Loading

Get G4s 401k

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G4s 401k online

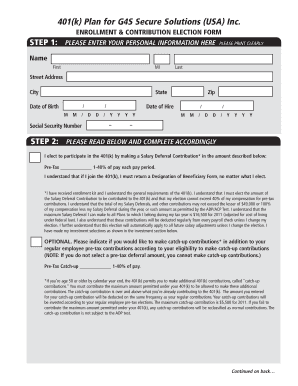

Filling out the G4s 401k enrollment and contribution election form is an essential step for ensuring your financial future. This guide provides clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your G4s 401k enrollment online.

- Click the ‘Get Form’ button to access the G4s 401k enrollment and contribution election form and open it in your preferred editor.

- Begin by entering your personal information clearly in the designated fields. This includes your first name, middle initial, last name, street address, city, state, ZIP code, date of birth, and date of hire.

- Next, read the information provided and indicate your election to participate in the 401(k) plan by selecting the percentage of your pre-tax salary you wish to contribute. This amount can range from 1% to 40% of your pay each pay period.

- If you are eligible, consider making additional catch-up contributions if you are age 50 or older. Indicate the amount you wish to contribute in the specified field.

- Proceed to select your investment allocations. You need to allocate percentages to the investment options provided, ensuring that the total reaches exactly 100%.

- Finally, review the information you have entered. Ensure all sections are completed accurately, then sign and date the form. Ensure you have completed a Designation of Beneficiary.

- Return the completed form to ING using the provided address or instructions to submit it electronically if applicable.

Complete your G4s 401k form online today to secure your financial future!

You can withdraw from your G4s 401k for various reasons, including financial hardship, purchasing a first home, paying for education expenses, or covering medical costs. Each withdrawal has specific conditions that you must meet, so understanding these rules is crucial. To navigate these complexities, consider leveraging tools and support from the uslegalforms platform, which can provide clarity on the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.