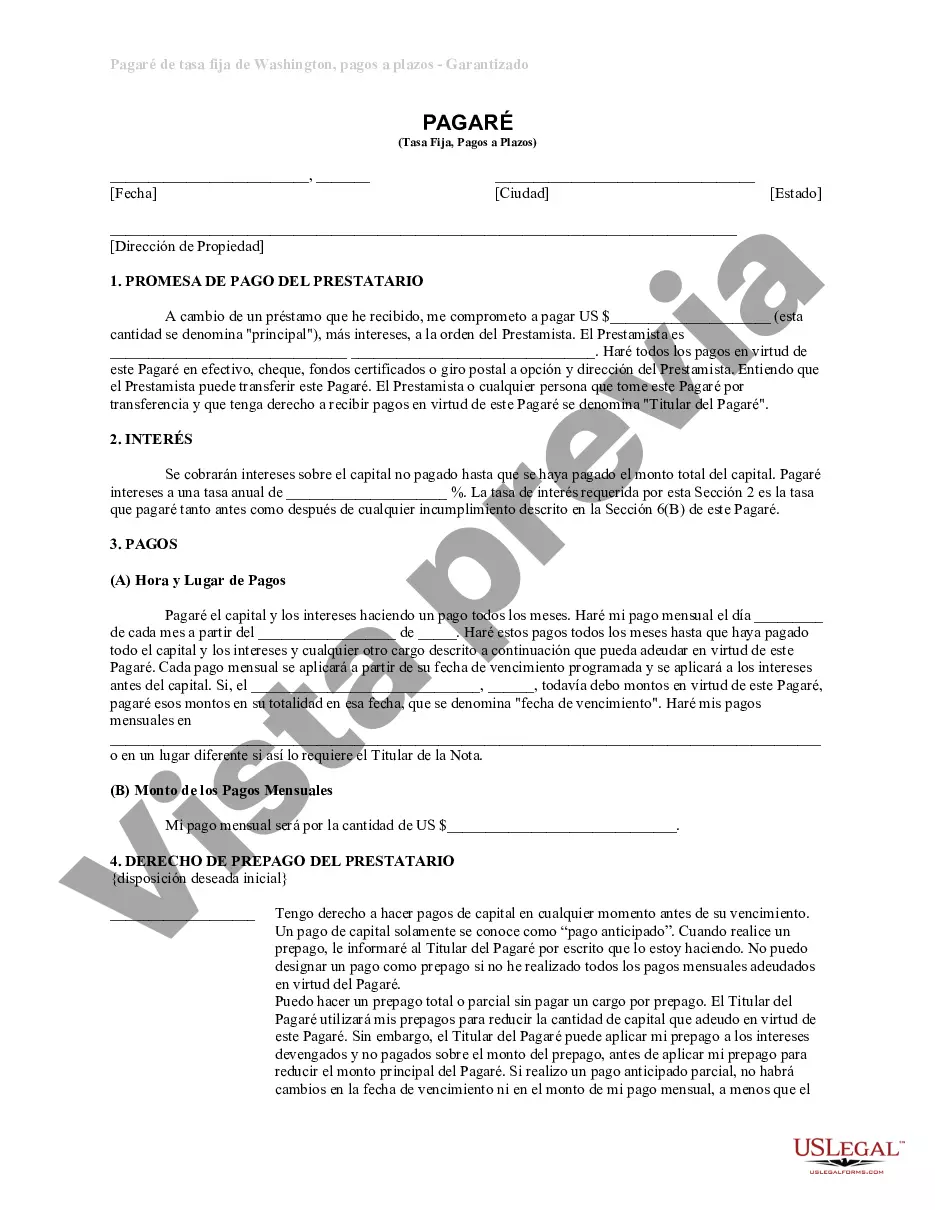

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Renton Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal agreement that outlines the terms and conditions for a loan secured by residential real estate property in Renton, Washington. This type of promissory note is commonly used when a borrower wants to borrow a specific amount of money for a predetermined period of time, with the residential property serving as collateral for the loan. In Renton, Washington, there may be different variations or types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, each with its own specific features and conditions. These variations can include: 1. Traditional Fixed-Rate Promissory Note: This type of promissory note offers a fixed interest rate for the entire loan term, ensuring that the borrower's monthly payments will remain the same throughout the repayment period. This provides borrowers with stability and predictable payment amounts. 2. Adjustable Rate Promissory Note: This type of promissory note establishes an interest rate that can fluctuate over time based on a specific financial index, such as the prime rate. Unlike a fixed-rate promissory note, the interest rate on an adjustable rate note may change periodically, resulting in varying monthly payments for the borrower. 3. Balloon Promissory Note: A balloon promissory note typically has a shorter repayment period compared to traditional promissory notes. The borrower makes smaller monthly payments throughout most of the loan term, and then a larger "balloon" payment is due at the end. This type of note is beneficial for borrowers who expect a significant financial gain by the time the balloon payment becomes due. 4. Interest-Only Promissory Note: With an interest-only note, the borrower pays only the interest on the loan for a specified period, usually a few years, before the principal repayment is required. This type of note can be useful for borrowers who anticipate increased income or property value in the future. 5. Variable-Rate Promissory Note: Also referred to as a floating-rate note, this type of promissory note includes an interest rate that adjusts periodically based on prevailing market conditions. This variable rate feature allows borrowers to take advantage of potential decreases in interest rates over time. Renton Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as a legal document protecting the rights and obligations of both the borrower and lender. It includes key provisions such as the loan amount, interest rate, repayment schedule, default terms, and details of the property securing the loan. When entering into such an agreement, it is essential for both parties to consult legal professionals specializing in real estate law to ensure compliance with Renton, Washington regulations and to safeguard their respective interests throughout