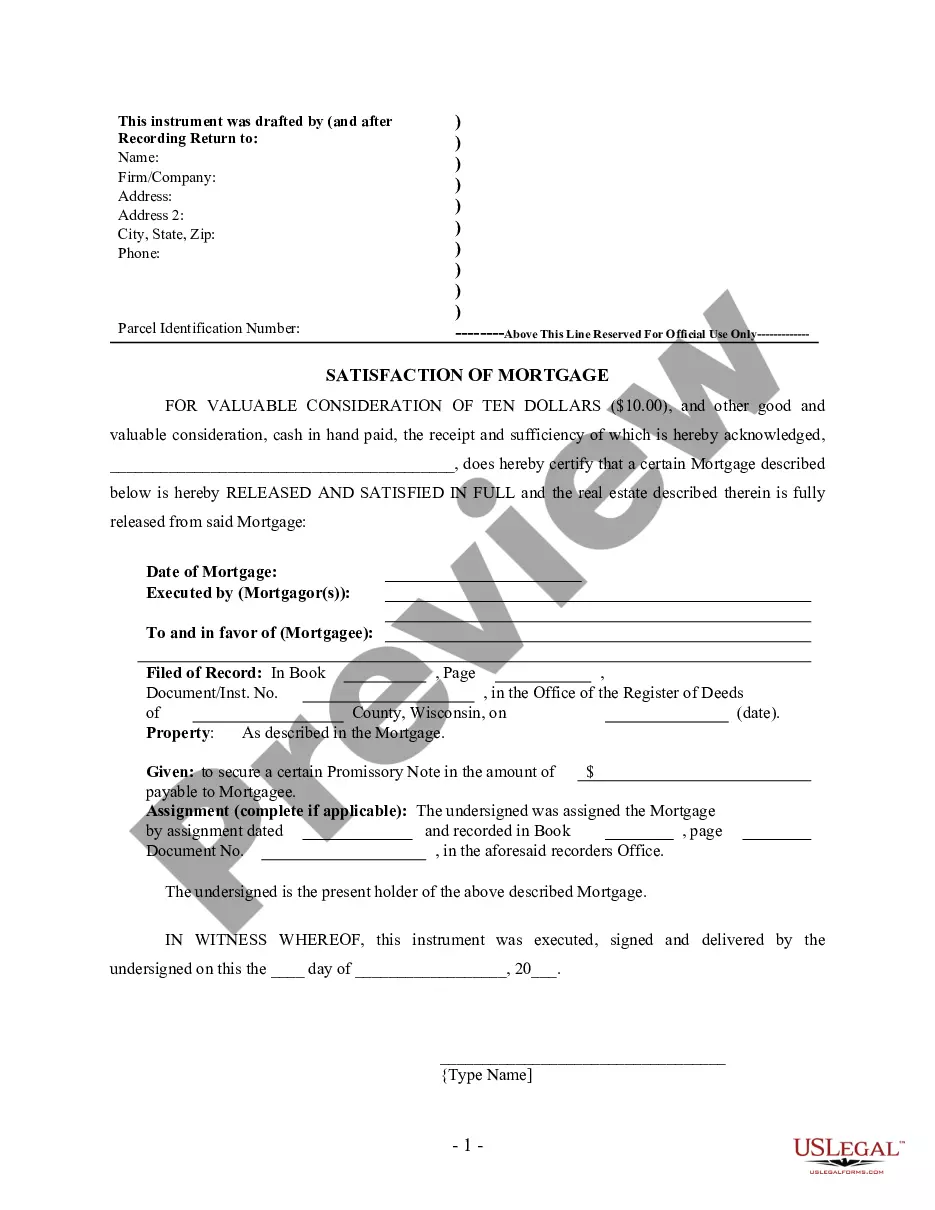

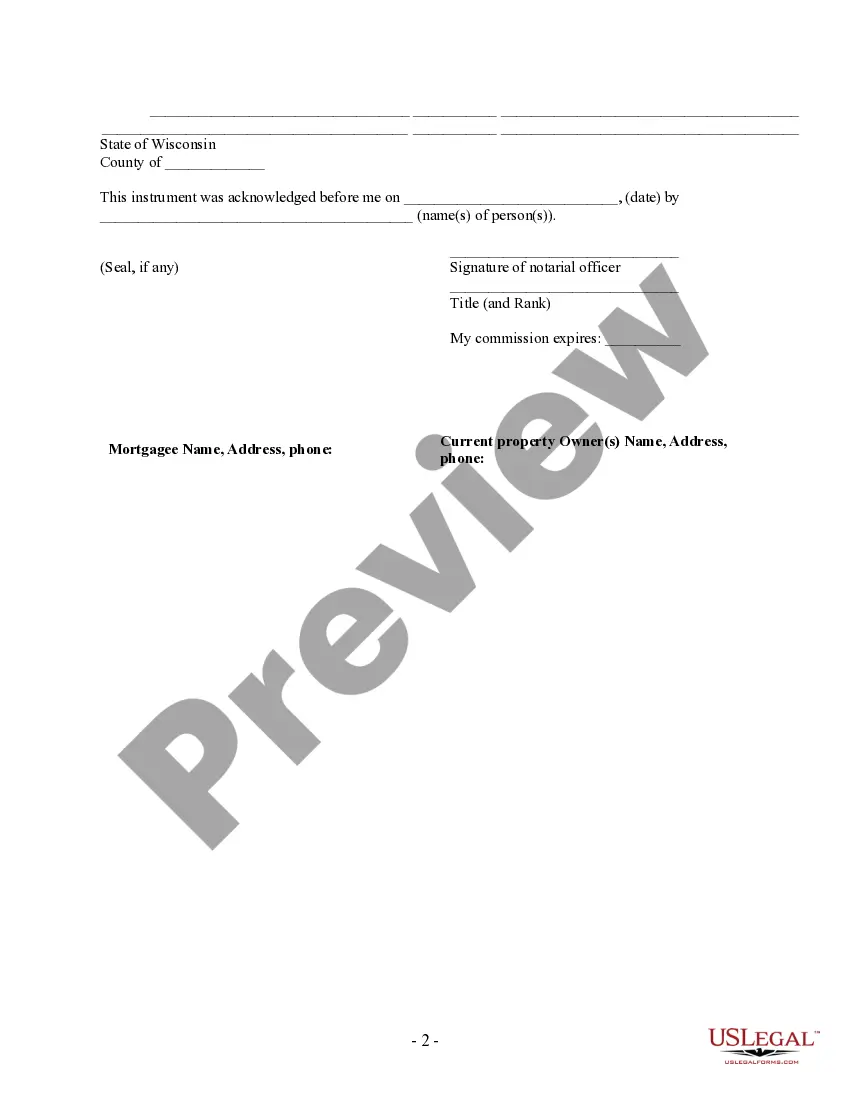

This form is for the satisfaction or release of a deed of trust for the state of Wisconsin by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Understanding Green Bay Wisconsin Satisfaction, Release, and Cancellation of Mortgage by Individual Introduction: In Green Bay, Wisconsin, the satisfaction, release, or cancellation of a mortgage by an individual is a vital process that acknowledges the repayment of a mortgage loan in full. This article aims to provide a detailed description of this procedure, its significance, and the various types of satisfaction, release, or cancellation available in Green Bay. 1. What is Green Bay Wisconsin Satisfaction, Release, or Cancellation of Mortgage by Individual? The satisfaction, release, or cancellation of a mortgage by an individual in Green Bay refers to the legal process that officially recognizes the repayment of a mortgage loan by the borrower. This process eliminates the lien placed on the property by the mortgage and declares the property free and clear from any mortgage obligations. 2. Importance of Satisfaction, Release, or Cancellation of Mortgage: The satisfaction, release, or cancellation of a mortgage by an individual is crucial for both the borrower and the lender. For borrowers, it establishes ownership without any encumbrances, allowing the property to be transferred, sold, or refinanced with ease. For lenders, it ensures that the debt has been fulfilled and the lien on the property can be removed, enabling them to retain an accurate record of who owns the property. 3. Types of Green Bay Wisconsin Satisfaction, Release, or Cancellation of Mortgage by Individual: a. Voluntary Satisfaction: This occurs when a borrower repays the mortgage loan in full on their own, typically through regular payments or a lump sum payment. The borrower then files a satisfaction of mortgage form with the local county recorder's office to cancel the mortgage officially. b. Partial Satisfaction: This type occurs when a borrower pays off a portion of their mortgage debt, typically due to a refinancing or a loan modification. The lender would then provide a partial release or