Get New Mexico Rpd 41338

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Mexico Rpd 41338 online

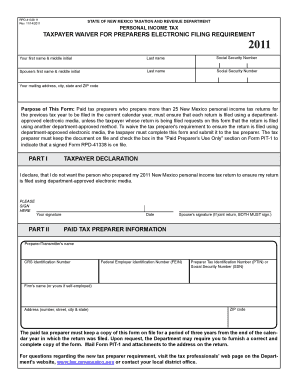

The New Mexico Rpd 41338 form is essential for taxpayers who wish to waive the electronic filing requirement for their personal income tax return. This guide provides clear and comprehensive steps to help you fill out this form efficiently online.

Follow the steps to complete the New Mexico Rpd 41338 form.

- Click ‘Get Form’ button to access the document and open it for editing. This action ensures you have the most up-to-date version of the form.

- Begin filling out the form by entering your first name and middle initial, followed by your last name and Social Security number in the designated fields.

- If applicable, provide your spouse's first name, middle initial, last name, and their Social Security number. This information is vital for joint tax returns.

- Fill in your mailing address, including city, state, and ZIP code. This address will be used for all correspondence related to your tax filings.

- In Part I, you must declare that you do not wish your tax preparer to file using department-approved electronic media by signing your name where indicated.

- If you are submitting a joint return, ensure that your spouse also signs in the designated area.

- In the Paid Tax Preparer Information section, enter the preparer/transmitter's name, their CRS Identification Number, and Federal Employer Identification Number (FEIN). Include their Preparer Tax Identification Number (PTIN) or Social Security Number (SSN).

- Fill in the firm’s name if applicable and provide their complete address, including city and ZIP code.

- Once all required fields are completed, review the form for accuracy and clarity.

- Save your changes to the form, and consider downloading or printing a copy for your records. You may also share it with your tax preparer as required.

Complete your New Mexico Rpd 41338 form online today to ensure your tax filing requirements are met.

The New Mexico non-resident withholding tax applies to income earned by non-residents who conduct business within the state. This tax ensures that non-residents contribute to the state's revenue when they earn income. If you find yourself in this category, familiarize yourself with Form RPD-41338, as it outlines your obligations and procedures. Platforms like US Legal Forms can help you access the right forms and navigate the filing process smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.