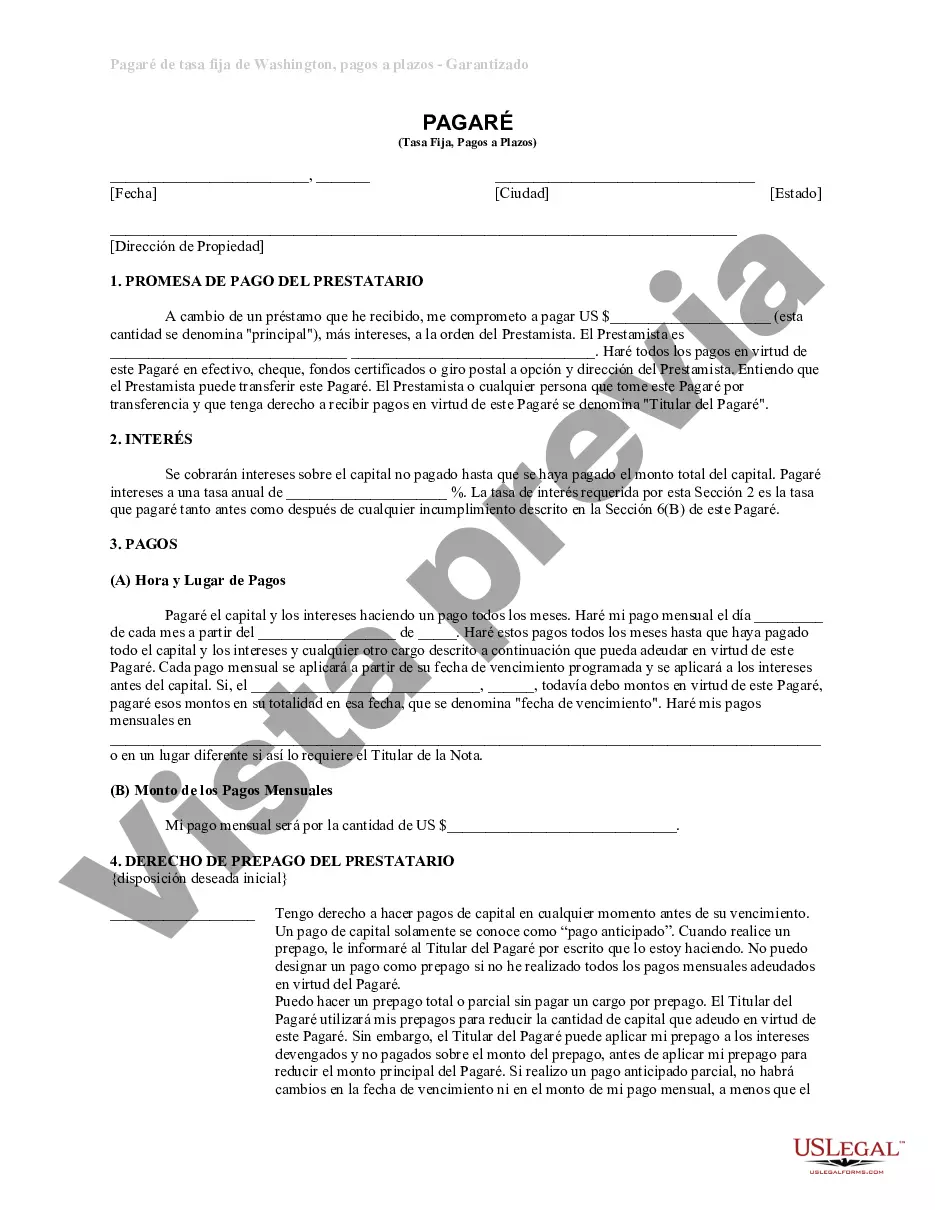

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Vancouver Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that serves as evidence of a borrower's commitment to repay a loan obtained for residential real estate in Vancouver, Washington. This promissory note emphasizes structured installment payments to be made at fixed interest rates for a specified period. The note is secured by the residential property involved in the transaction, granting the lender a legal claim on the property if the borrower fails to fulfill their repayment obligations. There are various types of Vancouver Washington Installments Fixed Rate Promissory Notes Secured by Residential Real Estate available, which cater to different borrower needs and lender preferences. Some of these variations include: 1. Traditional Installments Fixed Rate Promissory Note: This is the standard form where the borrower agrees to make regular payments of principal and interest over a predetermined duration, typically ranging from 15 to 30 years. The interest rates remain fixed throughout the loan term, providing stability to both the borrower and the lender. 2. Balloon Installments Fixed Rate Promissory Note: In this type of promissory note, the borrower agrees to make regular payments for a specific period, usually 5 to 10 years, at a fixed interest rate. However, there is a large "balloon" payment due at the end of the term, requiring the borrower to either refinance, sell the property, or pay off the remaining loan balance. 3. Adjustable-Rate Installments Fixed Rate Promissory Note: In contrast to the traditional fixed-rate promissory note, this type allows for periodic adjustments to the interest rate. These adjustments are typically tied to an index such as the London Interbank Offered Rate (LIBOR) or the U.S. Prime Rate. The interest rate can fluctuate based on market conditions, thereby impacting the borrower's monthly payments. The Vancouver Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a crucial legal document that outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment period, and consequences of default. It highlights the borrower's responsibilities and the lender's rights, ensuring transparency and safeguarding the interests of both parties involved.A Vancouver Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that serves as evidence of a borrower's commitment to repay a loan obtained for residential real estate in Vancouver, Washington. This promissory note emphasizes structured installment payments to be made at fixed interest rates for a specified period. The note is secured by the residential property involved in the transaction, granting the lender a legal claim on the property if the borrower fails to fulfill their repayment obligations. There are various types of Vancouver Washington Installments Fixed Rate Promissory Notes Secured by Residential Real Estate available, which cater to different borrower needs and lender preferences. Some of these variations include: 1. Traditional Installments Fixed Rate Promissory Note: This is the standard form where the borrower agrees to make regular payments of principal and interest over a predetermined duration, typically ranging from 15 to 30 years. The interest rates remain fixed throughout the loan term, providing stability to both the borrower and the lender. 2. Balloon Installments Fixed Rate Promissory Note: In this type of promissory note, the borrower agrees to make regular payments for a specific period, usually 5 to 10 years, at a fixed interest rate. However, there is a large "balloon" payment due at the end of the term, requiring the borrower to either refinance, sell the property, or pay off the remaining loan balance. 3. Adjustable-Rate Installments Fixed Rate Promissory Note: In contrast to the traditional fixed-rate promissory note, this type allows for periodic adjustments to the interest rate. These adjustments are typically tied to an index such as the London Interbank Offered Rate (LIBOR) or the U.S. Prime Rate. The interest rate can fluctuate based on market conditions, thereby impacting the borrower's monthly payments. The Vancouver Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a crucial legal document that outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment period, and consequences of default. It highlights the borrower's responsibilities and the lender's rights, ensuring transparency and safeguarding the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.