satisfaction, acknowledging the partial repayment and reducing the mortgage amount accordingly. c. Satisfaction by Substitution: This form of satisfaction occurs when a borrower obtains a new loan to replace the existing mortgage, often through refinancing. The new loan pays off the previous mortgage, and the lender provides a satisfaction of mortgage or release to acknowledge the substitution. d. Satisfaction Due to Foreclosure: In situations where a borrower defaults on their mortgage and the lender initiates foreclosure proceedings, once the property is sold during the foreclosure process, the lender provides a satisfaction or release, completing the legal cancellation of the mortgage by individual. Conclusion: The satisfaction, release, or cancellation of a mortgage by an individual in Green Bay, Wisconsin, is a crucial step to confirm completion of loan repayment and remove any encumbrances from the property. Understanding the different types of satisfaction provides borrowers and lenders with the necessary knowledge to navigate this process correctly. Remember to consult with legal professionals during this procedure to ensure compliance with local regulations and expedite the mortgage satisfaction process effectively.Title: Understanding Green Bay Wisconsin Satisfaction, Release, and Cancellation of Mortgage by Individual Introduction: In Green Bay, Wisconsin, the satisfaction, release, or cancellation of a mortgage by an individual is a vital process that acknowledges the repayment of a mortgage loan in full. This article aims to provide a detailed description of this procedure, its significance, and the various types of satisfaction, release, or cancellation available in Green Bay. 1. What is Green Bay Wisconsin Satisfaction, Release, or Cancellation of Mortgage by Individual? The satisfaction, release, or cancellation of a mortgage by an individual in Green Bay refers to the legal process that officially recognizes the repayment of a mortgage loan by the borrower. This process eliminates the lien placed on the property by the mortgage and declares the property free and clear from any mortgage obligations. 