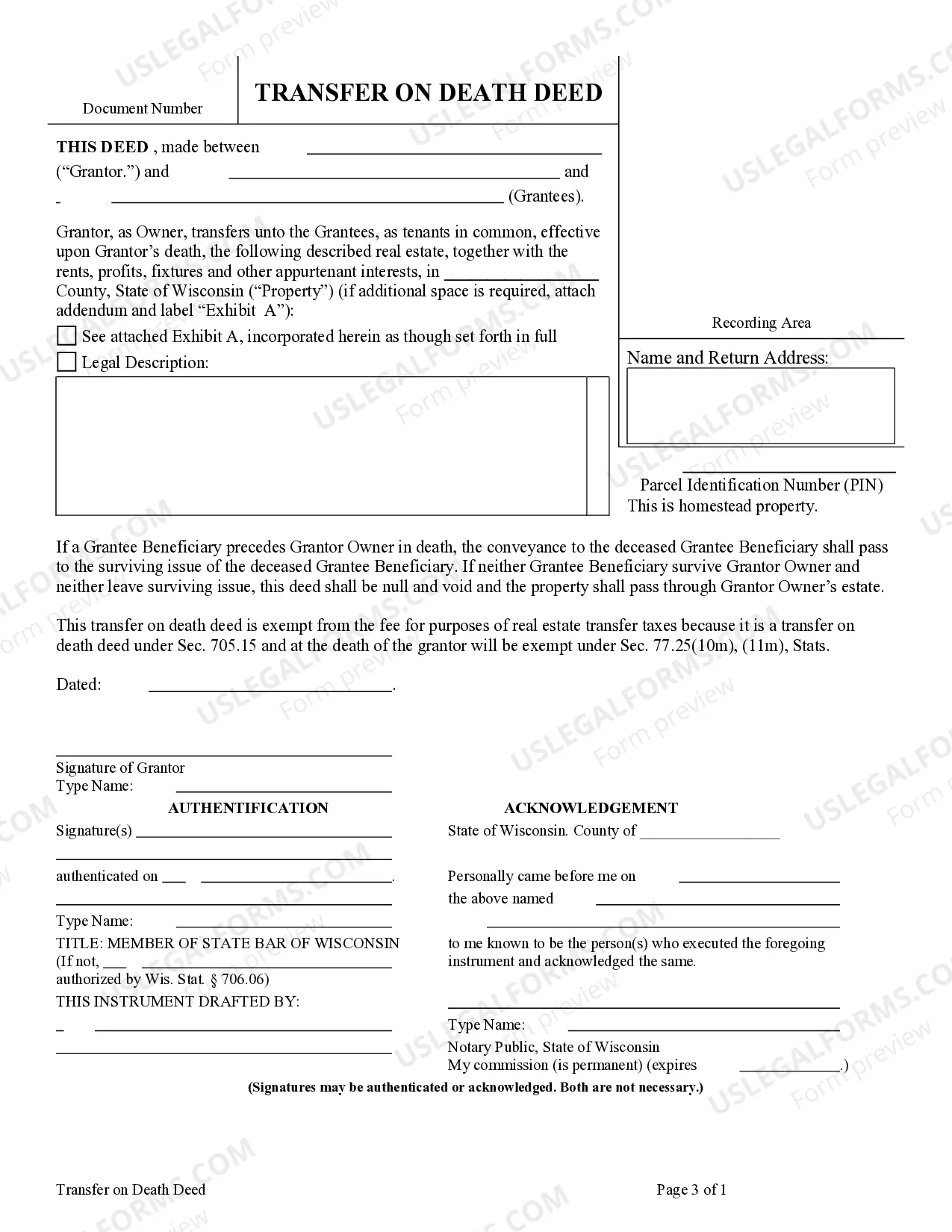

This form is a Transfer on Death Deed where the Grantor is an Individual and the Grantee Beneficiaries are two Individual. This transfer is revocable by Grantor until his/her death and effective only upon the death of the Grantor. To be effective, the deed must be recorded prior to the death of Grantor. This deed complies with all state statutory laws.

A Transfer on Death Deed (TOD), also known as a Beneficiary Deed, is a legal document utilized in Green Bay, Wisconsin, to transfer property ownership from an individual to two specific individuals upon the original owner's death. This type of deed provides a straightforward and efficient process of passing property to chosen beneficiaries without the need for probate. In Green Bay, Wisconsin, there are several types of Transfer on Death Deeds or TOD — Beneficiary Deeds that cater to various circumstances. These include: 1. Joint Tenancy with Right of Survivorship (TWOS): This TOD deed allows two individuals to own the property with an equal share of ownership, and when one owner passes away, the surviving individual receives full ownership rights automatically. 2. Tenants in Common: This TOD deed permits two individuals to own the property with separate, distinct shares. In this case, if one owner dies, their share will not automatically transfer to the other individual but will be distributed according to the deceased's will or intestate succession rules. 3. Life Estate with Remainder Interest: In this type of TOD deed, an individual (known as the life tenant) retains the right to live in and utilize the property during their lifetime. Once the life tenant dies, ownership automatically transfers to the two designated individuals (known as remainder beneficiaries) without the need for probate. 4. Revocable TOD Deed: With this TOD deed, the individual retains the ability to revoke or change the beneficiaries at any time before their death. It provides flexibility in altering the designated beneficiaries without requiring a complete revision of the deed. 5. Irrevocable TOD Deed: Unlike the revocable TOD deed, the irrevocable TOD deed does not allow the individual to revoke or alter the designated beneficiaries once the deed is executed. It provides a secure and immutable transfer of property ownership to the chosen beneficiaries. In summary, the Green Bay, Wisconsin Transfer on Death Deed or TOD — Beneficiary Deed from an individual to two individuals offers various options to transfer property ownership seamlessly and efficiently. Depending on the circumstances and preferences of the parties involved, Joint Tenancy with Right of Survivorship, Tenants in Common, Life Estate with Remainder Interest, Revocable TOD Deed, or Irrevocable TOD Deed can be chosen as the most suitable type of deed. These deeds eliminate the need for probate and ensure a smooth transfer of property assets to the intended beneficiaries.