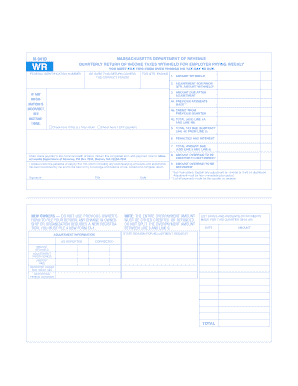

Get M 941d Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Overpaid online

How to fill out and sign Accompanying online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The preparing of legal paperwork can be expensive and time-consuming. However, with our preconfigured web templates, things get simpler. Now, working with a M 941d Form takes at most 5 minutes. Our state online samples and simple instructions eradicate human-prone errors.

Adhere to our simple steps to have your M 941d Form ready quickly:

- Find the web sample from the library.

- Complete all required information in the required fillable fields. The user-friendly drag&drop user interface allows you to include or relocate areas.

- Make sure everything is completed properly, without typos or lacking blocks.

- Use your e-signature to the PDF page.

- Simply click Done to save the adjustments.

- Save the document or print out your PDF version.

- Send instantly towards the receiver.

Take advantage of the quick search and powerful cloud editor to generate an accurate M 941d Form. Remove the routine and make papers on the internet!

How to edit Withheld: customize forms online

Pick a rock-solid document editing solution you can trust. Modify, complete, and sign Withheld securely online.

Too often, editing documents, like Withheld, can be a challenge, especially if you received them online or via email but don’t have access to specialized tools. Of course, you can find some workarounds to get around it, but you risk getting a form that won't fulfill the submission requirements. Using a printer and scanner isn’t an option either because it's time- and resource-consuming.

We provide a simpler and more efficient way of modifying files. An extensive catalog of document templates that are straightforward to change and certify, making fillable for some individuals. Our platform extends way beyond a set of templates. One of the best parts of utilizing our services is that you can revise Withheld directly on our website.

Since it's an online-based option, it saves you from having to download any application. Plus, not all corporate rules permit you to install it on your corporate laptop. Here's the best way to easily and securely complete your documents with our platform.

- Hit the Get Form > you’ll be instantly taken to our editor.

- As soon as opened, you can kick off the customization process.

- Select checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date field to include a particular date to your document.

- Add text boxes, photos and notes and more to complement the content.

- Use the fillable fields option on the right to add fillable {fields.

- Select Sign from the top toolbar to generate and add your legally-binding signature.

- Hit DONE and save, print, and pass around or download the document.

Say goodbye to paper and other inefficient ways of modifying your Withheld or other files. Use our tool instead that includes one of the richest libraries of ready-to-edit templates and a powerful document editing services. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

DOR has released its 2022 Massachusetts Personal Income tax forms. You will also find prior-year forms, estimated tax payment vouchers, and nonresident composite forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.