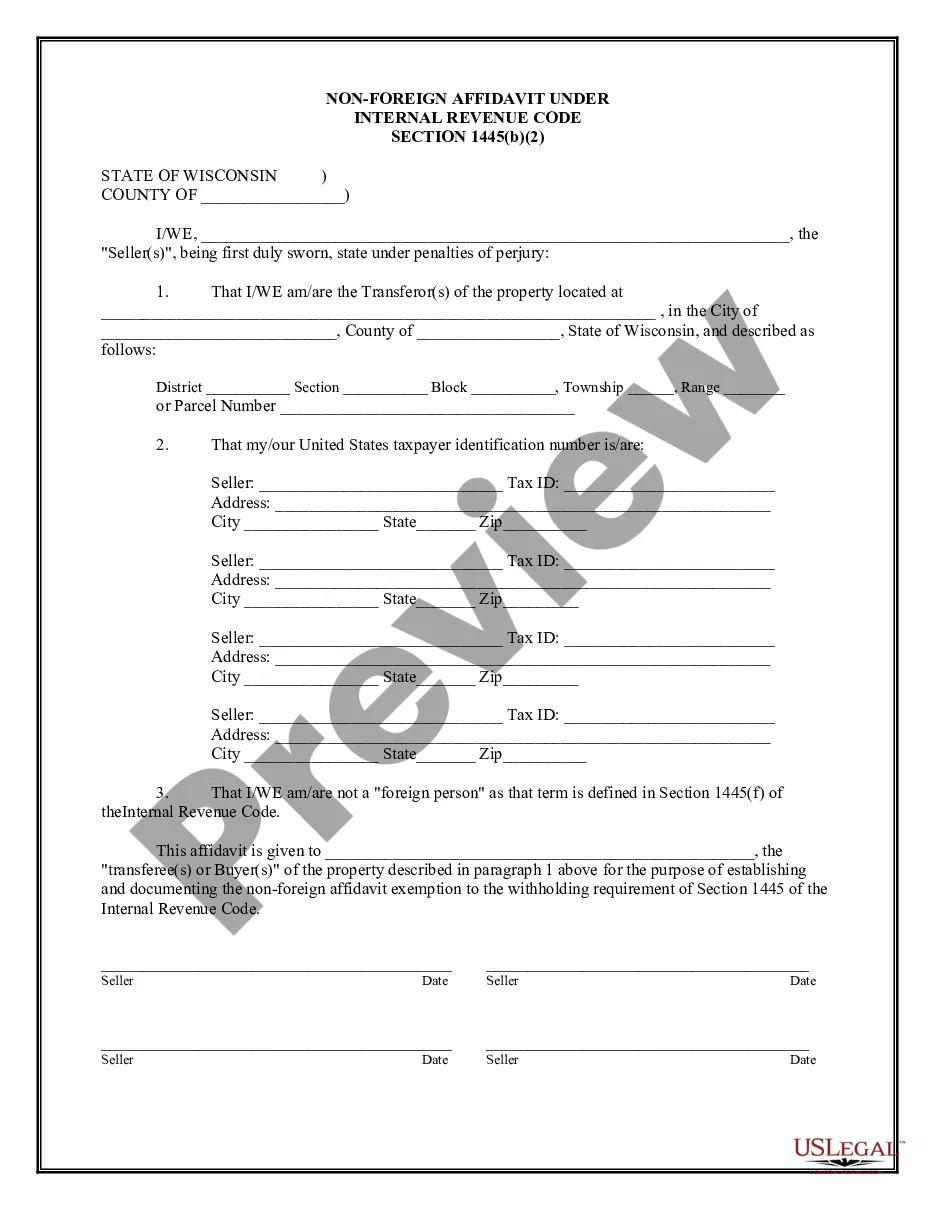

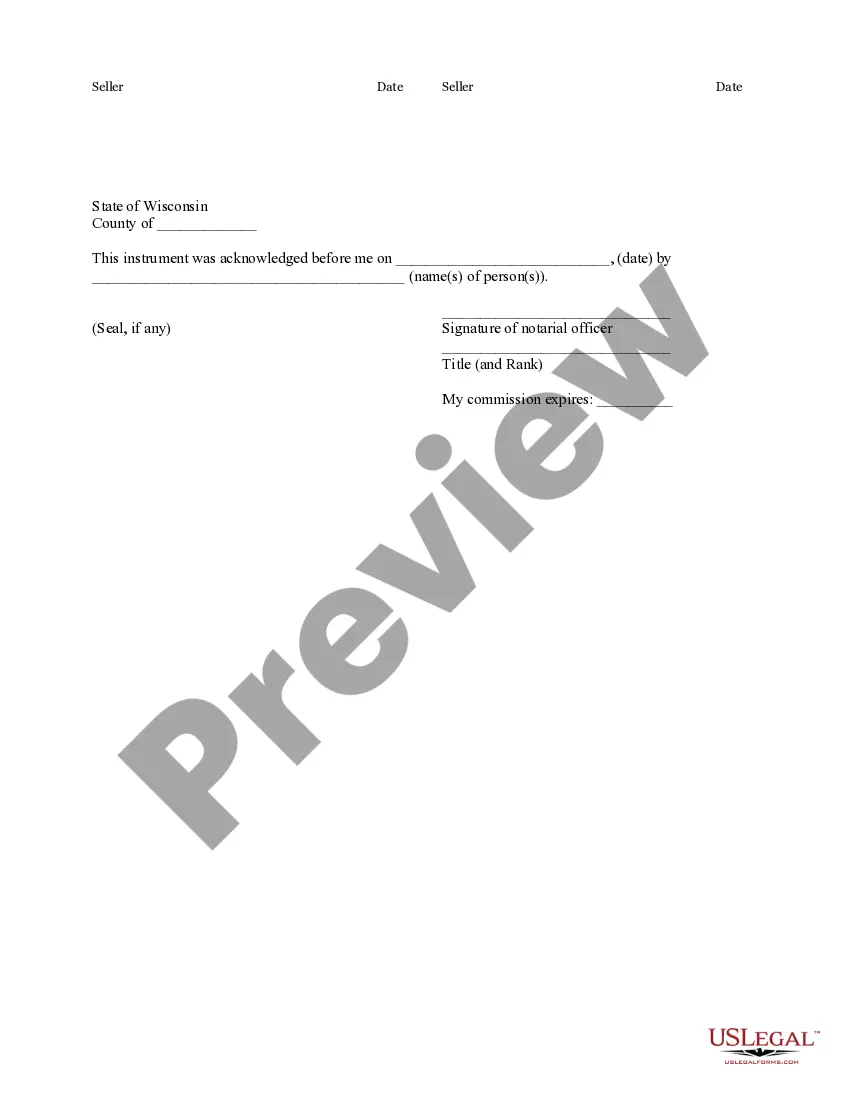

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445 is a legal document that certifies the non-foreign status of a seller to the buyer or transferee of real property in the United States. This affidavit is specifically required when the property being sold is subject to the provisions of Section 1445 of the Internal Revenue Code (IRC). Section 1445 of the IRC mandates that the buyer or transferee must withhold a certain percentage of the sales price when acquiring a U.S. real property interest from a foreign person. However, if the seller is deemed a non-foreign person, this withholding requirement does not apply. To establish such non-foreign status, the seller must provide a Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445. The Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445 includes specific information about the seller, the property being sold, and the intended use of the property. It typically requires the seller to state their name, address, taxpayer identification number, and country of citizenship or incorporation. The affidavit may also include details regarding any subsidiaries or affiliates involved in the transaction. It is important to note that there are no distinct types of Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445. However, there may be variations in formatting and language among different versions of the affidavit that are used in various jurisdictions. It is crucial for parties involved in real estate transactions within Green Bay, Wisconsin, to use the specific affidavit form required by the local authorities to ensure compliance with the applicable regulations. In summary, a Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions involving foreign sellers. By providing this affidavit, the seller certifies their non-foreign status, relieving the buyer from the obligation to withhold a portion of the sales price as required by IRC Section 1445.A Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445 is a legal document that certifies the non-foreign status of a seller to the buyer or transferee of real property in the United States. This affidavit is specifically required when the property being sold is subject to the provisions of Section 1445 of the Internal Revenue Code (IRC). Section 1445 of the IRC mandates that the buyer or transferee must withhold a certain percentage of the sales price when acquiring a U.S. real property interest from a foreign person. However, if the seller is deemed a non-foreign person, this withholding requirement does not apply. To establish such non-foreign status, the seller must provide a Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445. The Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445 includes specific information about the seller, the property being sold, and the intended use of the property. It typically requires the seller to state their name, address, taxpayer identification number, and country of citizenship or incorporation. The affidavit may also include details regarding any subsidiaries or affiliates involved in the transaction. It is important to note that there are no distinct types of Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445. However, there may be variations in formatting and language among different versions of the affidavit that are used in various jurisdictions. It is crucial for parties involved in real estate transactions within Green Bay, Wisconsin, to use the specific affidavit form required by the local authorities to ensure compliance with the applicable regulations. In summary, a Green Bay Wisconsin Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions involving foreign sellers. By providing this affidavit, the seller certifies their non-foreign status, relieving the buyer from the obligation to withhold a portion of the sales price as required by IRC Section 1445.