Loading

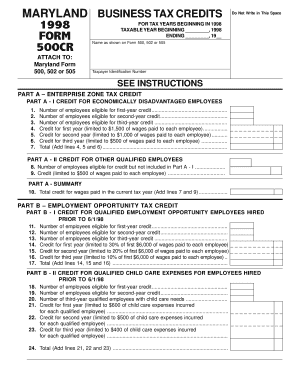

Get Form 500cr Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 500cr Maryland online

Filling out the Form 500cr Maryland online is an essential task for businesses seeking to claim various tax credits against corporation or personal income tax. This guide will provide a user-friendly, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the Form 500cr Maryland online successfully.

- Press the ‘Get Form’ button to obtain the form and access it in the editor.

- Enter the taxable year at the top of the form, specifying the beginning and ending dates. Ensure this matches your annual tax return.

- Proceed to Part A for the Enterprise Zone Tax Credit. Complete the sections for economically disadvantaged employees by entering the number of eligible employees and the corresponding credits based on their employment duration.

- In Part B, report your eligibility for the Employment Opportunity Tax Credit by detailing the number of qualified employees and eligible expenses incurred.

- Continue to Part C and enter information regarding any qualified employees with disabilities, including their employment duration and applicable credits.

- Advance to subsequent sections including those for Job Creation, Neighborhood Assistance, and others as applicable, filling out the required details for each credit.

- Consolidate your total credits in Part J and make any necessary additions for prior credit years as indicated.

- Finally, review your completed form for accuracy before saving your changes, downloading, printing, or sharing the document as needed.

Complete your documents online today to take advantage of available tax credits!

Related links form

Yes, you can file your amended tax return online in Maryland. This process allows you to correct any mistakes made in your original filing, including updates related to Form 500CR Maryland. To ensure a smooth experience, consider using online platforms like US Legal Forms that provide resources and guidance for filing amendments. This can help you navigate the process with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.