Loading

Get Tennessee Distilled Spirits Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tennessee Distilled Spirits Tax Form online

Filling out the Tennessee Distilled Spirits Tax Form can seem daunting, but with a clear understanding of its components and structure, you can complete it efficiently online. This guide will provide step-by-step instructions to help you navigate through the form with ease.

Follow the steps to complete the Tennessee Distilled Spirits Tax Form online.

- Press the ‘Get Form’ button to access the Tennessee Distilled Spirits Tax Form and open it in your preferred editor.

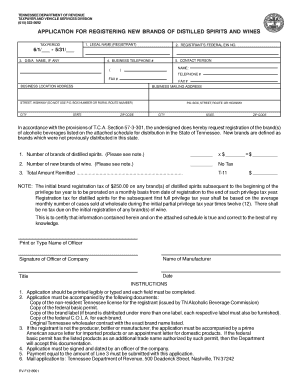

- Enter the legal name of the registrant in the first field. Ensure that this is the official name as registered.

- Fill in the federal Employer Identification Number (EIN) in the next section to identify your business for tax purposes.

- Specify the Doing Business As (D/B/A) name, if applicable, in the corresponding field.

- Provide the contact person's name and business telephone number for any future correspondence regarding the application.

- Input the business location address, ensuring you do not use a P.O. Box number. Include street/highway, city, state, and zip code.

- Next, fill out the business mailing address using the same details. If it is a P.O. Box, ensure it is indicated correctly.

- Indicate the tax period in the format of 6/1/___ - 5/31/___ for accurate record-keeping.

- List the number of brands of distilled spirits you are registering, followed by the registration fee for each brand.

- Total the amount to be remitted in the designated field, ensuring your calculations are correct.

- Affirm that the information provided is true and accurate by signing and dating the application in the space provided.

- Include all necessary attachments as outlined in the instructions, such as copies of licenses and permits.

- Once completed, save your changes, and you can either download, print, or share the form as needed.

Start filling out your Tennessee Distilled Spirits Tax Form online today!

Related links form

Yes, you must file a Tennessee tax return if you meet certain income requirements or if you operate a business in the state. If you engage in the sale of distilled spirits, filing the Tennessee Distilled Spirits Tax Form is crucial for reporting your revenue and paying the appropriate taxes. Always check for updates to regulations to ensure proper compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.