Get 501 C 8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 9th online

How to fill out and sign 8th online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Have you been trying to find a quick and efficient tool to fill in 501 C 8 at an affordable price? Our platform provides you with an extensive variety of forms that are available for submitting on the internet. It takes only a couple of minutes.

Stick to these simple actions to get 501 C 8 completely ready for submitting:

- Get the document you need in the collection of templates.

- Open the template in the online editing tool.

- Go through the guidelines to discover which info you will need to provide.

- Choose the fillable fields and put the necessary details.

- Put the date and place your e-signature as soon as you complete all of the fields.

- Look at the document for misprints and other errors. If you need to correct something, our online editor and its wide variety of tools are ready for your use.

- Download the filled out form to your gadget by clicking Done.

- Send the e-document to the parties involved.

Filling in 501 C 8 does not have to be complicated any longer. From now on easily get through it from your home or at the workplace from your smartphone or PC.

How to edit Deductibility: customize forms online

Sign and share Deductibility along with any other business and personal documents online without wasting time and resources on printing and postal delivery. Take the most out of our online form editor with a built-in compliant electronic signature tool.

Signing and submitting Deductibility templates electronically is faster and more effective than managing them on paper. However, it requires utilizing online solutions that ensure a high level of data security and provide you with a certified tool for generating eSignatures. Our robust online editor is just the one you need to complete your Deductibility and other personal and business or tax templates in a precise and proper manner in line with all the requirements. It features all the essential tools to quickly and easily complete, adjust, and sign paperwork online and add Signature fields for other parties, specifying who and where should sign.

It takes just a few simple steps to fill out and sign Deductibility online:

- Open the chosen file for further managing.

- Utilize the upper panel to add Text, Initials, Image, Check, and Cross marks to your template.

- Underline the important details and blackout or erase the sensitive ones if necessary.

- Click on the Sign tool above and decide on how you want to eSign your sample.

- Draw your signature, type it, upload its image, or use an alternative option that suits you.

- Switch to the Edit Fillable Fileds panel and place Signature areas for other parties.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Verify that all data provided is complete and correct before you click Done.

- Share your form with others utilizing one of the available options.

When signing Deductibility with our extensive online solution, you can always be sure to get it legally binding and court-admissible. Prepare and submit documentation in the most efficient way possible!

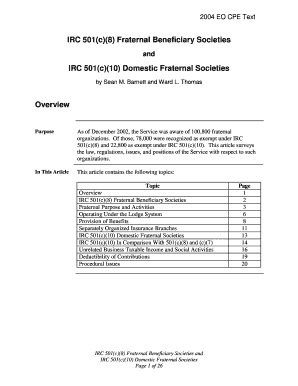

501c3 Vs 501c8: Similarities and Differences These organizations are formed to support the public, and donations to these organizations are entirely tax-deductible. 501c8 organizations, on the other hand, are developed to support the organization's members.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.