This form is a Fiduciary Deed where the grantor may be an executor of will, trustee, guardian, or conservator.

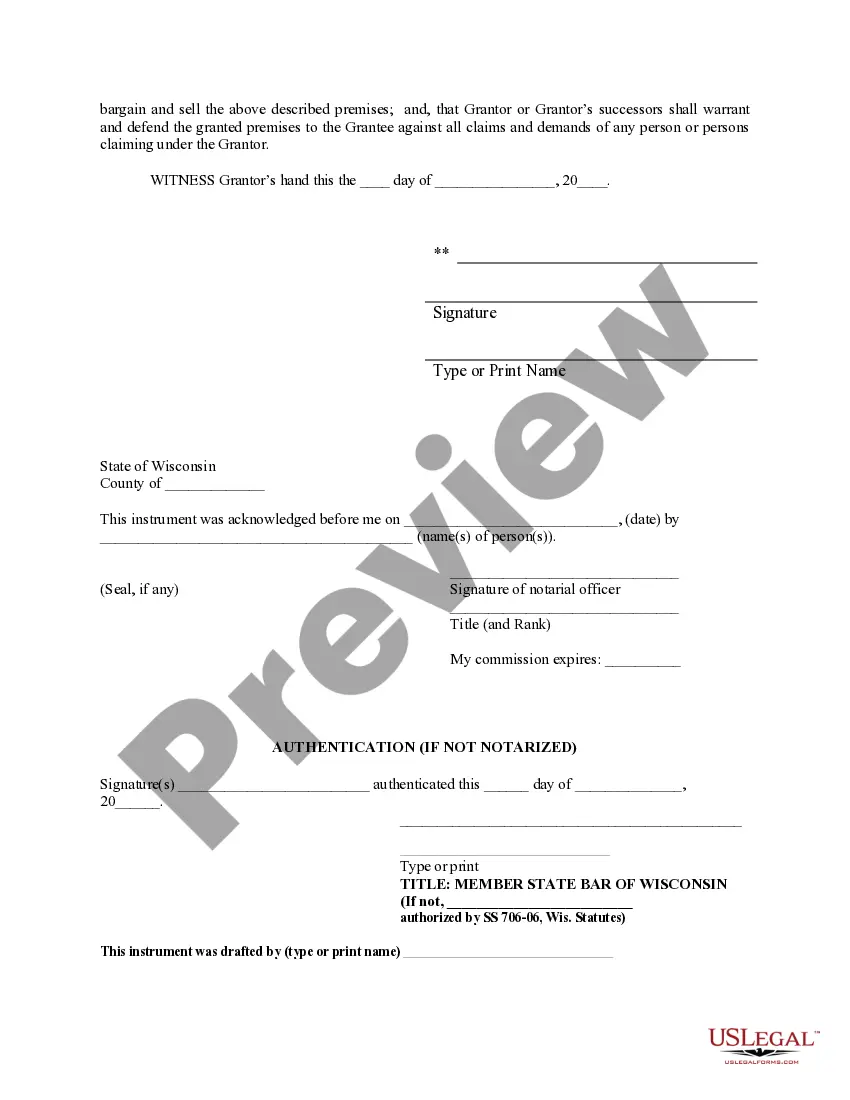

Green Bay Wisconsin Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and Other Fiduciaries Introduction: A Green Bay Wisconsin Fiduciary Deed is a legal document that allows fiduciaries, such as Executors, Trustees, Trustees, Administrators, and other appointed individuals, to transfer real estate property ownership. This detailed guide will explain the purpose, requirements, and types of Fiduciary Deeds available in Green Bay, Wisconsin, assisting fiduciaries in understanding their responsibilities and making informed decisions. 1. Understanding Fiduciary Deeds: A Fiduciary Deed is commonly used when a fiduciary, acting on behalf of an estate or trust, needs to transfer property ownership to a designated beneficiary or third party. Executors, Trustees, Trustees, Administrators, and other appointed fiduciaries must adhere to specific legal requirements to execute a Fiduciary Deed lawfully. 2. Purpose of Green Bay Wisconsin Fiduciary Deed: The primary purpose of a Fiduciary Deed in Green Bay, Wisconsin, is to efficiently transfer property ownership from an estate or trust to the intended recipient. Fiduciaries must ensure that the deed accurately reflects the transfer to protect the interests of both the property's owner and the beneficiary. 3. Requirements for Green Bay Wisconsin Fiduciary Deed: Executing a Fiduciary Deed in Green Bay, Wisconsin, involves several important requirements. These may include: a. Legal Authority: Fiduciaries must have the proper legal authority to act on behalf of the estate or trust. This may involve being appointed as an Executor through a Last Will and Testament, acting as a Trustee per the terms of a Trust Agreement, or being designated by a court as an Administrator in the absence of a will or trust. b. Identification of Parties: The Fiduciary Deed must clearly identify the fiduciary, property owner, and the intended recipient of the property. c. Property Description: The Fiduciary Deed should include an accurate and detailed description of the property being transferred, including its legal description, address, and any relevant identifying information. d. Execution and Notarization: The Fiduciary Deed must be signed and dated by the fiduciary and notarized to validate its authenticity. 4. Types of Green Bay Wisconsin Fiduciary Deeds: a. Executor's Deed: This type of Fiduciary Deed is commonly used when an Executor needs to transfer property from an estate to a beneficiary according to the terms of a Will. b. Trustee's Deed: A Trustee's Deed is utilized by a Trustee to transfer property from a trust to a beneficiary, in line with the provisions outlined in the Trust Agreement. c. Administrator's Deed: When there is no Will or Trust in place, an Administrator appointed by the court can employ an Administrator's Deed to transfer ownership of a property to the rightful heirs. Conclusion: Executing a Green Bay Wisconsin Fiduciary Deed is a crucial responsibility for fiduciaries, ensuring property transfers are conducted accurately and in accordance with legal requirements. Executors, Trustees, Trustees, Administrators, and other fiduciaries must carefully review the specific type of Fiduciary Deed needed, identify parties involved, accurately describe the property, and follow the requisite legal procedures for execution and notarization. By understanding the purpose and requirements of Fiduciary Deeds, fiduciaries can fulfill their obligations and safeguard