Loading

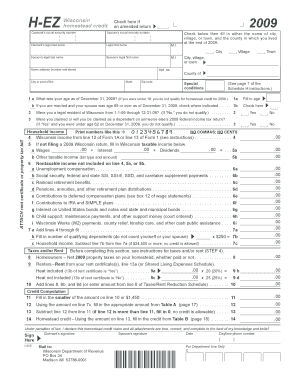

Get Wi Homestead Refund Form 2009 Hez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wi Homestead Refund Form 2009 Hez online

Filling out the Wi Homestead Refund Form 2009 Hez can seem daunting, but with clear instructions, you can complete it efficiently. This guide provides step-by-step support to ensure you accurately fill out the form and submit your claim.

Follow the steps to successfully complete the Wi Homestead Refund Form 2009 Hez

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information in the claimant information section, including your full name, social security number, and home address. Ensure accuracy as this information is essential for processing your claim.

- Answer the required questions related to age, residency, and dependency status. These responses will determine your eligibility for the homestead credit. Make sure to provide truthful answers as incorrect information can disqualify your claim.

- Provide details regarding your household income. Follow the instructions to include all relevant income sources accurately. Attach any necessary documentation such as a rent certificate or property tax bill to support your claim.

- Complete the taxes and/or rent calculations. If you are a homeowner, fill in your net property taxes, or if you are a renter, calculate based on your rent certificate. Ensure you follow the provided percentages based on whether heat was included in your rent.

- Conduct the credit computation based on your previous entries. This section requires reviewing specific tables provided in the instructions to determine the correct credit amount.

- Sign and date your claim at the bottom of the form. If you are married, your spouse must also provide their signature. An unsigned form will not be processed.

- Once all fields are complete, you may save changes, download the form, print it out, or share it as needed.

Complete your Wi Homestead Refund Form 2009 Hez online today to ensure you receive the credits you deserve.

In Wisconsin, seniors can qualify for property tax exemptions or credits at the age of 65. However, the specific benefits may vary based on income and other factors. It is beneficial to understand the details of these programs when considering your financial plans. To navigate these options efficiently, tools like the Wi Homestead Refund Form 2009 Hez can be helpful.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.