This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

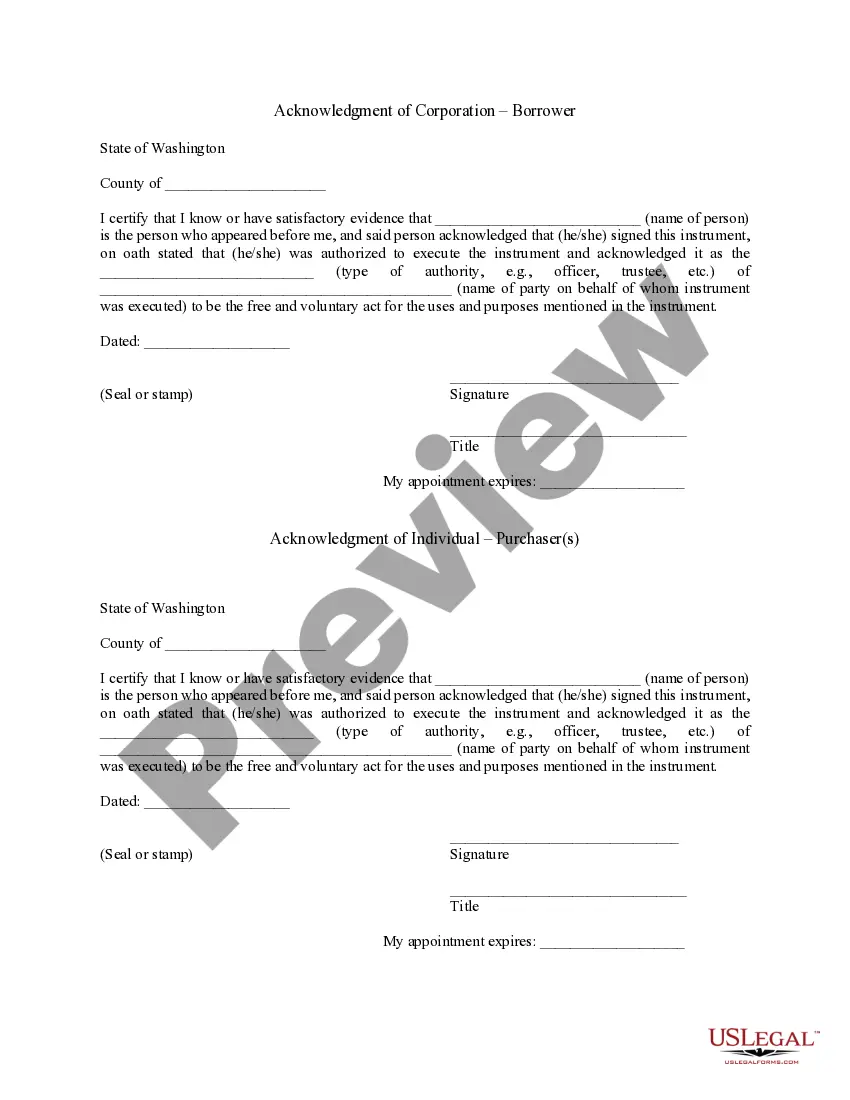

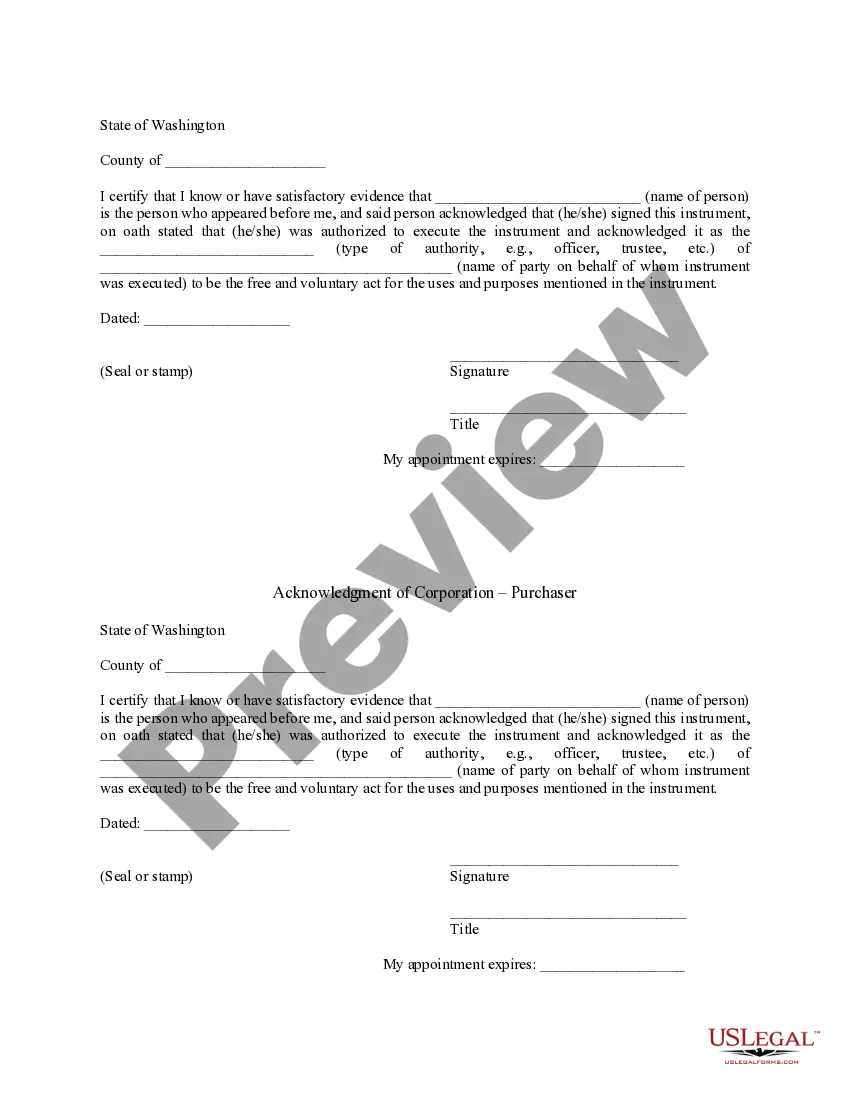

Spokane Valley Washington Assumption Agreement of Deed of Trust and Release of Original Mortgagors: A Complete Guide Introduction: In Spokane Valley, Washington, the Assumption Agreement of Deed of Trust and Release of Original Mortgagors plays a crucial role in real estate transactions. This legally binding document allows a new party to assume the responsibilities and obligations of an existing mortgage loan while releasing the original mortgagors from their liability. This guide will provide a detailed description of the process, requirements, and different types of Assumption Agreements in Spokane Valley, Washington. 1. Understanding the Assumption Agreement: An Assumption Agreement is a formal contract that transfers the mortgage obligation from the original mortgagors (borrowers) to a new party, known as the assignee or the assumption. This agreement ensures smooth transitions in real estate ownership and financing, preventing the need for loan repayment upon sale or transfer. 2. Key Elements of the Assumption Agreement: — Identification of the original mortgagors and their contact information. — Identification of the neassumptionor and their contact information. — Detailed description of the property being transferred. — Terms and conditions of the assumption, including financial responsibilities and repayment terms. — Verification of the original mortgagor's consent to release their obligations. — Signatures of all parties involved, including witnesses and notary public. 3. Types of Assumption Agreements: a) Simple Assumption Agreement: This is the most common type of assumption agreement, where the assumption takes over the mortgage liability with no major changes to the loan terms. The original interest rate, repayment schedule, and terms of the original mortgage remain intact. b) Qualified Assumption Agreement: In certain cases, the lender may require the new assumption to meet specific qualifying criteria. This could include a credit check, income verification, and other financial qualifications before approving the assumption. c) Subject-to Assumption Agreement: This type of agreement allows the assumption to assume the mortgage loan while keeping the original mortgage terms in place. However, the assumption is not personally liable for any pre-existing debts or liabilities attached to the original mortgage. 