Get 5305 Sep

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5305 Sep online

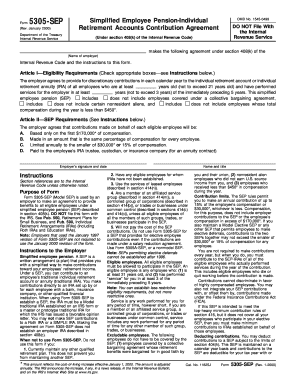

Filling out Form 5305-SEP allows employers to establish a simplified employee pension plan for their eligible employees. This guide provides clear, step-by-step instructions to help you complete the form effectively while ensuring compliance with Internal Revenue Service regulations.

Follow the steps to complete the 5305 Sep online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the name of the employer in the designated section of the form.

- In Article I, check the appropriate boxes that outline the eligibility requirements for employees. Indicate the minimum age of employees and the duration of service required for participation.

- Move on to Article II and confirm the SEP requirements. Ensure that contributions will be made based on the specified compensation limits and that they are equal for all employees.

- Once all sections are completed, review the form carefully for accuracy. Make sure all necessary fields are filled out without modification.

- After finalizing the form, save your changes, download the completed form, and keep a copy for your records.

Complete your forms online effortlessly to streamline your document management process.

To make a SEP contribution, begin by calculating the eligible compensation for your employees or yourself if self-employed. You should then submit contributions that align with the guidelines set forth in IRS Form 5305 SEP. A convenient way to handle these contributions is to transfer funds directly into the SEP-IRA accounts. Using an established platform like uslegalforms can simplify the process, ensuring you meet all legal requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.