the interests of all parties involved in property transfers.Green Bay Wisconsin Fiduciary Deed: A Comprehensive Guide for Executors, Trustees, Trustees, Administrators, and Other Fiduciaries Introduction: A Green Bay Wisconsin Fiduciary Deed is a legal document that allows fiduciaries, such as Executors, Trustees, Trustees, Administrators, and other appointed individuals, to transfer real estate property ownership. This detailed guide will explain the purpose, requirements, and types of Fiduciary Deeds available in Green Bay, Wisconsin, assisting fiduciaries in understanding their responsibilities and making informed decisions. 1. Understanding Fiduciary Deeds: A Fiduciary Deed is commonly used when a fiduciary, acting on behalf of an estate or trust, needs to transfer property ownership to a designated beneficiary or third party. Executors, Trustees, Trustees, Administrators, and other appointed fiduciaries must adhere to specific legal requirements to execute a Fiduciary Deed lawfully. 2. Purpose of Green Bay Wisconsin Fiduciary Deed: The primary purpose of a Fiduciary Deed in Green Bay, Wisconsin, is to efficiently transfer property ownership from an estate or trust to the intended recipient. Fiduciaries must ensure that the deed accurately reflects the transfer to protect the interests of both the property's owner and the beneficiary. 3. Requirements for Green Bay Wisconsin Fiduciary Deed: Executing a Fiduciary Deed in Green Bay, Wisconsin, involves several important requirements. These may include: a. Legal Authority: Fiduciaries must have the proper legal authority to act on behalf of the estate or trust. This may involve being appointed as an Executor through a Last Will and Testament, acting as a Trustee per the terms of a Trust Agreement, or being designated by a court as an Administrator in the absence of a will or trust. b. Identification of Parties: The Fiduciary Deed must clearly identify the fiduciary, property owner, and the intended recipient of the property. c. Property Description: The Fiduciary Deed should include an accurate and detailed description of the property being transferred, including its legal description, address, and any relevant identifying information. d. Execution and Notarization: The Fiduciary Deed must be signed and dated by the fiduciary and notarized to validate its authenticity. 4. Types of Green Bay Wisconsin Fiduciary Deeds: a. Executor's Deed: This type of Fiduciary Deed is commonly used when an Executor needs to transfer property from an estate to a beneficiary according to the terms of a Will. b. Trustee's Deed: A Trustee's Deed is utilized by a Trustee to transfer property from a trust to a beneficiary, in line with the provisions outlined in the Trust Agreement. c. Administrator's Deed: When there is no Will or Trust in place, an Administrator appointed by the court can employ an Administrator's Deed to transfer ownership of a property to the rightful heirs. Conclusion: Executing a Green Bay Wisconsin Fiduciary Deed is a crucial responsibility for fiduciaries, ensuring property transfers are conducted accurately and in accordance with legal requirements. Executors, Trustees, Trustees, Administrators, and other fiduciaries must carefully review the specific type of Fiduciary Deed needed, identify parties involved, accurately describe the property, and follow the requisite legal procedures for execution and notarization. By understanding the purpose and requirements of Fiduciary Deeds, fiduciaries can fulfill their obligations and safeguard the interests of all parties involved in property transfers.