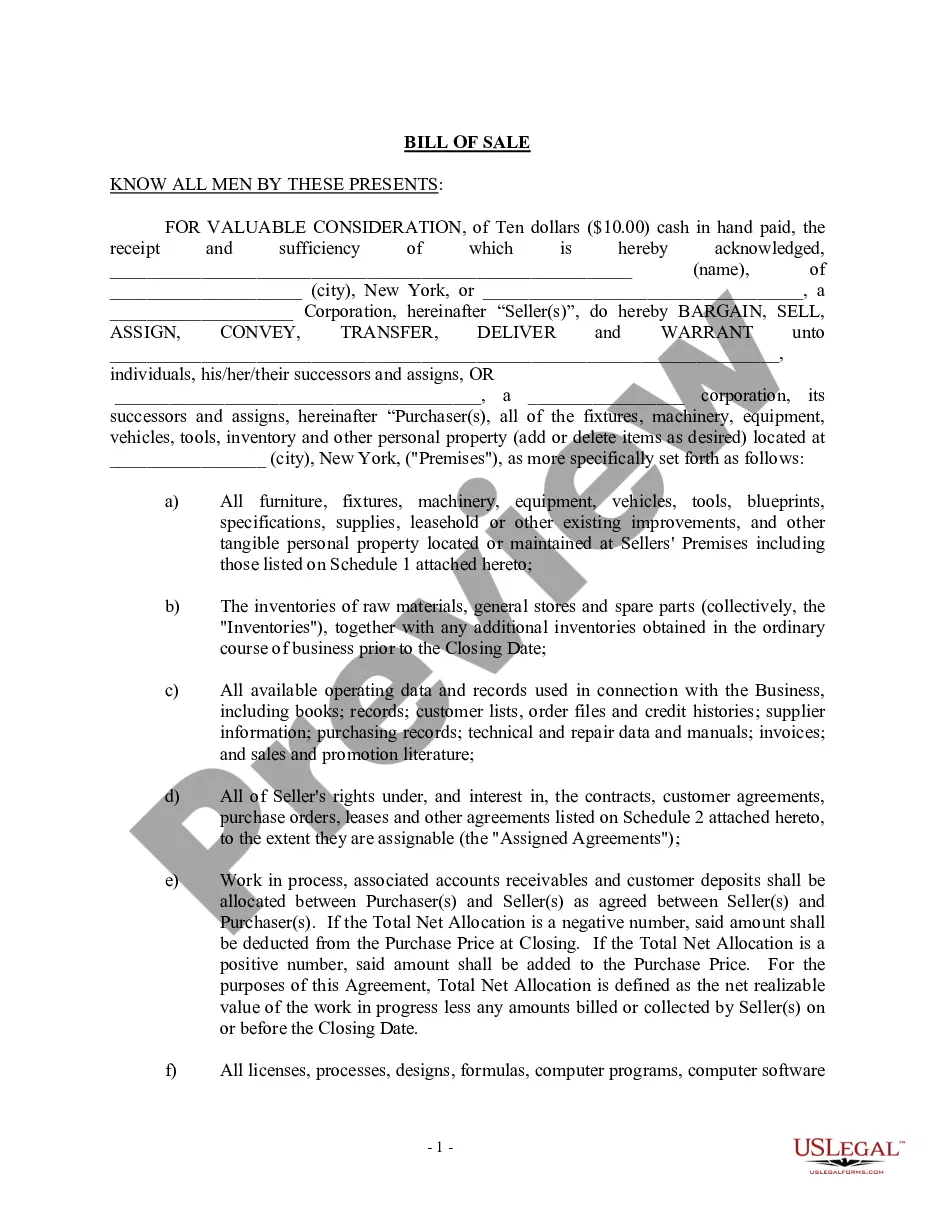

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Seattle Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are looking for a legitimate form, it’s challenging to discover a superior service than the US Legal Forms website – one of the most extensive collections available online.

Here you can obtain thousands of templates for both business and personal use categorized by types and regions, or specific keywords.

With the excellent search feature, locating the most recent Seattle Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Choose the file format and save it to your device.

- Moreover, the relevance of each document is verified by a team of expert lawyers who routinely assess the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Seattle Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to Log In to your profile and click the Download button.

- If this is your first time using US Legal Forms, simply follow the guidelines outlined below.

- Ensure you have selected the form you desire. Review its description and use the Preview function (if available) to examine its contents. If it does not satisfy your needs, use the Search option located at the top of the screen to find the suitable document.

- Verify your choice. Click the Buy now button. Then, choose your desired pricing plan and provide the necessary information to register for an account.

Form popularity

FAQ

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

A promissory Note Requires acceptance.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment. Ultimately, it serves as a necessary piece of the legal puzzle that helps guarantee that sums are repaid in full and in a timely fashion.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Risk-free notes: The risk with promissory notes is that the issuer will not be able to make principal and/or interest payments. Risk and reward are intrinsically related when investing. There is no reward without some level of risk.

Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.