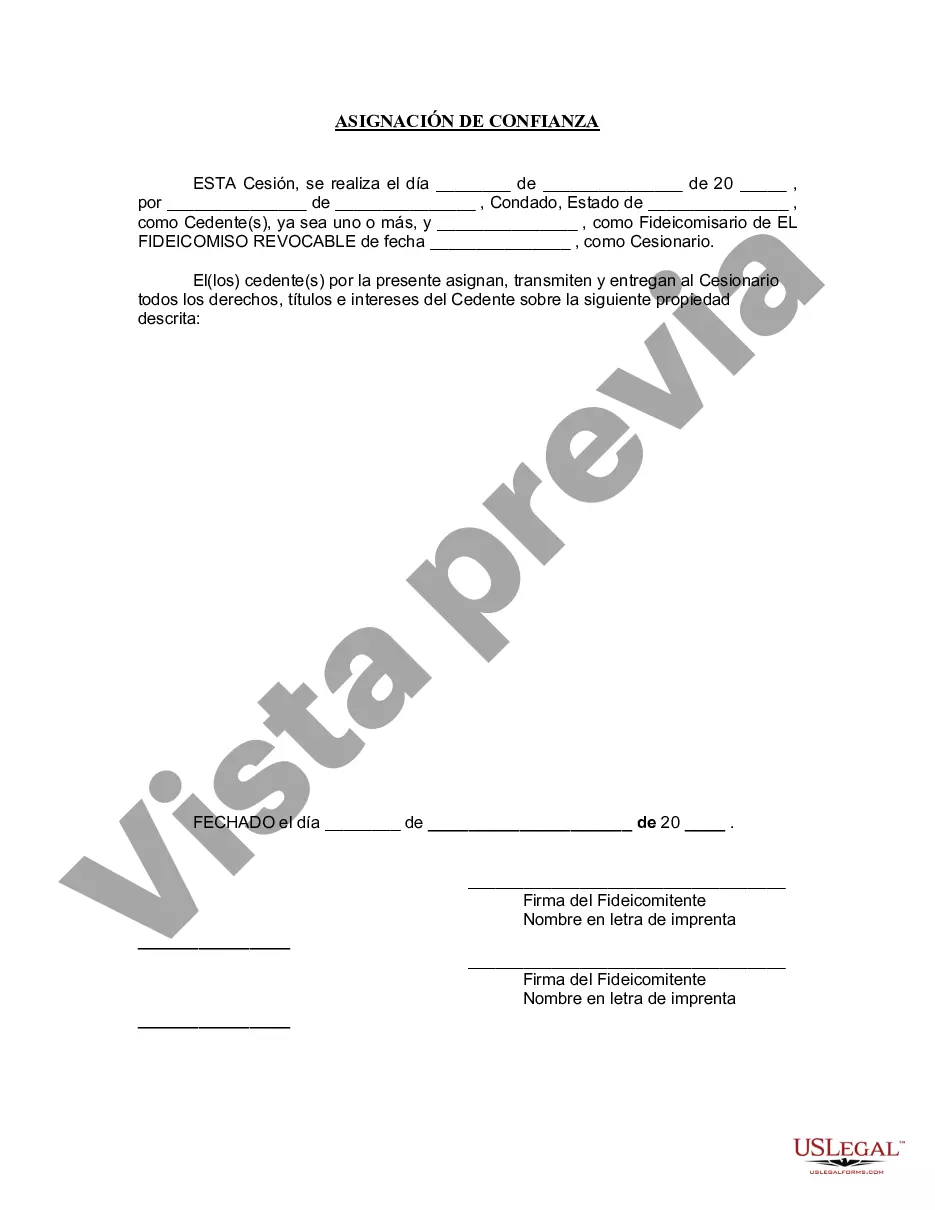

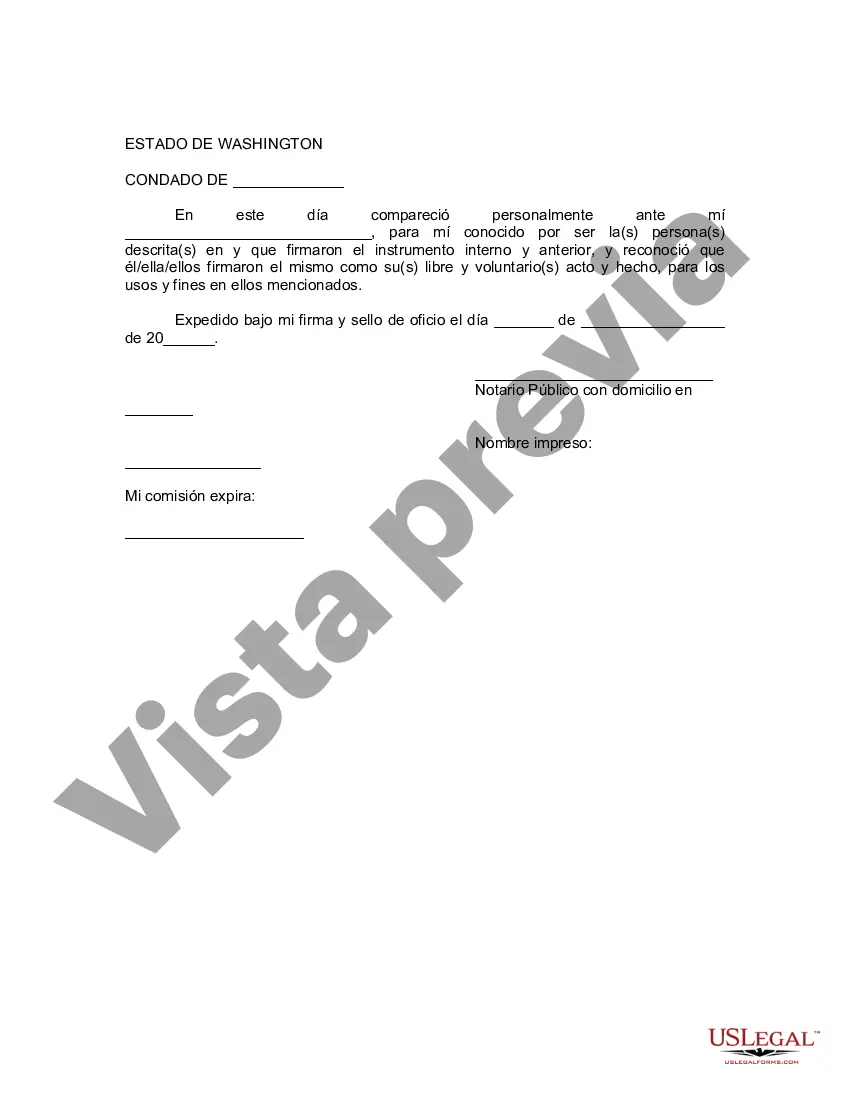

King Washington Asignación a un fideicomiso en vida - Washington Assignment to Living Trust

Description

How to fill out Washington Asignación A Un Fideicomiso En Vida?

If you have previously utilized our service, Log In to your account and store the King Washington Assignment to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to procure your document.

You have continuous access to each document you have acquired: you can find it in your profile under the My documents menu whenever you need to use it again. Take advantage of the US Legal Forms service to effortlessly discover and save any template for your personal or professional needs!

- Ensure you’ve found the correct document. Browse the description and use the Preview option, if present, to confirm if it satisfies your requirements. If it isn’t suitable, utilize the Search tab above to locate the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your King Washington Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your template. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

El fideicomisario es el heredero que va a recibir los bienes de la herencia por parte del fiduciario y no por el testador/fideicomitente. El fideicomisario es la persona que va a poder disponer de manera libre de los bienes de la herencia.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

El fideicomisario es el beneficiario que fue nombrado en el contrato de fideicomiso. Puede ser una persona fisica o moral, que recibira bienes, valores o recursos cuando se cumplan las condiciones establecidas.

Cuando se habla del fideicomiso, es necesario distinguir al menos las tres partes principales que componen esta figura mercantil: el fiduciante, el fiduciario y el fideicomisario. Fiduciante.Fiduciario.Fideicomisario.

El Fideicomiso es un contrato en el cual una persona (fideicomitente) le transmite la propiedad o administracion de determinados bienes a otra (fiduciario), en donde esta ultima la ejerce en beneficio de quien se designe en el contrato (fideicomisario), hasta que se cumpla un plazo o condicion pactados.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

El fideicomisario es el beneficiario que fue nombrado en el contrato de fideicomiso. Puede ser una persona fisica o moral, que recibira bienes, valores o recursos cuando se cumplan las condiciones establecidas.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.