Loading

Get Lorain City Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lorain City Tax Forms online

Filling out the Lorain City Tax Forms online can be a straightforward process when you have a clear understanding of each section and field. This guide will provide comprehensive, step-by-step instructions to assist users in completing the forms accurately and efficiently.

Follow the steps to complete the Lorain City Tax Forms online.

- Press the 'Get Form' button to access the Lorain City Tax Forms. This will allow you to open the document in the specified editor.

- Begin by entering your name and address as they appear on the records. Make sure to correct any inaccuracies to ensure proper processing.

- If you have moved during the tax year, fill out the section by providing the date you moved into Lorain and your previous address.

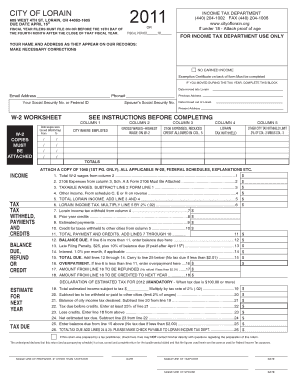

- Complete the W-2 worksheet. Attach copies of all applicable W-2 forms along with the first page of your 1040 form.

- In the income section, enter your gross wages from your W-2s. Ensure to report this in Column 2.

- Follow the specific instructions for reporting any 2106 expenses that could reduce the credit allowed in Column 5.

- Calculate the Lorain tax withheld and enter it in Column 4. Additionally, provide the appropriate amounts for other city tax withheld in Column 5.

- Determine the total income by adding any other income from schedule C, E, or H to your calculated taxable wages.

- Calculate the Lorain income tax by multiplying your total Lorain income by the applicable tax rate of 2%.

- List any prior year credits, estimated payments, and any credits for taxes withheld to other cities. Add these to calculate total payments and credits.

- Assess if there is a balance due and, if applicable, enter this amount along with late filing penalties or interest if you are filing after the due date.

- Complete the estimated tax declaration for the next year if your estimated tax due is $100 or more, providing necessary calculations.

- Finally, review all entries for accuracy, sign and date the form, ensuring any preparer’s signature is included if applicable.

- Once completed, you can save your changes, download the form, print, or share it as required for submission.

Start filling out your Lorain City Tax Forms online today to ensure you meet your tax obligations on time.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can access Lorain City tax forms online through the official city’s tax office website, where many documents are readily available for download. For a more comprehensive experience, platforms like USLegalForms allow users to find various tax forms tailored to their needs, streamlining the online search process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.