4. Steps Involved in the Assumption Agreement Process: a) Initiation: The new assumption expresses their interest in assuming the mortgage, and the original mortgagors agree to transfer the liability. b) Documentation: An attorney or professional advisor drafts the Assumption Agreement, including all necessary details and terms agreed upon by all parties involved. c) Review and Negotiation: Both parties review the agreement and negotiate any modifications or clarifications required before its finalization. d) Signing and Notarization: All parties, including witnesses if necessary, sign the agreement. A notary public notarizes the document to ensure its legal validity. e) Approval: The agreement is sent to the lender for their review and approval. The lender may require additional documentation or fees to process the assumption. f) Release of Original Mortgagors: Once the lender approves the assumption, the original mortgagors are released from their obligations, and the assumption becomes solely responsible for the mortgage debt moving forward. g) Decoration: The Assumption Agreement is officially recorded with the county's land or property records, providing public notice of the changed ownership and responsibility. Conclusion: The Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential legal tool for both buyers and sellers in Spokane Valley, Washington. Whether opting for a simple, qualified, or subject-to assumption agreement, it is crucial to understand the process, requirements, and implications of assuming a mortgage loan. Consulting with a real estate attorney or professional advisor can ensure a smooth and legally sound transaction.Spokane Valley Washington Assumption Agreement of Deed of Trust and Release of Original Mortgagors: A Complete Guide Introduction: In Spokane Valley, Washington, the Assumption Agreement of Deed of Trust and Release of Original Mortgagors plays a crucial role in real estate transactions. This legally binding document allows a new party to assume the responsibilities and obligations of an existing mortgage loan while releasing the original mortgagors from their liability. This guide will provide a detailed description of the process, requirements, and different types of Assumption Agreements in Spokane Valley, Washington. 1. Understanding the Assumption Agreement: An Assumption Agreement is a formal contract that transfers the mortgage obligation from the original mortgagors (borrowers) to a new party, known as the assignee or the assumption. This agreement ensures smooth transitions in real estate ownership and financing, preventing the need for loan repayment upon sale or transfer. 2. Key Elements of the Assumption Agreement: — Identification of the original mortgagors and their contact information. — Identification of the neassumptionor and their contact information. — Detailed description of the property being transferred. — Terms and conditions of the assumption, including financial responsibilities and repayment terms. — Verification of the original mortgagor's consent to release their obligations. — Signatures of all parties involved, including witnesses and notary public. 