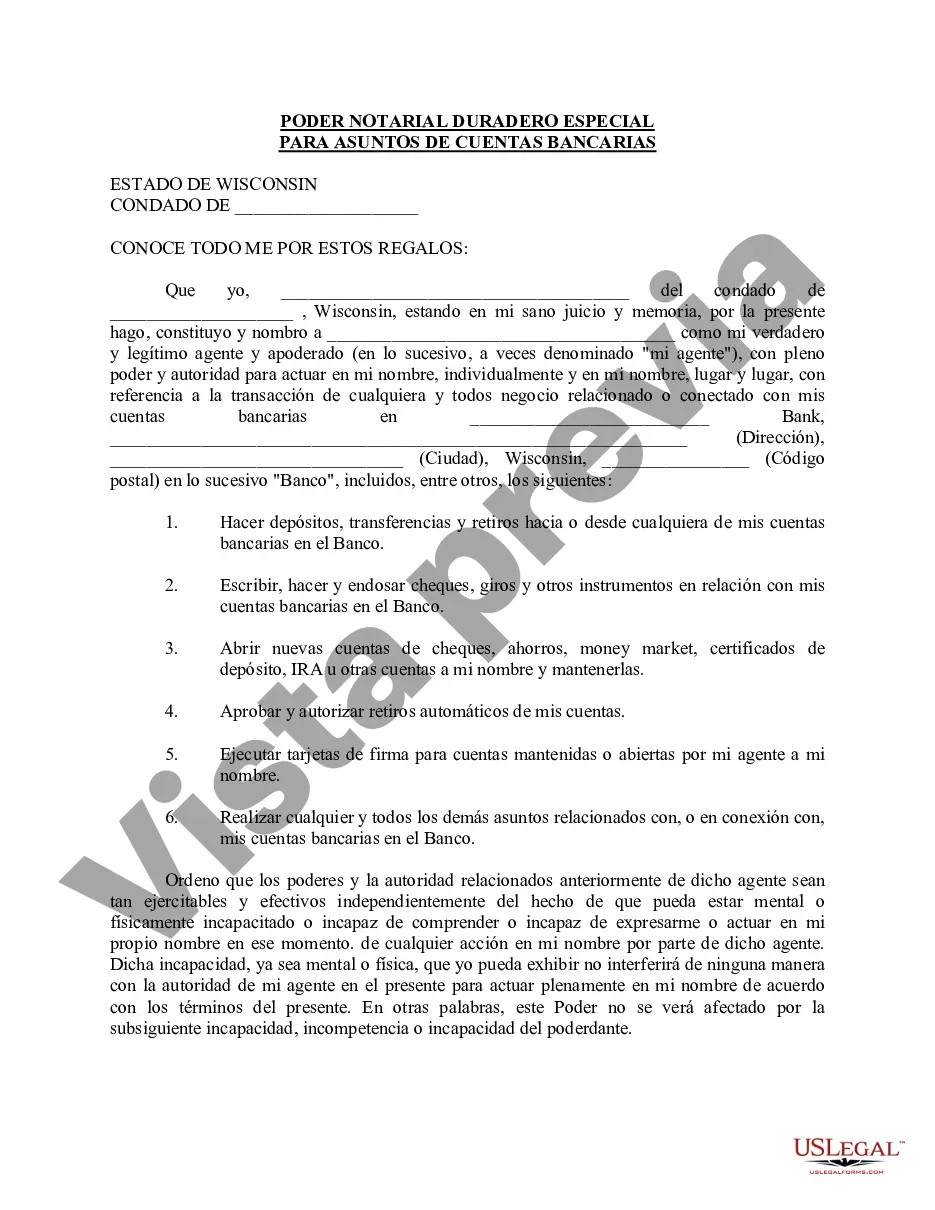

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a specific individual the authority to make financial decisions and transactions pertaining to another person's bank accounts, even in the event of their incapacity or disability. This type of power of attorney is specifically designed to handle matters related to bank accounts and is durable, meaning it remains effective even if the principal becomes incapacitated. The Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters provides the designated agent with the power to open, close, and manage bank accounts on behalf of the principal. This may include tasks such as depositing or withdrawing funds, writing checks, managing investments, paying bills, and monitoring account activity. The agent is responsible for acting in the best interest of the principal, ensuring that their financial affairs are handled properly and ethically. It is crucial to understand that there may be different variations or specific types of Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters, depending on the specific requirements or circumstances involved. Some common types include: 1. Limited Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over specific bank accounts or a limited range of transactions. It is suitable when the principal wants to delegate control over only certain financial matters. 2. General Power of Attorney for Bank Account Matters: Unlike the limited version, this type of power of attorney provides broader authority to the agent, allowing them to handle all aspects of the principal's bank accounts. It is typically employed when the principal wants a comprehensive delegation of financial responsibilities. 3. Springing Power of Attorney for Bank Account Matters: This variant of the Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters becomes effective only upon the occurrence of a specific event or condition. For instance, it might come into effect if the principal becomes mentally incapacitated, ensuring a smooth transition of financial decision-making powers. 4. Joint Power of Attorney for Bank Account Matters: In this scenario, multiple individuals are assigned as agents, and they must act jointly when making financial decisions. This requirement ensures accountability and shared responsibility when managing the principal's bank accounts. When creating a Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters, it is advisable to consult with an attorney to ensure compliance with state laws and to tailor the document to the principal's unique circumstances. This legal instrument provides a practical solution for individuals who anticipate the need for someone they trust to manage their bank accounts effectively. Having a clear and detailed power of attorney in place can bring peace of mind to both the principal and their agent, while ensuring financial matters are handled efficiently.Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a specific individual the authority to make financial decisions and transactions pertaining to another person's bank accounts, even in the event of their incapacity or disability. This type of power of attorney is specifically designed to handle matters related to bank accounts and is durable, meaning it remains effective even if the principal becomes incapacitated. The Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters provides the designated agent with the power to open, close, and manage bank accounts on behalf of the principal. This may include tasks such as depositing or withdrawing funds, writing checks, managing investments, paying bills, and monitoring account activity. The agent is responsible for acting in the best interest of the principal, ensuring that their financial affairs are handled properly and ethically. It is crucial to understand that there may be different variations or specific types of Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters, depending on the specific requirements or circumstances involved. Some common types include: 1. Limited Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over specific bank accounts or a limited range of transactions. It is suitable when the principal wants to delegate control over only certain financial matters. 2. General Power of Attorney for Bank Account Matters: Unlike the limited version, this type of power of attorney provides broader authority to the agent, allowing them to handle all aspects of the principal's bank accounts. It is typically employed when the principal wants a comprehensive delegation of financial responsibilities. 3. Springing Power of Attorney for Bank Account Matters: This variant of the Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters becomes effective only upon the occurrence of a specific event or condition. For instance, it might come into effect if the principal becomes mentally incapacitated, ensuring a smooth transition of financial decision-making powers. 4. Joint Power of Attorney for Bank Account Matters: In this scenario, multiple individuals are assigned as agents, and they must act jointly when making financial decisions. This requirement ensures accountability and shared responsibility when managing the principal's bank accounts. When creating a Green Bay Wisconsin Special Durable Power of Attorney for Bank Account Matters, it is advisable to consult with an attorney to ensure compliance with state laws and to tailor the document to the principal's unique circumstances. This legal instrument provides a practical solution for individuals who anticipate the need for someone they trust to manage their bank accounts effectively. Having a clear and detailed power of attorney in place can bring peace of mind to both the principal and their agent, while ensuring financial matters are handled efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.