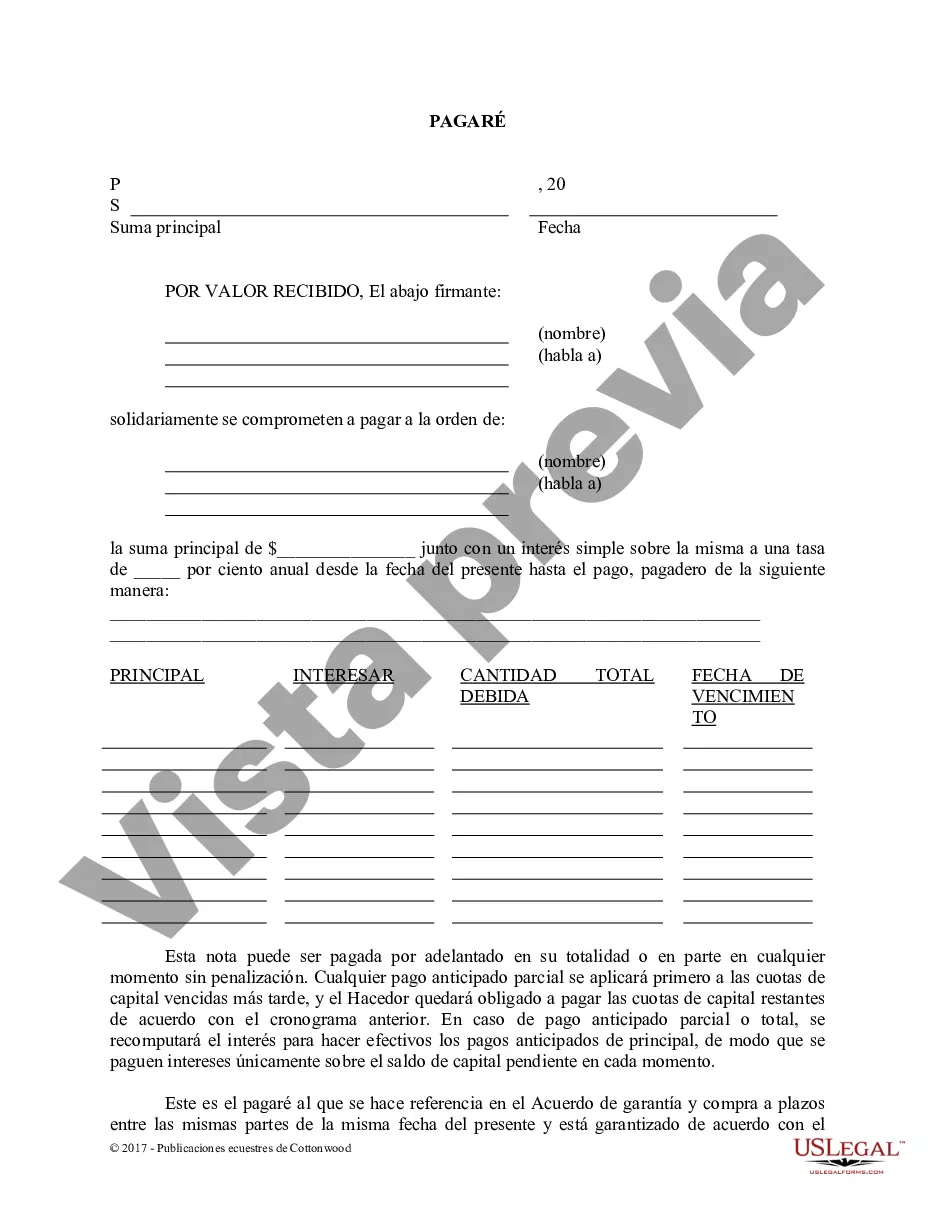

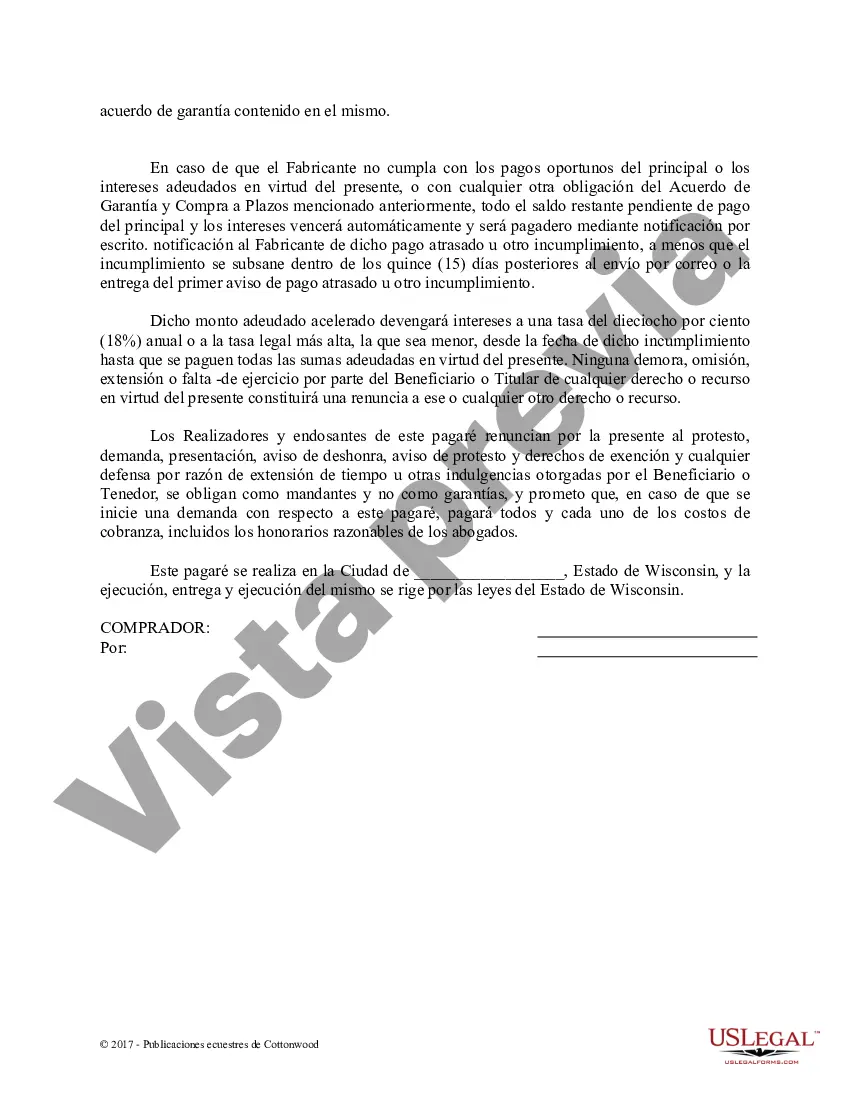

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Green Bay Wisconsin Promissory Note — Horse Equine Forms are legally binding documents that outline the specific terms and conditions of a loan agreement between individuals or entities involved in the horse equine industry. These forms serve as a written record of the loan transaction and are crucial in protecting the rights and interests of both the lender and the borrower. These promissory note forms for the horse equine industry in Green Bay, Wisconsin, are designed to provide a clear and comprehensive overview of the loan, ensuring that all parties involved are aware of their obligations and responsibilities. They include important details such as the loan amount, interest rate, repayment terms, and any additional terms or conditions mutually agreed upon. Here are some of the different types of Green Bay Wisconsin Promissory Note — Horse Equine Forms: 1. Simple Promissory Note: This is a basic form that outlines the essential terms of the loan, including repayment schedule and interest rate. 2. Installment Promissory Note: This type of form is used when the loan repayment is divided into regular installments over a set period, making it easier for the borrower to manage the repayment. 3. Balloon Promissory Note: In this form, the borrower makes regular payments for a specific period, but a portion of the loan amount is due as a lump sum payment at the end of the term. 4. Secured Promissory Note: This form includes provisions for collateral, which can be a horse or other valuable assets, as a security for the loan. 5. Non-Recourse Promissory Note: This type of promissory note protects the borrower by limiting the lender's recourse only to the collateral provided, preventing them from seeking additional repayment sources. 6. Variable Interest Rate Promissory Note: This form allows for an adjustable interest rate, which can change based on agreed-upon conditions or market fluctuations. It is crucial for both the lender and the borrower to carefully review and understand the contents of the Green Bay Wisconsin Promissory Note — Horse Equine Forms before entering into any loan agreement. Seeking legal advice or consulting with professionals in the equine industry can help ensure