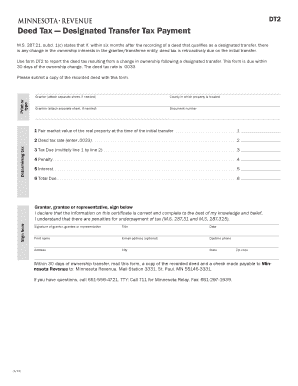

Get Formulario Dt2

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Optional online

How to fill out and sign Entity online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Business, legal, tax as well as other electronic documents need an advanced level of protection and compliance with the law. Our forms are updated on a regular basis according to the latest legislative changes. In addition, with our service, all of the information you provide in your Dt2 Form is protected against loss or damage with the help of top-notch encryption.

The tips below will allow you to fill out Dt2 Form quickly and easily:

- Open the template in our full-fledged online editor by clicking Get form.

- Fill out the necessary fields which are yellow-colored.

- Hit the arrow with the inscription Next to jump from field to field.

- Go to the e-signature tool to e-sign the template.

- Insert the date.

- Read through the entire e-document to make sure you have not skipped anything important.

- Press Done and save the new document.

Our service allows you to take the whole process of submitting legal documents online. Due to this, you save hours (if not days or even weeks) and get rid of additional payments. From now on, fill in Dt2 Form from your home, business office, or even on the move.

How to edit Multiply: customize forms online

Find the correct Multiply template and modify it on the spot. Streamline your paperwork with a smart document editing solution for online forms.

Your everyday workflow with documents and forms can be more efficient when you have everything you need in one place. For instance, you can find, obtain, and modify Multiply in one browser tab. If you need a specific Multiply, you can easily find it with the help of the smart search engine and access it immediately. You do not need to download it or look for a third-party editor to modify it and add your data. All the tools for efficient work go in one packaged solution.

This editing solution enables you to customize, fill, and sign your Multiply form right on the spot. Once you see a proper template, click on it to go to the editing mode. Once you open the form in the editor, you have all the needed instruments at your fingertips. You can easily fill in the dedicated fields and erase them if necessary with the help of a simple yet multifunctional toolbar. Apply all the modifications immediately, and sign the form without leaving the tab by merely clicking the signature field. After that, you can send or print your file if needed.

Make more custom edits with available instruments.

- Annotate your file using the Sticky note tool by putting a note at any spot within the document.

- Add required visual elements, if needed, with the Circle, Check, or Cross instruments.

- Modify or add text anywhere in the document using Texts and Text box instruments. Add content with the Initials or Date tool.

- Modify the template text using the Highlight and Blackout, or Erase instruments.

- Add custom visual elements using the Arrow and Line, or Draw tools.

Discover new opportunities in efficient and trouble-free paperwork. Find the Multiply you need in minutes and fill it out in in the same tab. Clear the mess in your paperwork for good with the help of online forms.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Penalties FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to Dt2 Form

- transferee

- retroactively

- tty

- mn

- payable

- Penalties

- determining

- optional

- qualifies

- resulting

- entity

- multiply

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.