3. Types of Assumption Agreements: a) Simple Assumption Agreement: This is the most common type of assumption agreement, where the assumption takes over the mortgage liability with no major changes to the loan terms. The original interest rate, repayment schedule, and terms of the original mortgage remain intact. b) Qualified Assumption Agreement: In certain cases, the lender may require the new assumption to meet specific qualifying criteria. This could include a credit check, income verification, and other financial qualifications before approving the assumption. c) Subject-to Assumption Agreement: This type of agreement allows the assumption to assume the mortgage loan while keeping the original mortgage terms in place. However, the assumption is not personally liable for any pre-existing debts or liabilities attached to the original mortgage. 4. Steps Involved in the Assumption Agreement Process: a) Initiation: The new assumption expresses their interest in assuming the mortgage, and the original mortgagors agree to transfer the liability. b) Documentation: An attorney or professional advisor drafts the Assumption Agreement, including all necessary details and terms agreed upon by all parties involved. c) Review and Negotiation: Both parties review the agreement and negotiate any modifications or clarifications required before its finalization. d) Signing and Notarization: All parties, including witnesses if necessary, sign the agreement. A notary public notarizes the document to ensure its legal validity. e) Approval: The agreement is sent to the lender for their review and approval. The lender may require additional documentation or fees to process the assumption. f) Release of Original Mortgagors: Once the lender approves the assumption, the original mortgagors are released from their obligations, and the assumption becomes solely responsible for the mortgage debt moving forward. g) Decoration: The Assumption Agreement is officially recorded with the county's land or property records, providing public notice of the changed ownership and responsibility. Conclusion: The Assumption Agreement of Deed of Trust and Release of Original Mortgagors is an essential legal tool for both buyers and sellers in Spokane Valley, Washington. Whether opting for a simple, qualified, or subject-to assumption agreement, it is crucial to understand the process, requirements, and implications of assuming a mortgage loan. Consulting with a real estate attorney or professional advisor can ensure a smooth and legally sound transaction.