2. Importance of Satisfaction, Release, or Cancellation of Mortgage: The satisfaction, release, or cancellation of a mortgage by an individual is crucial for both the borrower and the lender. For borrowers, it establishes ownership without any encumbrances, allowing the property to be transferred, sold, or refinanced with ease. For lenders, it ensures that the debt has been fulfilled and the lien on the property can be removed, enabling them to retain an accurate record of who owns the property. 3. Types of Green Bay Wisconsin Satisfaction, Release, or Cancellation of Mortgage by Individual: a. Voluntary Satisfaction: This occurs when a borrower repays the mortgage loan in full on their own, typically through regular payments or a lump sum payment. The borrower then files a satisfaction of mortgage form with the local county recorder's office to cancel the mortgage officially. b. Partial Satisfaction: This type occurs when a borrower pays off a portion of their mortgage debt, typically due to a refinancing or a loan modification. The lender would then provide a partial release or satisfaction, acknowledging the partial repayment and reducing the mortgage amount accordingly. c. Satisfaction by Substitution: This form of satisfaction occurs when a borrower obtains a new loan to replace the existing mortgage, often through refinancing. The new loan pays off the previous mortgage, and the lender provides a satisfaction of mortgage or release to acknowledge the substitution. d. Satisfaction Due to Foreclosure: In situations where a borrower defaults on their mortgage and the lender initiates foreclosure proceedings, once the property is sold during the foreclosure process, the lender provides a satisfaction or release, completing the legal cancellation of the mortgage by individual. Conclusion: The satisfaction, release, or cancellation of a mortgage by an individual in Green Bay, Wisconsin, is a crucial step to confirm completion of loan repayment and remove any encumbrances from the property. Understanding the different types of satisfaction provides borrowers and lenders with the necessary knowledge to navigate this process correctly. Remember to consult with legal professionals during this procedure to ensure compliance with local regulations and expedite the mortgage satisfaction process effectively.