Get Dallastown Area School District Millage Rate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dallastown Area School District Millage Rate online

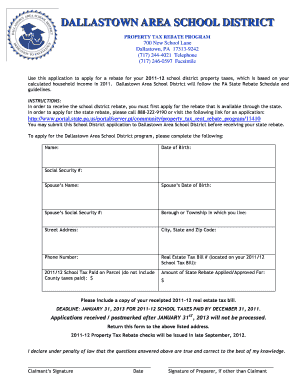

Filling out the Dallastown Area School District Millage Rate form can seem daunting, but with a clear guide, you can complete it with ease. This document will provide you with step-by-step instructions to ensure that you successfully submit your application for property tax rebate.

Follow the steps to fill out the Dallastown Area School District Millage Rate form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling in your name in the designated field. Ensure that you use your full legal name.

- Provide your date of birth. This should reflect your actual birth date in the specified format.

- Enter your Social Security number accurately. This information is crucial for processing your application.

- If you have a spouse, fill in their name, date of birth, and Social Security number in the corresponding fields.

- Indicate the borough or township where you are currently residing.

- Fill in your street address, along with your city, state, and zip code in the specified fields.

- Provide your phone number for any follow-up inquiries related to your application.

- Fill in your real estate tax bill number, which can be located on your 2011/12 School Tax Bill.

- Indicate the amount of school tax paid on your parcel, ensuring you do not include county taxes.

- State the amount of state rebate you have applied for or have been approved to receive.

- Attach a copy of your receipted 2011-12 real estate tax bill as a required document.

- Review your completed application for any errors or omissions before submission.

- Sign the document to declare that all information is true and correct according to your knowledge.

- Date your signature and, if applicable, have the preparer sign as well.

- Return this form to the listed address to ensure it is processed before the deadline.

Complete your Dallastown Area School District Millage Rate form online now to ensure you take advantage of your rebate opportunity.

In Pennsylvania, various districts have different tax rates due to their unique funding requirements and budgetary needs. Generally, areas with higher property values tend to have higher school taxes. While the Dallastown Area School District Millage Rate may not be the highest, it is essential to be aware of local tax rates when considering property investments. For those seeking detailed comparisons, resources like US Legal Forms can provide helpful insights into school tax rates across the state.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.