Loading

Get Canada T5013 Sch 1 E 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T5013 SCH 1 E online

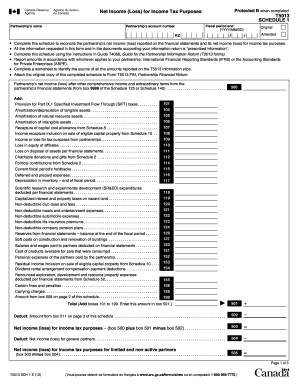

Completing the Canada T5013 SCH 1 E is an essential part of filing a partnership's tax return. This guide will help you navigate the form easily, providing clear steps to ensure accurate and complete submission.

Follow the steps to fill out the Canada T5013 SCH 1 E online.

- Click ‘Get Form’ button to access the Canada T5013 SCH 1 E online and open it in your browser.

- Start by entering the partnership's name at the top of the form to identify the entity.

- Input the partnership's account number, which is necessary for tax identification purposes.

- Fill in the fiscal period end date in the format YYYY/MM/DD to specify the partnership's financial reporting period.

- Select whether this is the original or amended schedule by marking the appropriate box.

- Complete the reconciliation of net income (loss) by following the instructions for each line item, ensuring that all figures align with the financial statements.

- Add any applicable provisions, such as the amount for Part IX.1 Specified Investment Flow Through (SIFT) taxes, by entering the correct amounts in the designated fields.

- Continue filling out subsequent sections for each relevant addition or deduction as outlined on the form. Carefully review each requirement to ensure compliance with tax regulations.

- Once all fields are filled out, review all entries for accuracy.

- After confirming that the form is complete, save changes, and download or print the document for submission.

- Consider sharing the completed form with relevant parties, such as partners or accountants, as needed.

Start completing your Canada T5013 SCH 1 E online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To get a copy of your tax return online in Canada, log in to your account on the Canada Revenue Agency website. You can view and download your filed tax returns there. Keeping your records updated is important for your financial health. If you need assistance, uslegalforms offers support to help you retrieve your documents.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.