the loan period.Renton Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal agreement that outlines the terms and conditions for a loan secured by residential real estate property in Renton, Washington. This type of promissory note is commonly used when a borrower wants to borrow a specific amount of money for a predetermined period of time, with the residential property serving as collateral for the loan. In Renton, Washington, there may be different variations or types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate, each with its own specific features and conditions. These variations can include: 1. Traditional Fixed-Rate Promissory Note: This type of promissory note offers a fixed interest rate for the entire loan term, ensuring that the borrower's monthly payments will remain the same throughout the repayment period. This provides borrowers with stability and predictable payment amounts. 2. Adjustable Rate Promissory Note: This type of promissory note establishes an interest rate that can fluctuate over time based on a specific financial index, such as the prime rate. Unlike a fixed-rate promissory note, the interest rate on an adjustable rate note may change periodically, resulting in varying monthly payments for the borrower. 3. Balloon Promissory Note: A balloon promissory note typically has a shorter repayment period compared to traditional promissory notes. The borrower makes smaller monthly payments throughout most of the loan term, and then a larger "balloon" payment is due at the end. This type of note is beneficial for borrowers who expect a significant financial gain by the time the balloon payment becomes due. 4. Interest-Only Promissory Note: With an interest-only note, the borrower pays only the interest on the loan for a specified period, usually a few years, before the principal repayment is required. This type of note can be useful for borrowers who anticipate increased income or property value in the future. 5. Variable-Rate Promissory Note: Also referred to as a floating-rate note, this type of promissory note includes an interest rate that adjusts periodically based on prevailing market conditions. This variable rate feature allows borrowers to take advantage of potential decreases in interest rates over time. Renton Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as a legal document protecting the rights and obligations of both the borrower and lender. It includes key provisions such as the loan amount, interest rate, repayment schedule, default terms, and details of the property securing the loan. When entering into such an agreement, it is essential for both parties to consult legal professionals specializing in real estate law to ensure compliance with Renton, Washington regulations and to safeguard their respective interests throughout the loan period.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.