Get California Sales Tax Prepayment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

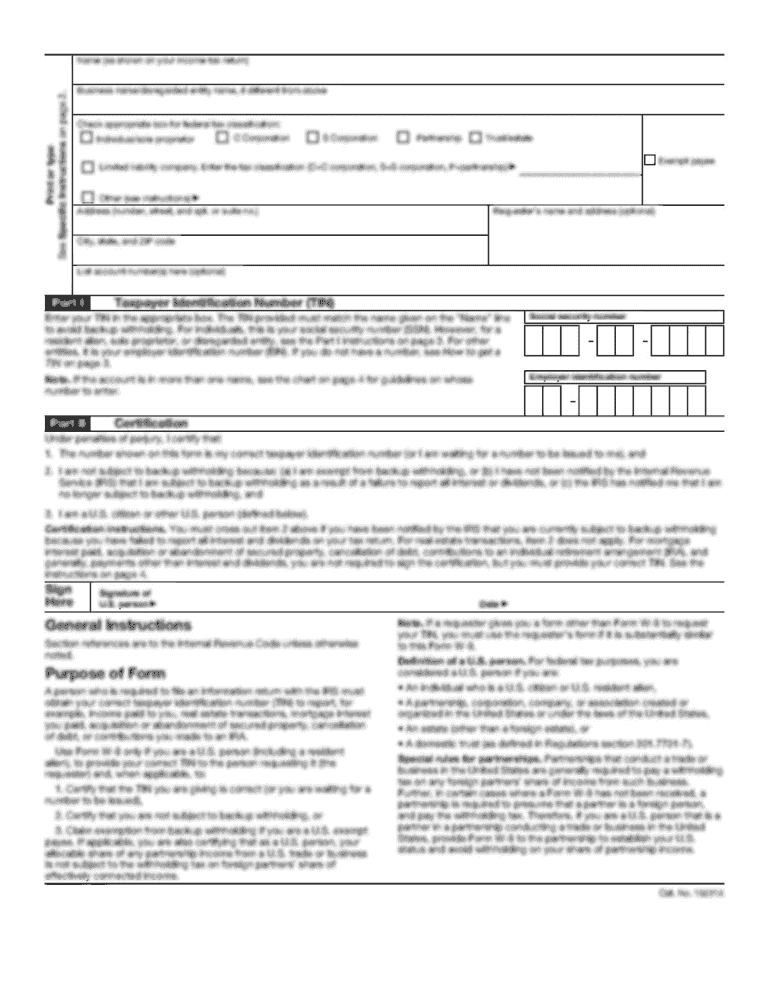

How to fill out the California Sales Tax Prepayment Form online

Filling out the California Sales Tax Prepayment Form online can streamline your tax filing process and ensure accuracy. This guide will provide you with step-by-step instructions to complete the form effectively.

Follow the steps to complete your form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your business information in the designated fields. This includes your business name, address, and contact information. Ensure all details are accurate, as they will be used for correspondence regarding your tax payments.

- Next, locate the section for reporting your taxable sales. Input the total amount of taxable sales for the specified period. Be sure to use figures that reflect your records to avoid discrepancies.

- Then, calculate the sales tax prepayment based on the taxable sales reported. Follow the provided instructions for finding the correct tax rate for your jurisdiction. Enter the calculated amount in the appropriate field.

- Review the information you've entered for completeness and accuracy. Make any necessary corrections before finalizing the submission of the form.

- Once you are satisfied with the information on the form, you may choose to save your changes, download the completed form, print it for your records, or share it as needed.

Start filling out your California Sales Tax Prepayment Form online today!

Calculating a $70,000 salary after taxes in California can vary based on several factors, including your filing status and deductions. Typically, California has a state income tax that can take a significant cut from your salary, along with federal taxes. After accounting for these deductions, you could expect to take home approximately $53,000 to $55,000 annually. Utilizing tools or forms, like the California Sales Tax Prepayment Form, can assist you in better understanding your tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.