Get Arts Re

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arts Re online

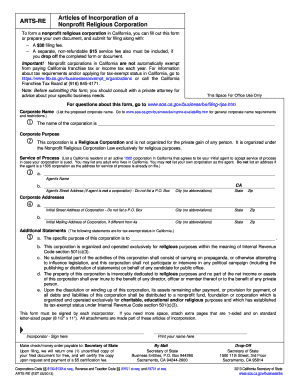

Completing the Arts Re form is an essential step in forming a nonprofit religious corporation in California. This guide will provide you with detailed, step-by-step instructions to ensure that you fill out the form correctly and understand its components.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to obtain a copy of the form and open it in your editing tool.

- Enter the proposed corporate name in the designated field. Ensure that the name complies with California's corporate name requirements. If needed, check name availability through the designated state resource.

- Fill in the corporate purpose section. Here, clarify that the corporation is established as a religious corporation and not for the personal gain of individuals, detailing the religious purposes.

- Identify a California resident or a registered 1505 corporation to serve as your agent for service of process. Provide the agent's name and, if applicable, their street address. Note that a P.O. Box is not acceptable for this address.

- Complete the corporate addresses section. Input the initial street address of the corporation and, if necessary, a different mailing address.

- In the additional statements section, provide the specific purpose of the corporation and confirm its organization and operation for religious purposes as required under the Internal Revenue Code.

- In the final segment, incorporate necessary clauses concerning political activities, asset distribution upon dissolution, and the dedication of property to religious purposes. Ensure each incorporator signs the form.

- Once completed, review the entire form for accuracy. You can then save your changes, download a copy, print it out, or share the form as needed.

Begin your document filing online to establish your nonprofit religious corporation today.

Filing taxes as an artist involves reporting all income earned from your creative work, including commissions, sales, and royalties. You should keep meticulous records of your income and related expenses, such as supplies and studio costs, to maximize your deductions. Using the right forms and guidance is crucial, and the US Legal Forms platform can help you navigate the specific requirements for artists, ensuring you file accurately and efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.