Loading

Get Vat1614d 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat1614d online

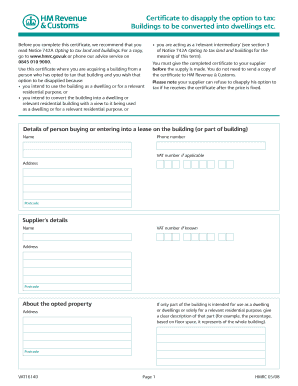

The Vat1614d form is essential for individuals or organizations acquiring a building and seeking to disapply an option to tax. This guide provides a clear and structured approach to filling out the form online, ensuring you understand each component and the necessary steps involved.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the Vat1614d and open it in your preferred editor.

- Provide the details of the person buying or leasing the building. Include their name, phone number, VAT number (if applicable), address, and postcode.

- Fill in the supplier's details, which include the supplier's name, VAT number (if known), address, and postcode.

- Describe the opted property by specifying which part of the building is intended for residential use. Include a clear description, such as the percentage of the building's floor space that this part represents, along with its address and postcode.

- Move to the declaration section. Certify your intentions for the building's use as a dwelling or for a relevant residential purpose. You must check off the applicable conditions (1, 2, or 3) and provide justification for your certification.

- Sign the form, print your name, and enter the current date. Indicate your status, such as Director, Company Secretary, Partner, or Sole Proprietor.

- Review all the entered information to ensure accuracy. Once complete, you can save the changes, download, print, or share the filled-out form as necessary.

Complete your Vat1614d form online to ensure a smooth process for disapplying the option to tax.

Use this certificate where you are acquiring a building from a person who has opted to tax that building and you wish that option to be disapplied because: • you intend to use the building as a dwelling or for a relevant residential purpose, or • you intend to convert the building into a dwelling or relevant ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.