that the terms are fair and enforceable.Green Bay Wisconsin Promissory Note — Horse Equine Forms are legally binding documents that outline the specific terms and conditions of a loan agreement between individuals or entities involved in the horse equine industry. These forms serve as a written record of the loan transaction and are crucial in protecting the rights and interests of both the lender and the borrower. These promissory note forms for the horse equine industry in Green Bay, Wisconsin, are designed to provide a clear and comprehensive overview of the loan, ensuring that all parties involved are aware of their obligations and responsibilities. They include important details such as the loan amount, interest rate, repayment terms, and any additional terms or conditions mutually agreed upon. Here are some of the different types of Green Bay Wisconsin Promissory Note — Horse Equine Forms: 1. Simple Promissory Note: This is a basic form that outlines the essential terms of the loan, including repayment schedule and interest rate. 2. Installment Promissory Note: This type of form is used when the loan repayment is divided into regular installments over a set period, making it easier for the borrower to manage the repayment. 3. Balloon Promissory Note: In this form, the borrower makes regular payments for a specific period, but a portion of the loan amount is due as a lump sum payment at the end of the term. 4. Secured Promissory Note: This form includes provisions for collateral, which can be a horse or other valuable assets, as a security for the loan. 5. Non-Recourse Promissory Note: This type of promissory note protects the borrower by limiting the lender's recourse only to the collateral provided, preventing them from seeking additional repayment sources. 6. Variable Interest Rate Promissory Note: This form allows for an adjustable interest rate, which can change based on agreed-upon conditions or market fluctuations. It is crucial for both the lender and the borrower to carefully review and understand the contents of the Green Bay Wisconsin Promissory Note — Horse Equine Forms before entering into any loan agreement. Seeking legal advice or consulting with professionals in the equine industry can help ensure that the terms are fair and enforceable.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.